One Credit Card Money Transfer: The people who are really in need of money and have one metal credit card can avail this money transfer from One credit card to bank account directly. Follow all the steps mentioned below with all images and proper explanation to avoid any confusion.

One Metal Card Money Transfer

Before we proceed to avail the loan or money from the card make sure you have offers available if not it is not possible to get loan or money from credit card.

Many other banks such as HDFC, IDFC, AXIS, RBL, DBS, ICICI, SBI and KOTAK provides this facility to the customers as Loan on Credit Card Offers, but if you look closely, it also works same as Loan on Credit Card, but One Credit Card Team is giving this offer as Direct Money Transfer to any Bank Account.

Steps To Get Money:

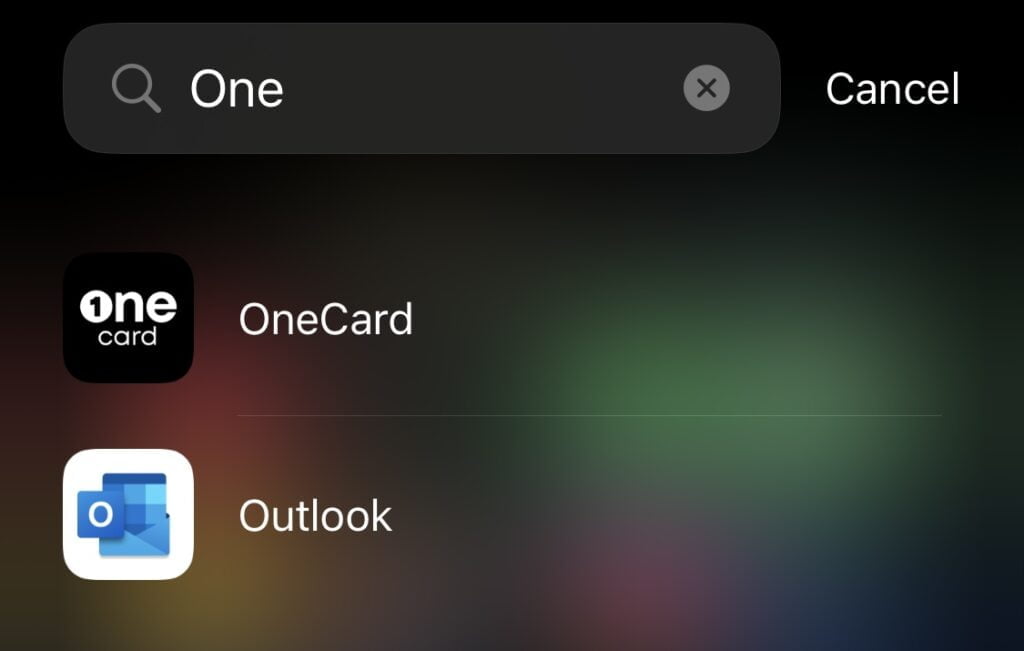

Step 1: Open your application in your phone (no matter what phone you use, one card app is available to all the platform). The application looks like this below image and if you don’t have one credit card, you can refer this one card website for Information about it: https://www.getonecard.app/

