Best Life Insurance: Will bring the truth about companies and people and makes your aware. I will tell you, how can you identify a best plan or company for yourself. Because if you understand this, no one will be able to fool you.

Who Needs Life Insurance?

Three types of people. First, you are going to be responsible or you are going to have dependents. Means you are young now, have not become married but, you will do it in a few years and then there will be children too. You have parents too who are going to become dependent on you slowly. Second, you already have dependents. Your family’s house runs with your money and third, you have existing liabilities. Most Indians take out a loan to buy a house or car or other loans.

Insurance Cover?

How much life insurance cover do you need? It depends on three things.

- Number One: As I said it should cover all your existing liabilities.

- Number Two: The money left after covering the liability should be sufficient for your family’s next 15 to 20 year’s expenses, without disturbing the family lifestyle. Means all the expenses that were being incurred by the family, those expenses should remain same There should not be a need to cut expenses, in short, your family does not have to survive, it has to thrive.

- Number Three: The amount should beat inflation. Death has no certainty. E.g.; It can happen tomorrow or it might not happen in the next 10–15 years. So if the death happens after 10-15 years, and your family gets the amount that you decided today. It might happen, that the amount doesn’t hold much value in the future because the value might become half due to inflation which is why, the money that you earn in a single year the cover should be 20 times of it.

Why the Cheapest?

The earlier in age you buy, the cheaper the premium will be and at whatever the premium you will buy the policy it will never change. For example- my 1 crore policy premium is Rs. 1021 per month. I’m paying the same amount since 3 years, and will be paying the same in old age too. Now you calculate yourself, it’s value will decrease every year due to inflation.

Meaning, I will be paying less premium in the future. If I will select Term Insurance on policy bazaar website, and then select salaried employee as my profile, then salary range and qualification. After that, the most important question will come. Do you smoke or chew tobacco? If I select ‘No’ and look for 2 crore cover till the age of 65.

Time Value of Money?

To understand further things, it is very important to understand the common point and it’s called Time Value of Money. A simple question. Should I give you 1 lakh rupees today or after than 10 years. What will you choose? If your answer is today, it’s a correct answer.

Because if you will get the money today, you can fulfill the today’s need. You can buy a macbook, or a Tata Nano if its price was the same. And if you don’t have to buy anything, you will think that If I will get 1 lakh rupees, why should I wait for 10 years, give it today. Why today? Because if I will invest 1 lakh rupees today in the Index fund.

Why not whole life insurance?

Will get a insurance that provides cover till the age of 99, no matter when we die, our family will get the money. It sounds interesting, but its premium is also 6 to 7 times expensive. Meaning, if you want a term insurance of Rs. 2 crore at the age of 28 when you are healthy.

It will cost you Rs,. 2000 per month. But if you want the same cover in whole life insurance it will cost you between 8 to 10 thousand rupees per month. If you invest that additional 6 thousand rupees for 30 years in the index funds. Assuming 12% CAGR, your investment will grow to Rs. 2 crore rupees. Did you understand? No? Let me explain.

Buy a term insurance, pay 2 thousand rupees premium and will get a 2 crore cover till the age of 65 years. Once you cross the age of 65, term insurance will get canceled. But sill you will be having Rs. 2 crore in your mutual fund. And by holding that 2 crore, it can become 4,8 or even 12 crore. Till the time you are alive and don’t need that money, your investment can grow multifold.

Adequate Term?

Now you have understood, that term insurance is best. But what should be the term, till what age it should cover you? Usually 65, because by then your children grow old enough to earn for themselves.

So after the age of 65, no one will be dependent on you and that’s why you don’t need a life insurance after that. But sometimes, the difference in 65 and 75 year plan is not much. For example, this policy has a premium of Rs. 2181 which covers till the age of 65. Now when I change it to 75 years, the premium has increased by around 300 rupees.

Best Company to Buy?

