HDFC Jumbo Loan: No documentation is needed to apply for this HDFC Jumbo Loan because the bank already has all the necessary information about the customer because the KYC procedures have been completed. As the bank has access to the cardholder’s credit history, the loan’s size is determined by that history, making it a pre-approved loan.

Definition?

Jumbo Loan- In this type, the credit limit is equivalent to or even higher than the credit limit, and even after the credit limit has been reached, the feature is not blocked. For More Info: https://www.hdfcbank.com/personal/borrow/popular-loans/loan-on-credit-card

A normal personal loan can be availed by any lender. It differs from one lender to another but usually starts at an interest rate of 10.25%. Choosing any of the above loans completely depends on the requirements of the applicant. If you already have Hdfc bank account and you have credit card on it, then you can easily reveal this insta jumbo loan offer on your card. If not, then you can choose the personal loan of your choice.

HDFC Jumbo Loan on credit card?

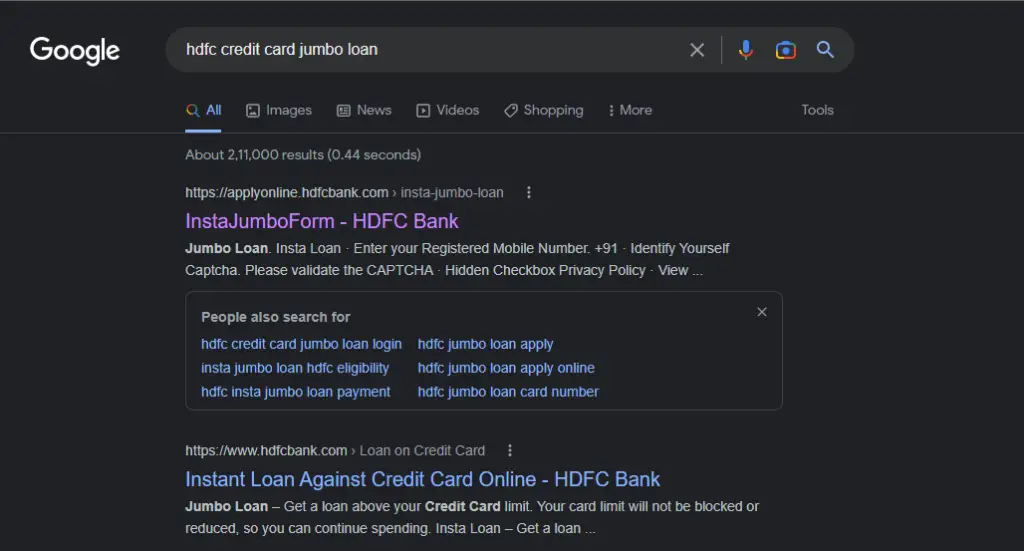

Please Visit this link or type in your browser the same which I have typed in the google search. If you have any links received from bank stating about your jumbo loan offer, then you can directly click on that link, and it will redirect you to the page.

Also, you can directly search for HDFC jumbo loan on any browser and the first link will appear. Just click on that to proceed with your HDFC jumbo loan offer.

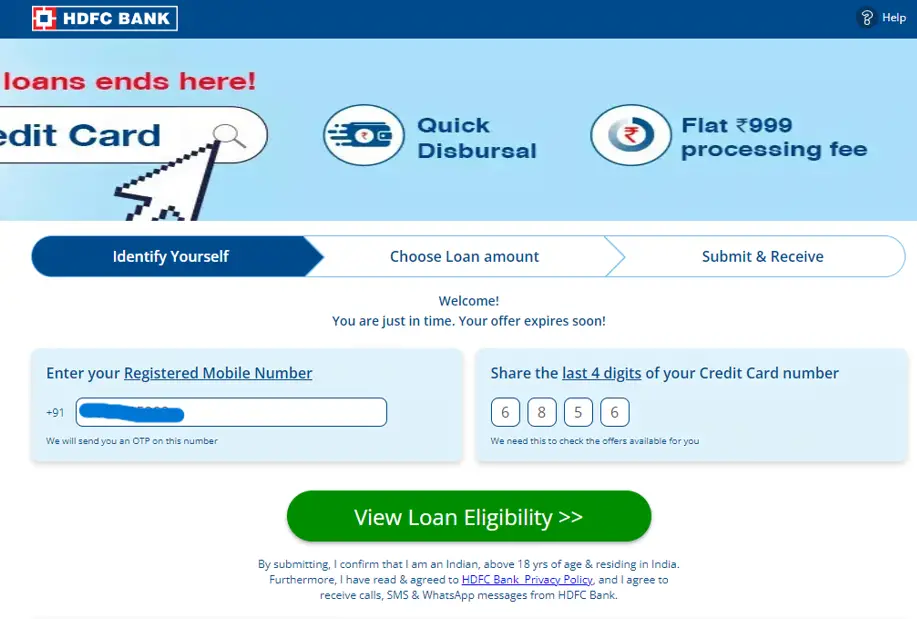

Put your registered mobile number and the last 4 digits of your credit card number. sometimes the site will be down, and you will not be able to see the offers. So, you can try later sometime.