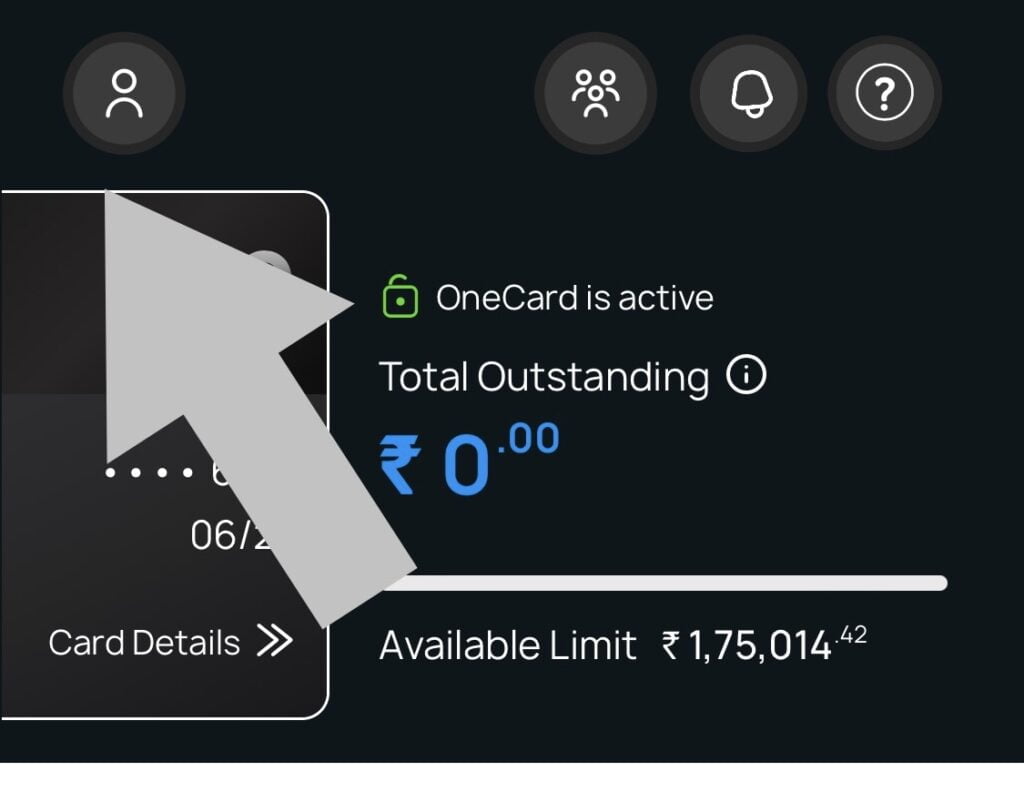

Step 2: Once you open the app, you can directly click on the profile icon which is pointing in this below image. Sometimes the same option will be available at the hemiscreen itself.

