Credit Card UPI Payments?

In this article, we will see how can we use our Indian rupee credit cards for all your UPI payments, such as barcode scanner, business account and many more features. As you are aware that RBI has enabled this feature for all the rupee credit card holders in which you can do your UPI payments with different vendors such as PhonePe, Google pay, pay app, cred app, paytm and many more UPI applications.

As you can see in the above image I am using credit applications to register my UPI credit card to do all my UPI payments for free up to ₹2000. I will guide you. How can you register your credit card into top three applications of the market like CRED App, Pazapp App and Phonepe. depending on the application, you may choose the below options and read more about it to configure the rupee credit cards for UPI payments.

Hdfc Payzapp App:

As you know, Payzapp app is application by HDFC Bank which also provides UPI payments by using credit card and you can follow the below steps to register your any bank credit card to pay app and do your barcode or UPI payments without any issue or hustle free.

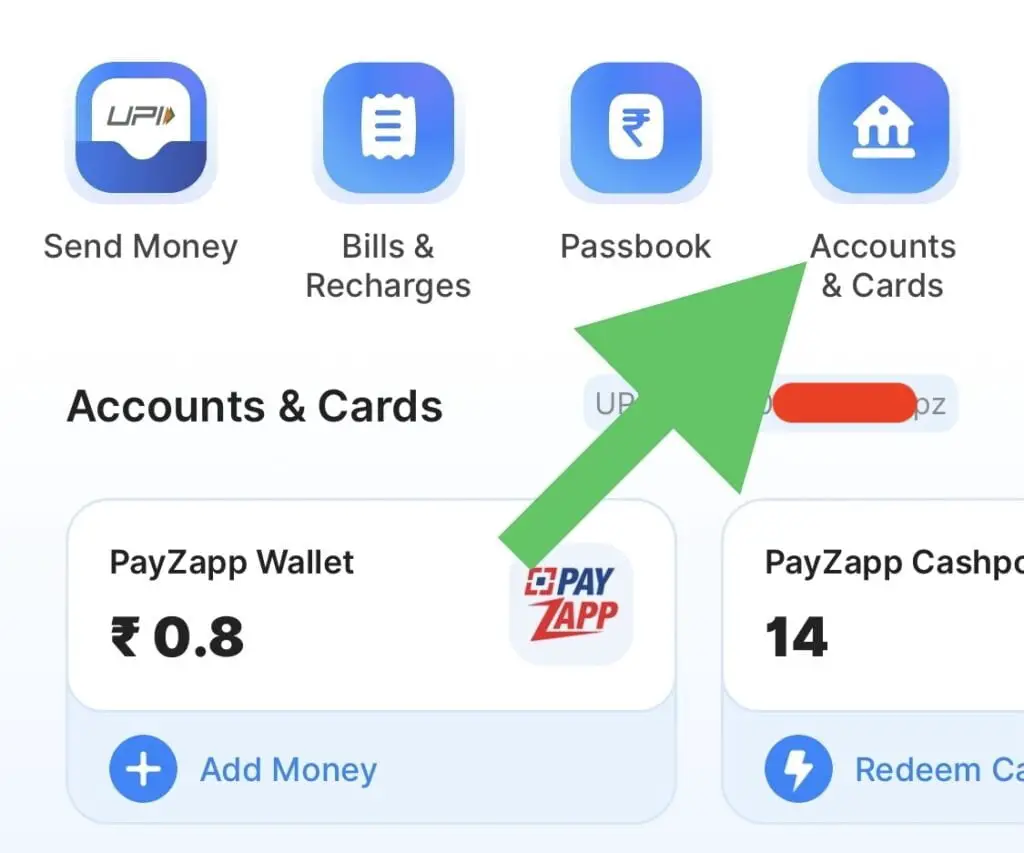

Step 1: Open your HDFC bank payzapp app and in the homepage itself you can find this accounts and card option. Click on that and proceed further with the below steps.

