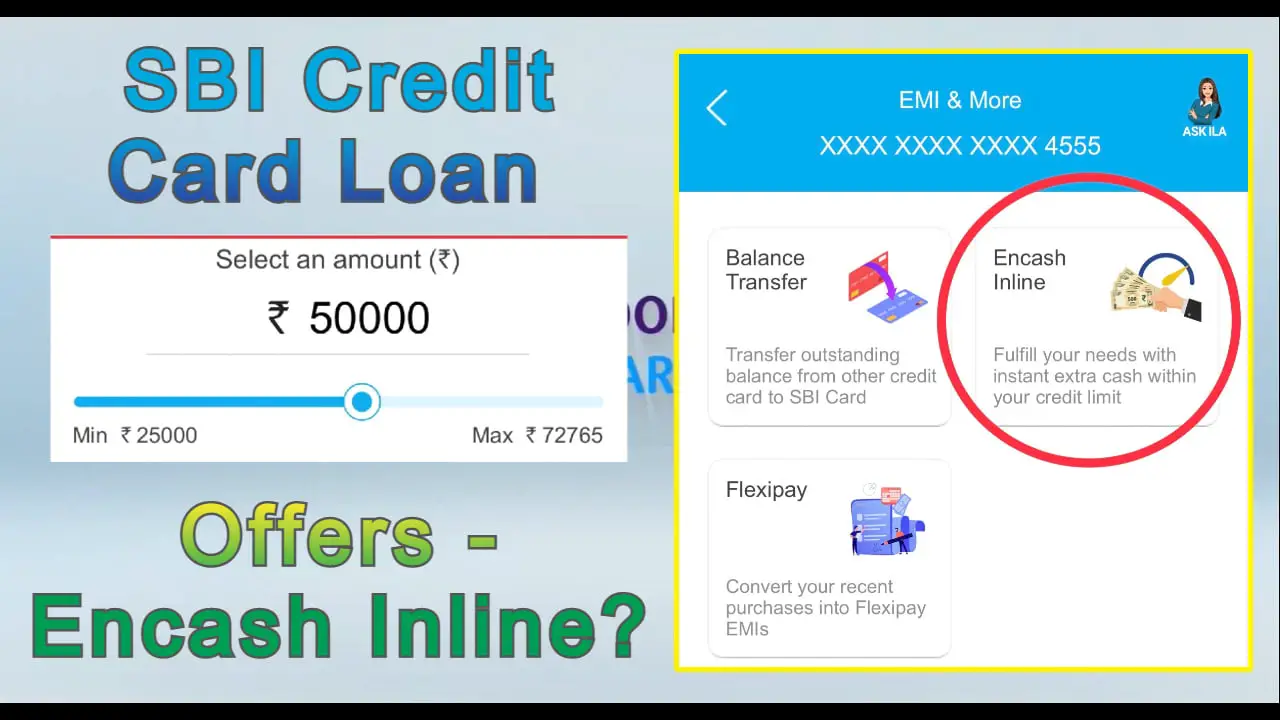

SBI Credit Card Loan: SBI Encash is nothing but loan offer on credit card. The SBI credit card loan is a pre-approved money-on-demand supply available to some select set of current SBI credit card customers. who pay there bills on time where It offers you minimum of 25,000 loan availability offer and max is dependent on you card limit.

Here, we will see how we can check Credit card loan offers on sbi credit cards and also, if you are eligible for loan or Encash then how to apply for that loan offers in the SBI credit card app only. We will see what the charges are applicable while availing the Encash option in SBI App.

SBI Encash?

SBI Encash: Coming to sbi credit card loan offers sbi is providing you better options compared to other banks credit cards. If you really need of cash, then sbi offers you the option of Encash Facility in your card app. If you have sbi credit card and you were using it past 6 months by clearing all your dues and bills on time, then you will get this offer from sbi credit card.

Probably if you this sbi Encash Facility then only you can get loan from the bank, there is no option in the app to apply manually if you are not eligible for Encash Facility. So, pay all your bills and dues on time to get this Loan offers option from SBI. For more about Encash Visit SBI Site!