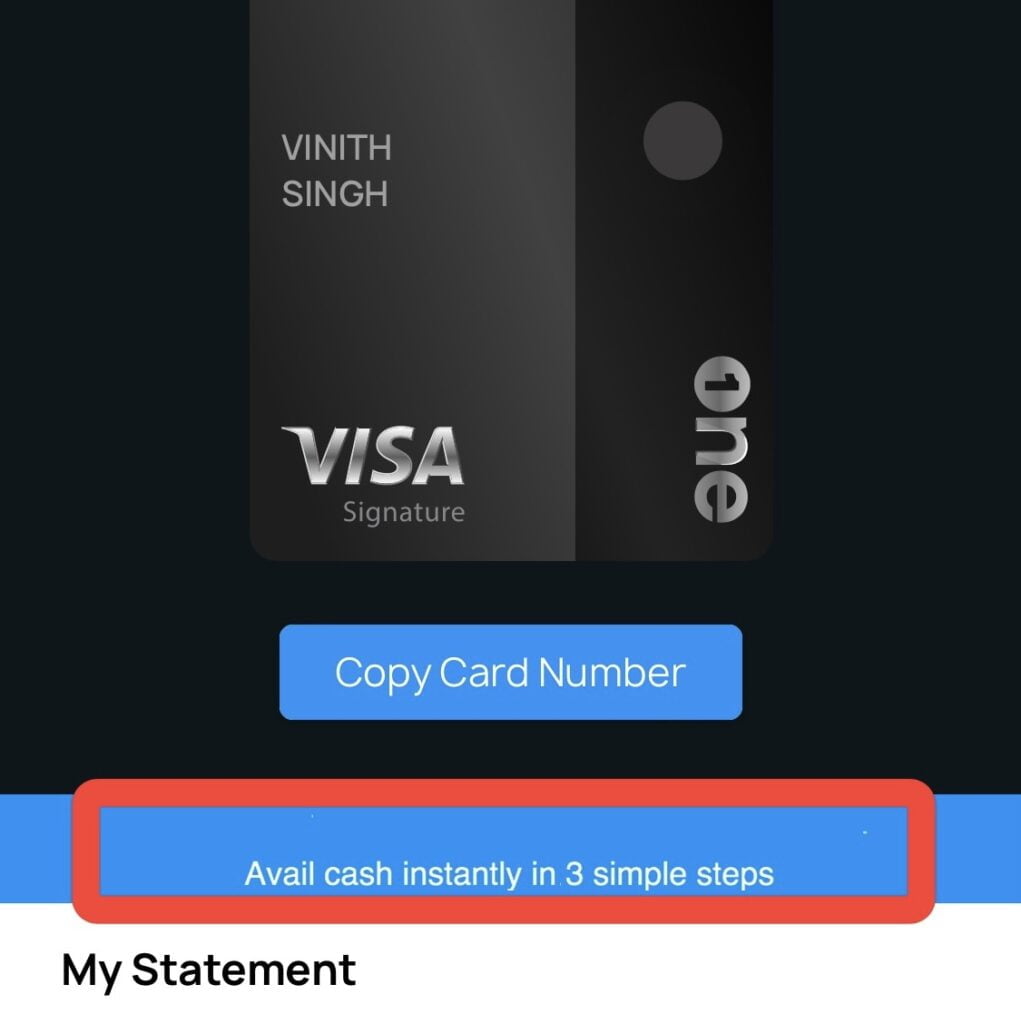

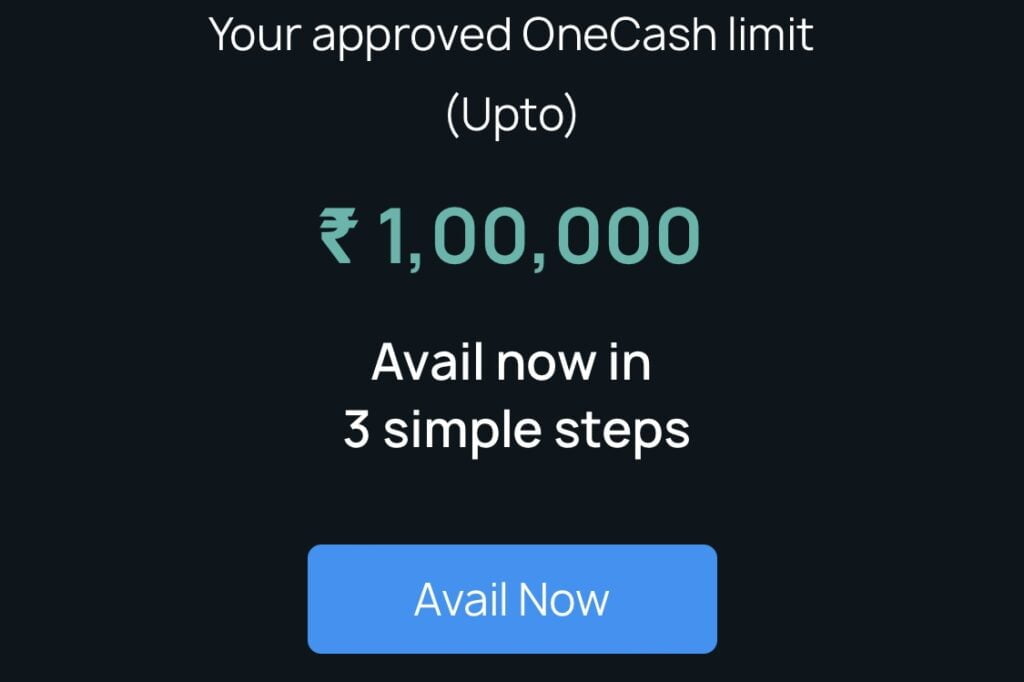

Step 3: As you can see in the below image once I click on the profile icon at the below of the card section, I am getting this “Avail cash instantly in 3 simple steps.”

Step 4: I have pre-approved limit of 1 Lakh rupees where I can transfer all my amount into any Bank account, but the problem is that I can only transfer the amount which included the Interest amount and GST’s. One done click on avail and proceed further.