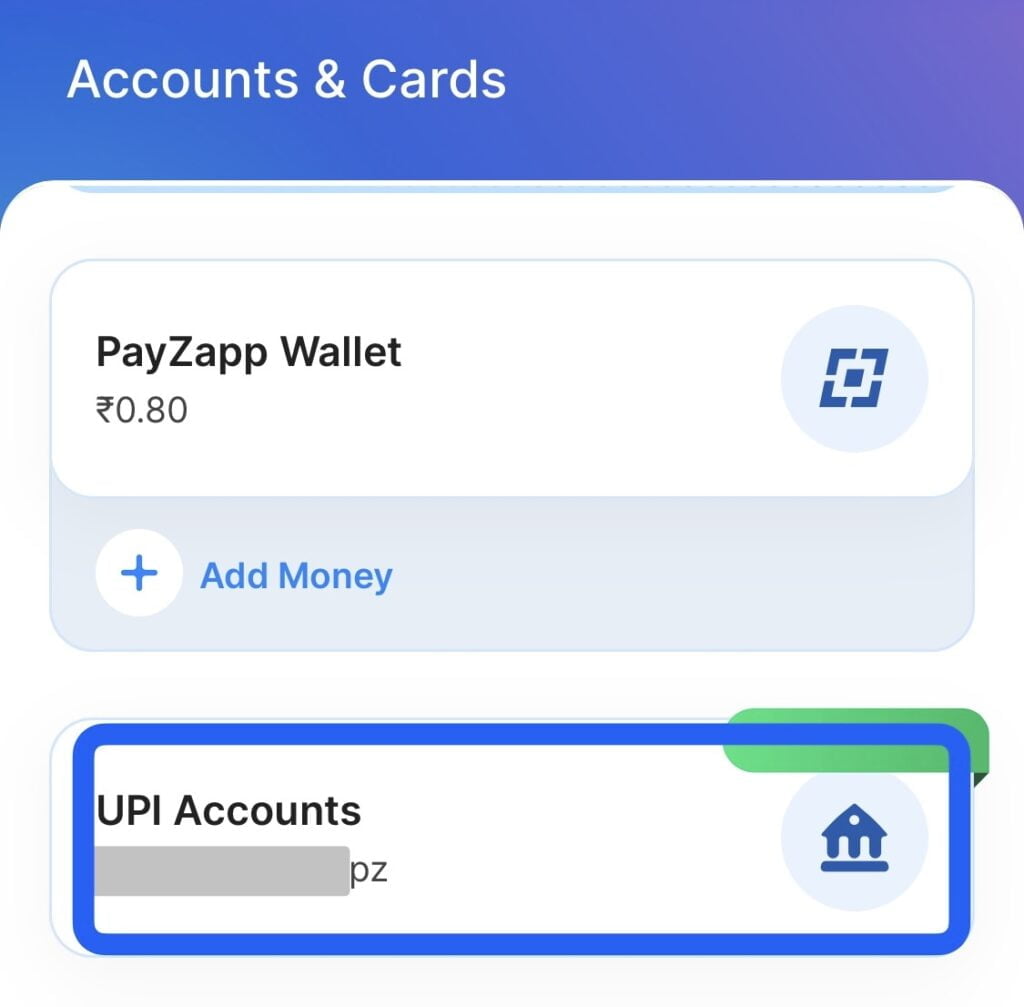

Step 2: As you can see here, I have multiple options and we will add rupay credit card so make sure you don’t select add card option which will be listed below. You have to select UPI accounts as you can see in the below image.