Fees/Tenures for Encash/Loan?

Fees: Processing fee equal to 2% of the Encash/Encash Inline amount will be levied at the time of booking. A minimum of 499+gst and a maximum of 3000+gst can be charged as the processing fee. This sum would be increased by applicable taxes.

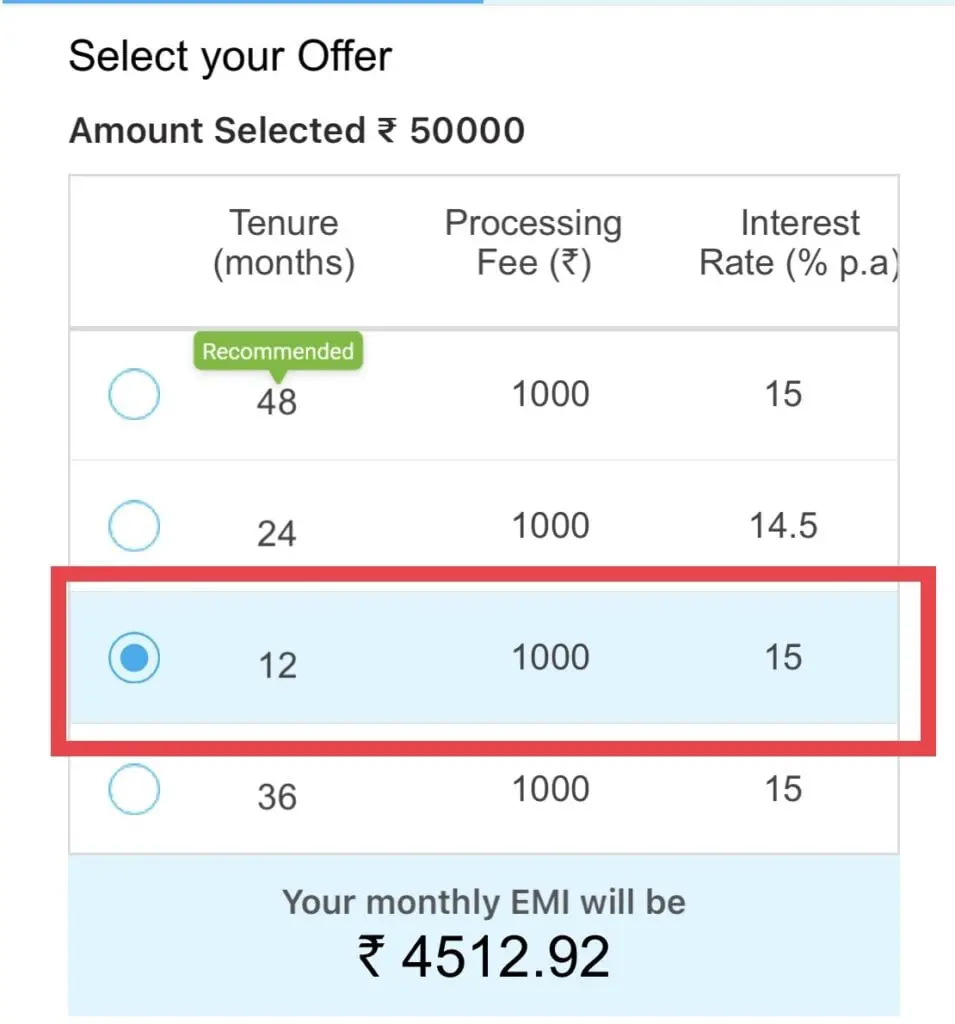

Tenures: Encash/Encash Inline reservations can be made for periods of 12, 24, or 48 months. Depending on the time and offerings, the tenures that are available may change. To find out the tenure that applies to the offer on your account, log in to sbi card website.

SBI Credit Card Loan Offer?