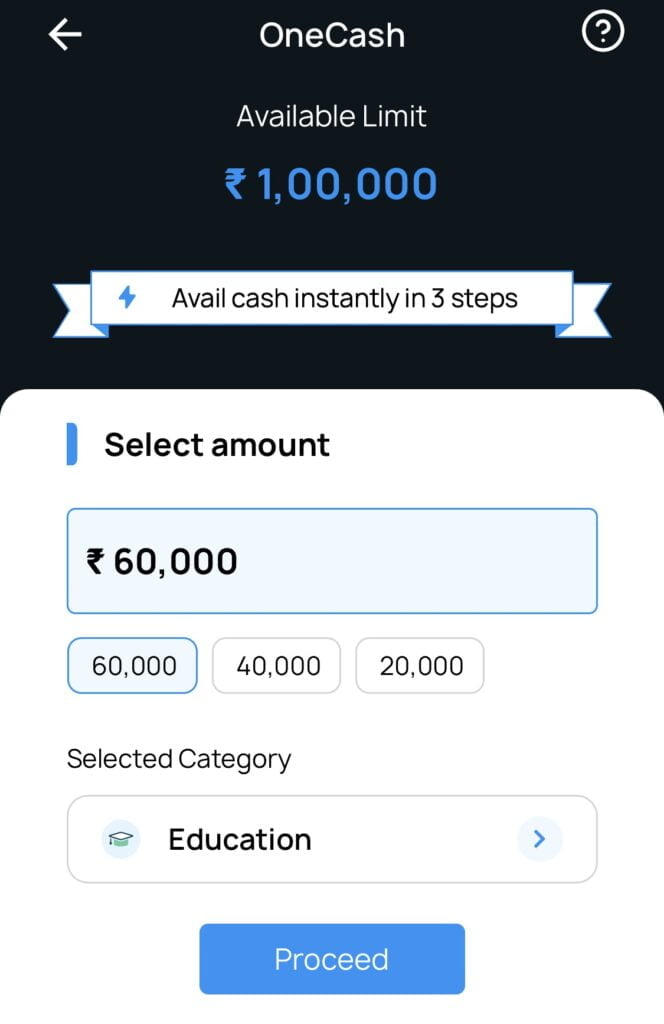

Step 5: Select the amount you want to transfer and choose where you want to spend it, the spend category will not increase or decrease the interest charges on the EMI tenures. so, you can select any of the options and proceed. further.

In my case I will take loan of rupees 60,000 to make you understand how it works and also selected the category as well!