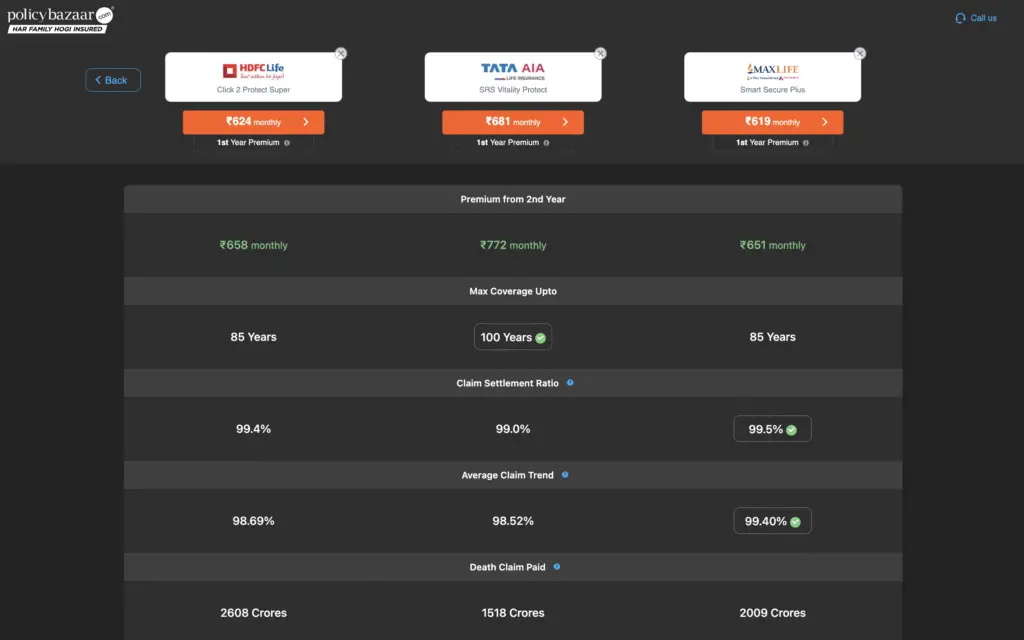

How to choose he best company for your term insurance. I have pasted link to check and compare top Term Insurance Companies!

So I will try to give you more updated information. First of all, you should think death is an uncertain event. It can happen today, after 10 years, or even after 30 years. So company should be strong enough to sustain for long term. Second point, company should have something to loose. It should have goodwill.

Generally small companies don’t have much reputation, If they reject your claim, you might raise your voice on different social media but no one will pay attention, and it won’t bother the company. So it should be a big and reputed company and you should have the faith that it will sustain for long term.

Third point, claim settlement ratio. It is a myth. Every company maintains their claim settlement number so that they can advertise this and lure you. So where to get all these ratios and including AUM data? In IRDA report.

Insurance Riders?

Along with taking term insurance, you should also take a couple of riders. Now what are these riders? Rider means add-on.

So mainly, there are two important riders The first one is critical illness rider Second is Accidental Disability Rider The specialty of critical illness is that Whenever you are diagnosed with a critical illness in life

Note: So whatever amount of rider you have taken You will get that whole amount in one shot. This is different from your health insurance Where the money is received as per the medical bill. it is not like that. If you have added a critical illness rider of Rs 30 lakh. So in case of critical illness, you will get 30 lakhs rupee.

Many company advertises, that we cover 50 illness if any of these disease happens to you, we will pay you. But many times , the common illness like, cancer is not included. So you don’t have to focus on number of illness. But rather focus on 10-12 illness which are common among Indians. Same doubts arises in accidental rider.

Vickey Rajpoot

Avoid Claim Rejection?

First of all while buying a policy, Be Honest. All the pre existing dieses that you have, be it hypertension, diabetes, cholesterol or heart disease.

Do you smoke? You need to answer all these questions honestly. No matter if smokers premiums are high, it was your decision to smoke. So you have to bear the premium. If you lie while taking an Insurance, that you don’t smoke and later it is discovered in any reports that the current health condition is caused by smoking.

After taking insurance, you need to be responsible. Whenever you go to hospital, for any health problem you need to maintain all the medical records in a file. After some time, it might get linked with Aadhaar and become digital it’s a good thing, but till then please maintain a proper file of it.

Best Life Insurance Problems?

Problem number 1!

More than 1.5 lakh crore is lying unclaimed in India. The definition of unclaimed money is, money that hasn’t been claimed in the last 15 years. This money is lying with, Insurance companies, mutual funds, Pension funds and bank accounts. So you have done a good work by taking a life insurance for your family.

But if your family doesn’t know that you have a insurance and they have to make so insurance is of no use. Not only they should know, that you have a life insurance. They should also have documents of it too. Insurance documents are present in physical form with you and also stored at NSDL in digital form.

Problem number 2!

The biggest problem is that we are middle class people. We always talk about earning crores, but we middle class people can’ imagine how richness look like and whether we will able to earn that much money. We just talk, and do nothing.

That’s why insurance companies give you monthly payout option. Means, if your family is entitled to receive 2 crore, they will not receive it in 1 shot, but instead, will receive monthly payout. This is also a bad decision for your family because if your family know this basic thing, that if they would put 2 crore in FD with 7% return.

Latest Post Links:

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)