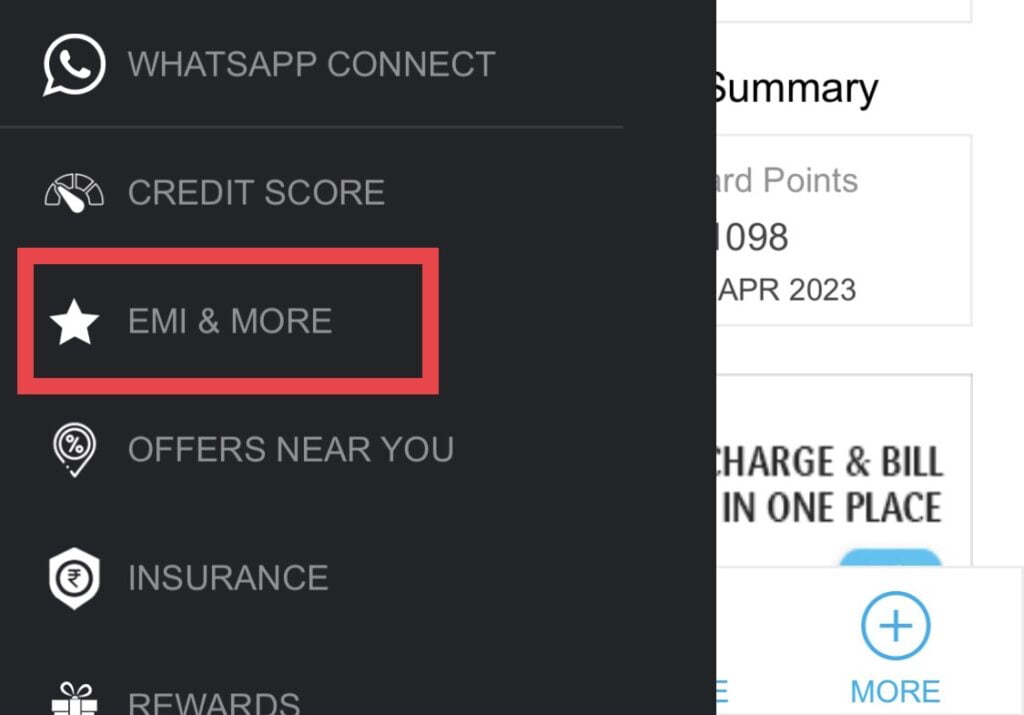

Step 1: Open your SBI card app and click on the ” gear icon” on the top.

Step 2: Once you click on the gear icon click on the ” EMI AND MORE ” to check the offers.