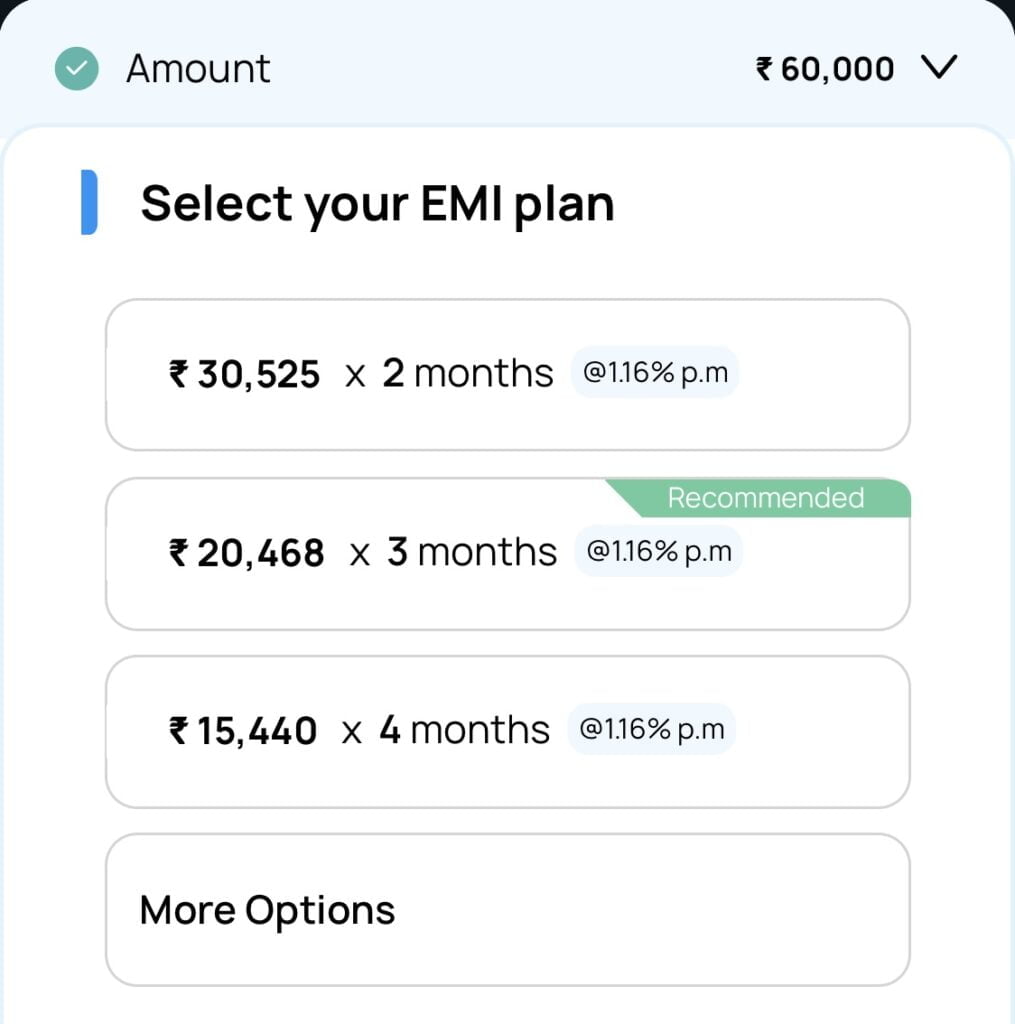

Step 6: Now in this window we can see that we have multiple options to re-pay the one cash amount. Select the option which you are comfortable with and if you want more time or tenure then click on the More Options Below.