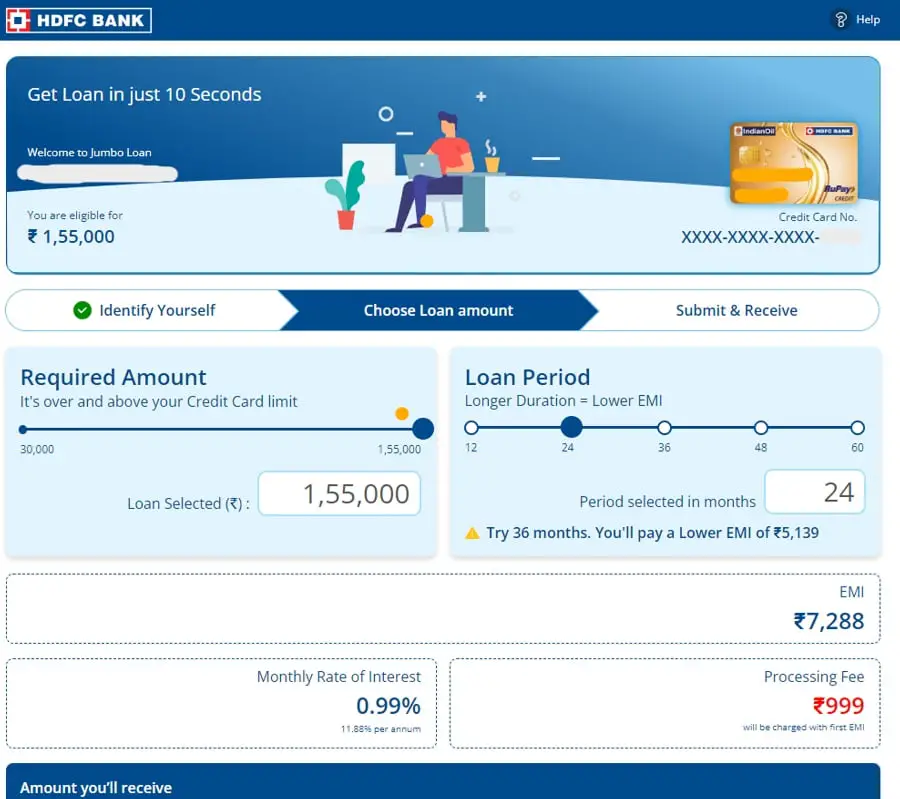

Select/Drag/Insert the amount you need it and also select Tenure accordingly to proceed further.

Check the rate of interest and amount of processing fee.

Please read carefully with all the offers or features available while selecting for your loan amount. The main thing which you have to focus on is your monthly interest rate and also at the bottom you can see your yearly interest. The processing fee is the one-time fee and it wil thisl get added in your first EMI. Also the GST associated to your processing fee will get added in your first EMI amount.