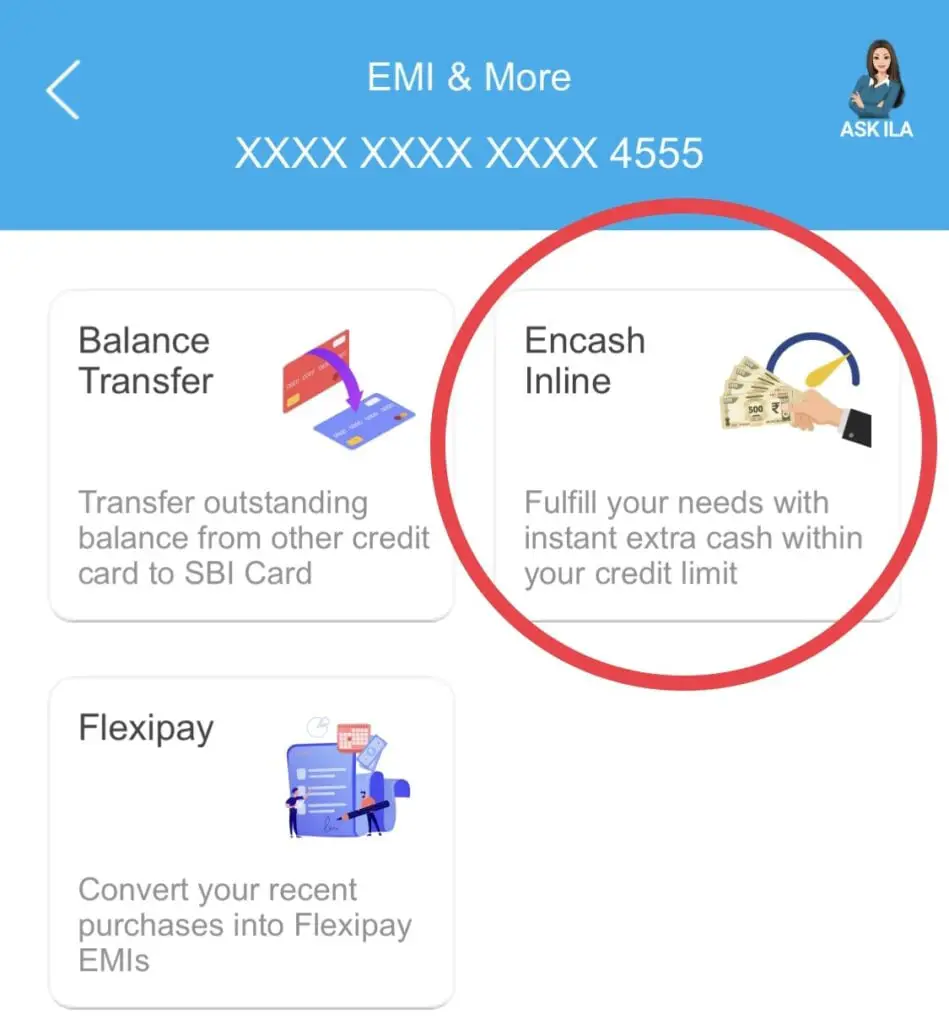

Step 3: If you see the Encash Inline option in your app then you are eligible for loan. In my case you can see below that I’m eligible on SBI credit card loan.

Apply SBI Encash?

Step 4: If already clicked on step 3 in above paragraph than follow the below steps from here to get loan amount into your bank account.

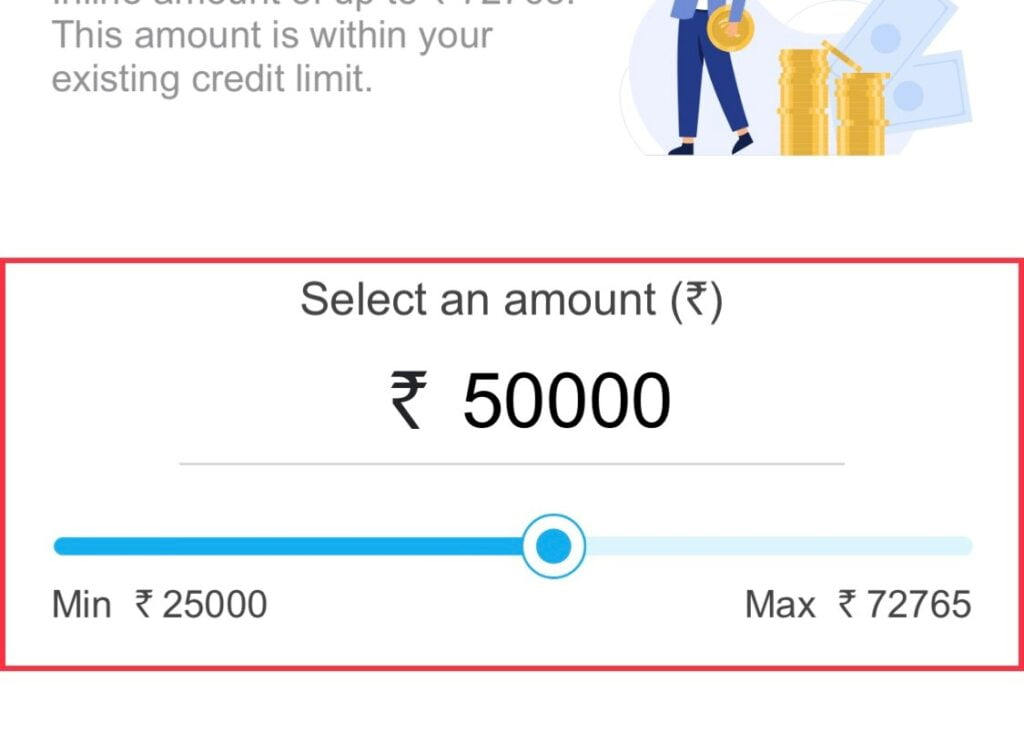

Step 5: Select the amount you want loan; you can toggle the button to adjust the minimum amount or maximum amount. The minimum amount you can get Encash is 25,000 you can’t get loan less than this amount.