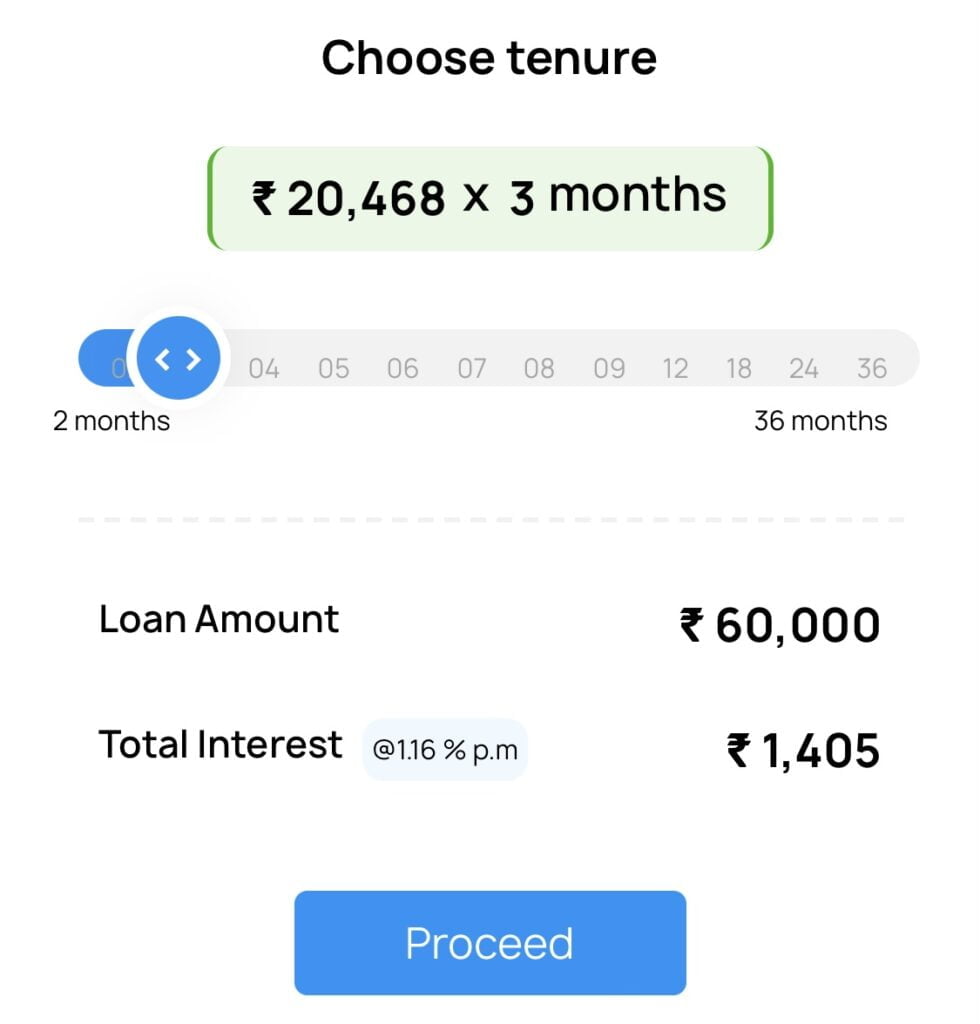

Step 7: Once you select More Options from the menu then here all the options will be available to re-pay your loan amount. The time period to re-pay your loan amount will be max up to 36 months.