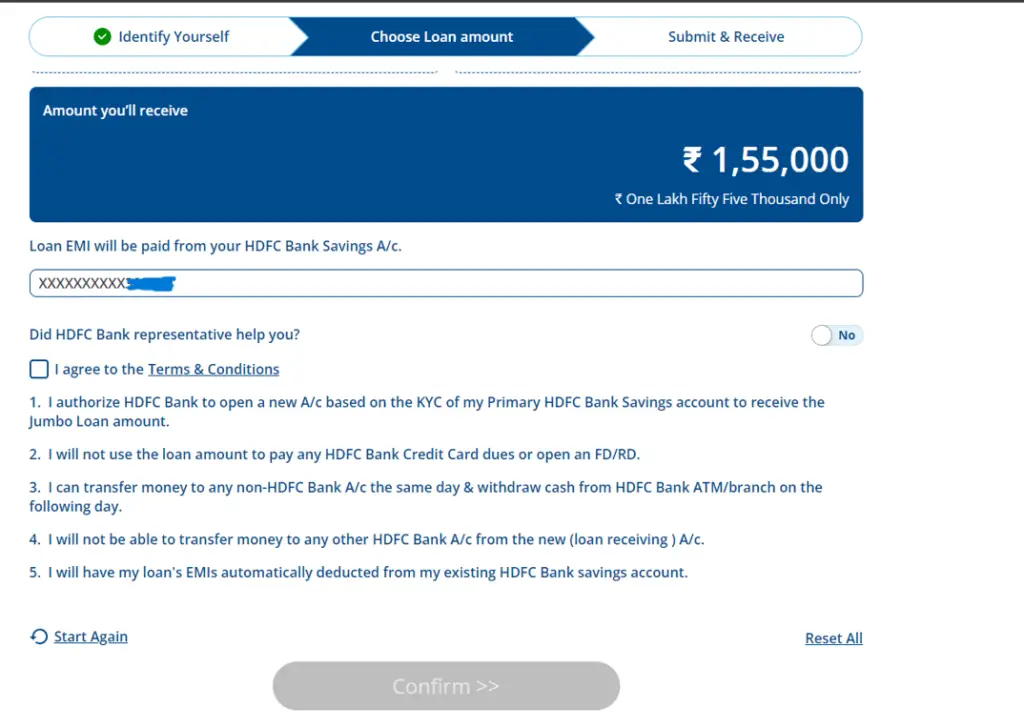

Tick/check terms and conditions and proceed.

Please read carefully with all the terms and conditions pension be below because this is necessary. Once you proceed with your loan account then because of this terms and conditions you cannot come back and do any modifications..