Step 6: Carefully check the interest amount is charged on the loan amount you have selected and also please check the processing fee is getting charged. In my case I will select 12-month options, for this option I have to pay extra 1000+gst as processing fee and the rate of interest will be 15% per year.

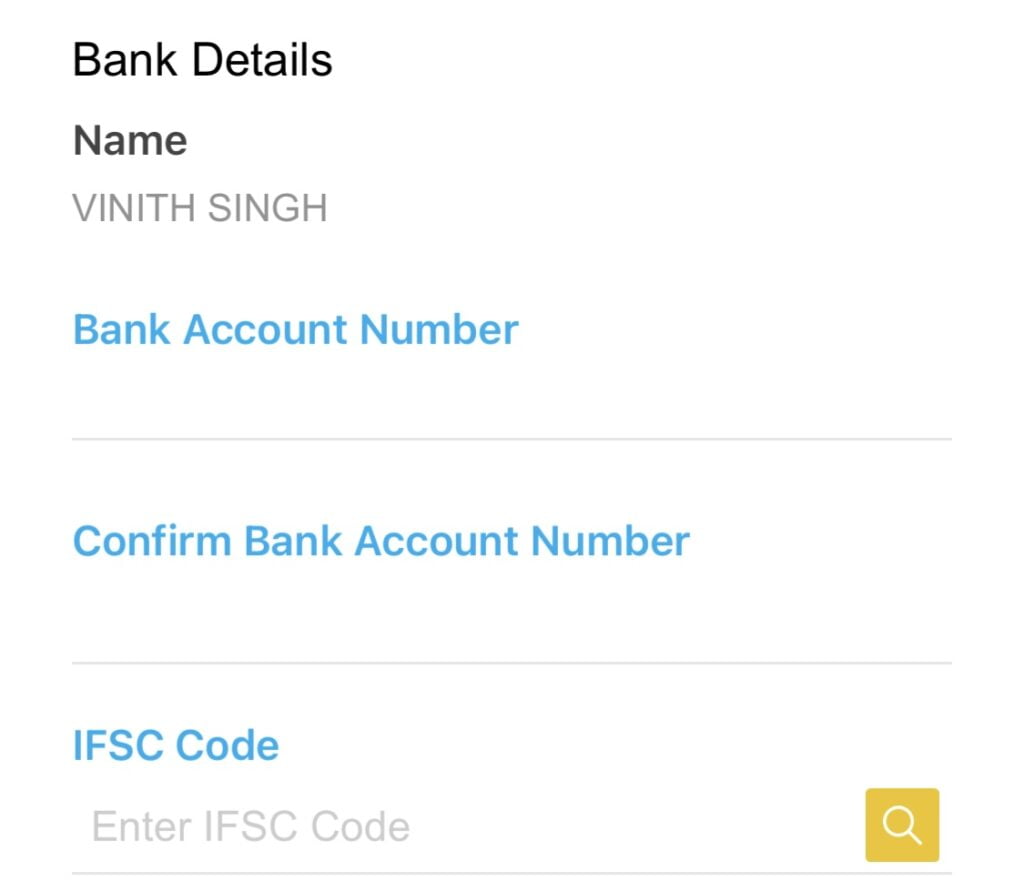

Step 7: In the last step you can provide the account details to get the amount. Note don’t use any other account, use your personal account because you can see below that in my account details my name is mentioned so you can’t change that name. Please provide the account number associated to the particular name and proceed further.

Note: You amount will get credited into your bank account maximum with in 2-4 days on time. Also, in some case it will get credited immediately to your bank account.

Encash Video!

Conclusion

SBI Encash is one of the best features to give loan to credit card users. you can avail this loan options in sbi credit card app. All the steps have mentioned above please follow the steps and get cash into your account immediately.

Related Posts!

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)