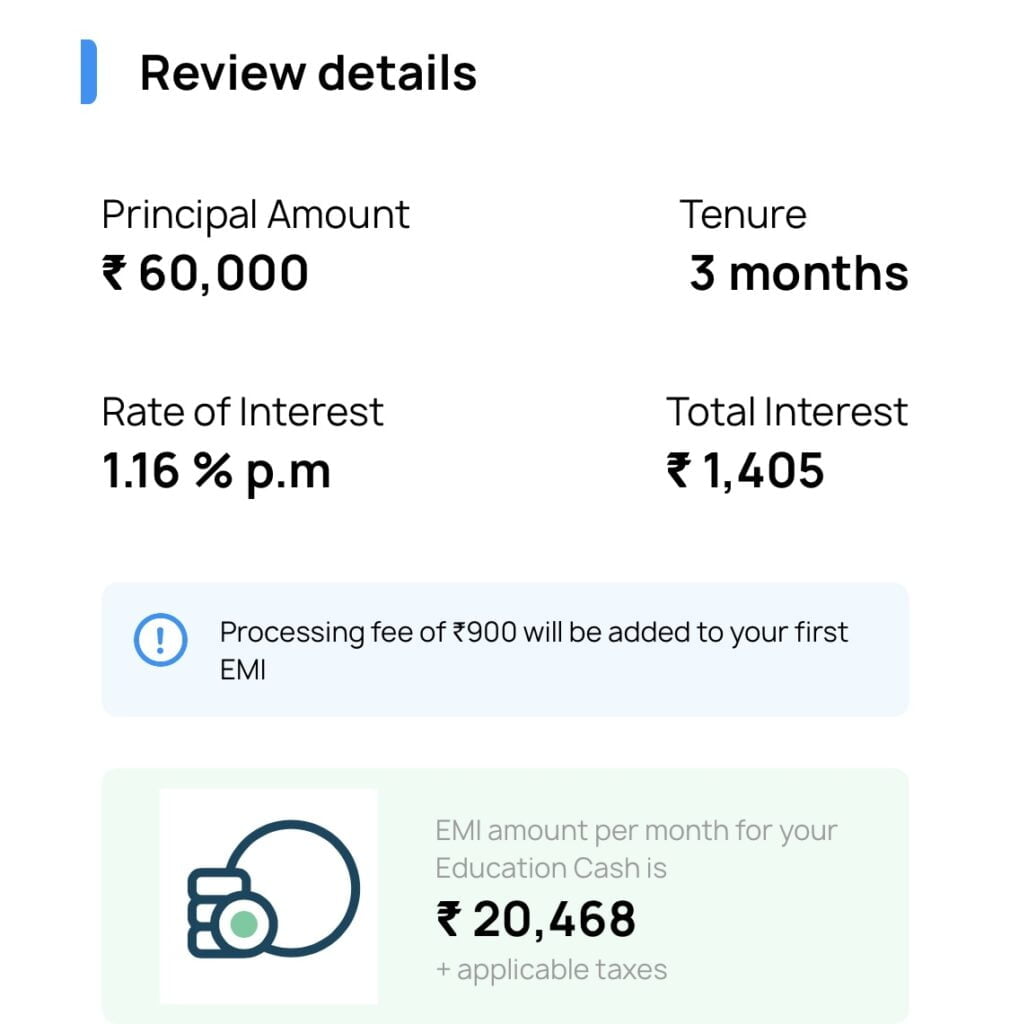

Step 8: At this step your details summary will be shown and please cross the check the option you have selected because once you select and proceed then you cannot make any changes once the amount is credited into Bank Account.

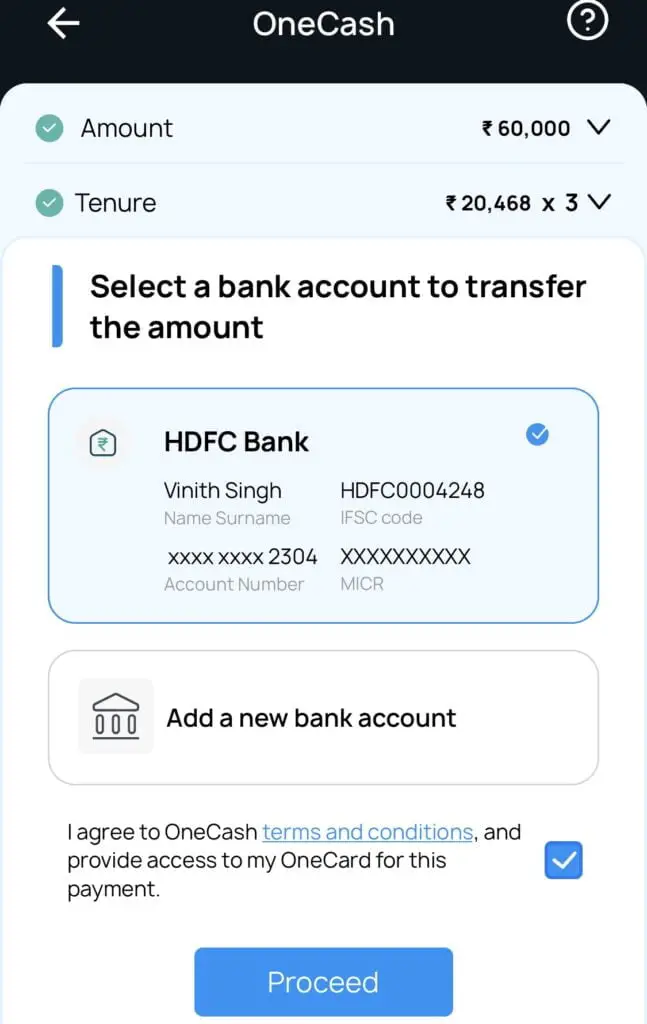

Step 9: At the last step it will ask for your account number in which the amount need to be transferred. You can choose the existing bank account number, or you can add new account from the below options.

One Credit Card Money Transfer Video!

Conclusion:

I hope I was able to show you all the steps regarding the One Cash Money Transfer on the one card app. If you have any doubts or conclusions, please feel free to comment down below. The loan amount will be transferred to your preferred bank account or if you want to do through UPI even that option One Card will provide you!

Latest Post Links:

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

CRED: Daily Earn Up To ₹1000 Using CRED App – Offers (kingfishertechtips.in)

Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)

EPFO: How To Find/Know Your UAN? – Kingfisher Tech Tips

EPFO-Change Mobile Number In UAN || How To Update? (kingfishertechtips.in)

Activate Your UAN Number On EPFO Portal — Step By Step! (kingfishertechtips.in)