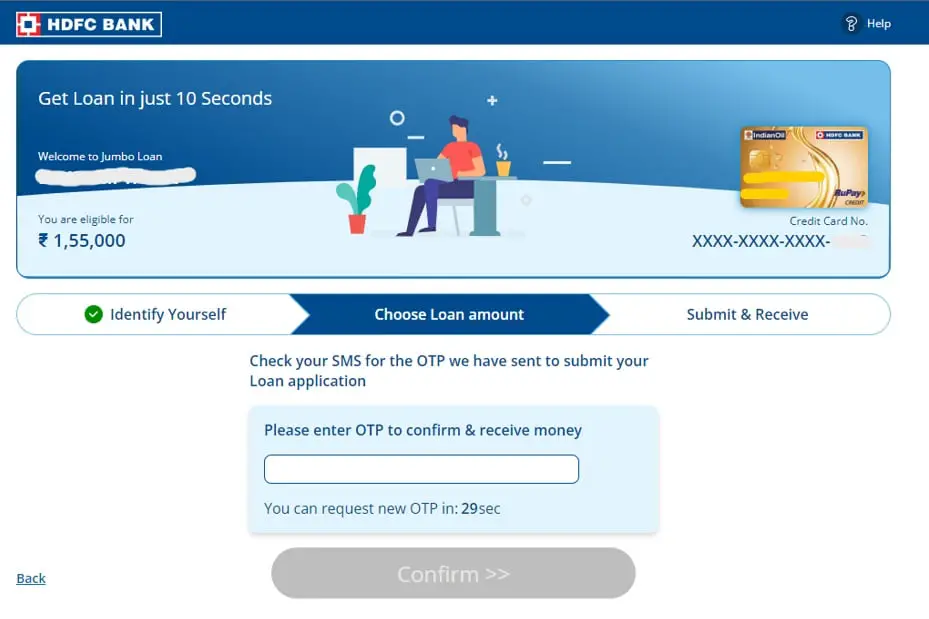

Put OTP and Proceed further

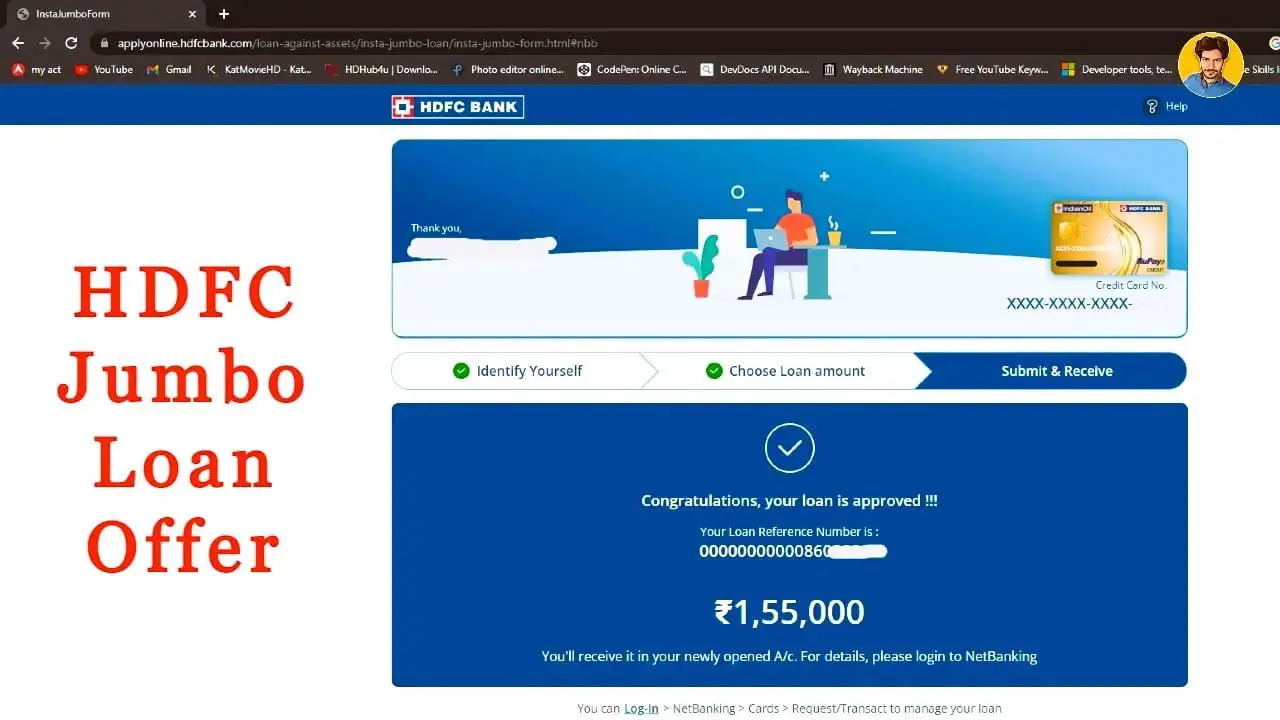

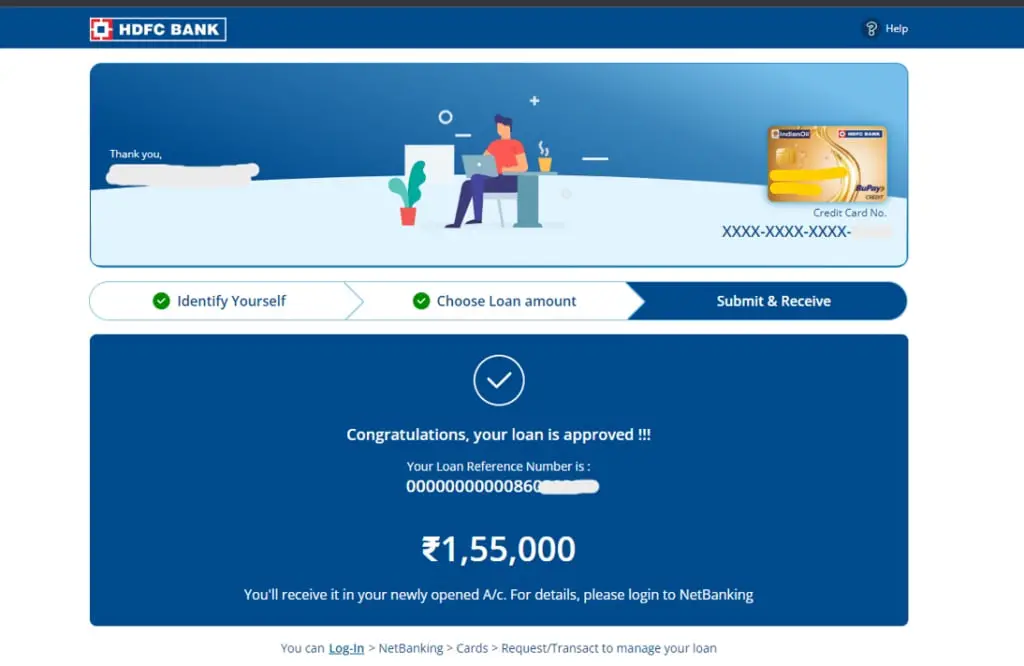

You request has been submitted and the amount will be processed immediately into your account

To pay the EMI Amount?

You can pay this loan’s EMI by sending a check straight to the account listed on the monthly loan statement you received through email. This account number is provisional and only associated with your jumbo loan. You can use this 16-digit account number as a bank account number for paying your bills through other banks using NEFT or IMPS.

By adding Beneficiary to any of our savings bank accounts, we can pay off Jumbo Loans.

Clients can add a 16-digit Jumbo Loan Account number as the beneficiary of direct NEFT/RTGS payments made from other bank accounts. The information about the beneficiary bank is given below.

Watch for more!

Conclusion

Customers with an HDFC Credit Card can apply for an HDFC Insta Jumbo Loan, which is a pre-approved loan. In other words, it is a credit limit that is higher than the cardholder’s present credit limit. This money is deposited in one single payment into their HDFC savings account.

The interested applicant must input their registered mobile number and card information in the online application form for a loan on credit card provided on the bank’s website in order to learn the credit limit of a certain HDFC credit card or to apply.

Latest Post Links:

- One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

- Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

- Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

- SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

- Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

- Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

- Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)

- EPFO: How To Find/Know Your UAN? – Kingfisher Tech Tips

- Activate Your UAN Number On EPFO Portal — Step By Step! (kingfishertechtips.in)