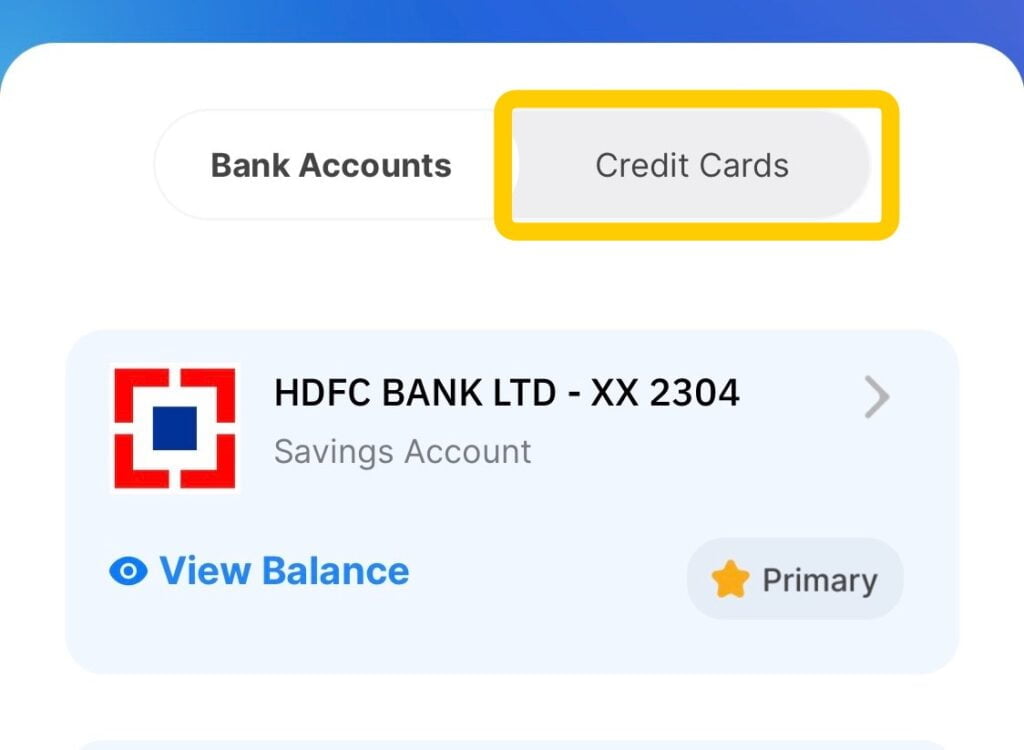

Step 3: We have two options here so you have to select one options that is credit card options. Make sure you don’t select bank accounts because as you know that all rupee credit cards are not bank accounts but act as a bank account when you do UPI payments, so make sure you select credit cards and follow the steps below.

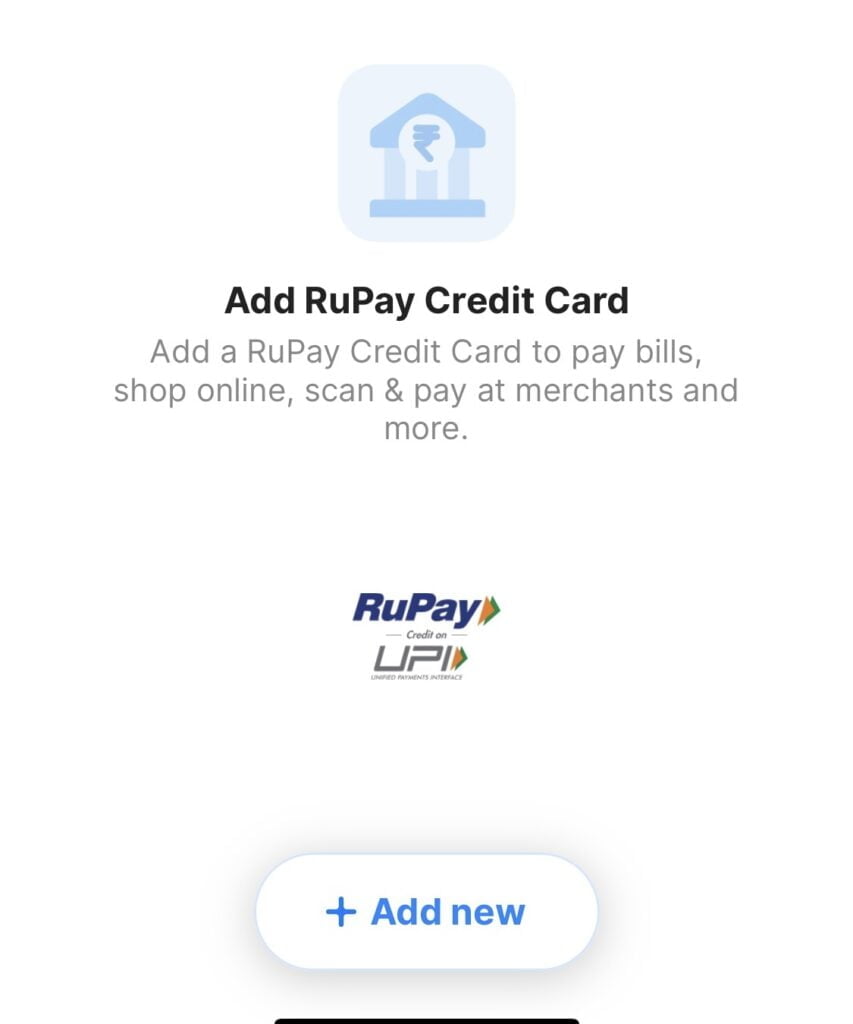

Step 4: As you can see in the below image that currently I don’t have any credit card but once I add credit card, the list of credit cards will be listed here so I will select a card option which is listed below.

Step 5: HERE WE HAVE TO SELECT WHAT BANK HAS PROVIDED YOU THE CREDIT CARD. IN MY CASE YOU CAN SEE THAT I HAVE RECENTLY GOT APPROVED WITH IDFC BANK CREDIT CARD SO I WILL ADD MY IDFC BANK RUPAY CREDIT CARD INTO HDFC APP SO THAT I CAN DO ALL MY UPI PAYMENTS for free of cost limit up to ₹2000.

Step 6: Once the verification is done, you have to provide last six digit of your rupee credit card number and associated expiry date and month for verification in any applications. In my case I’m using Hdfc Payzapp app.

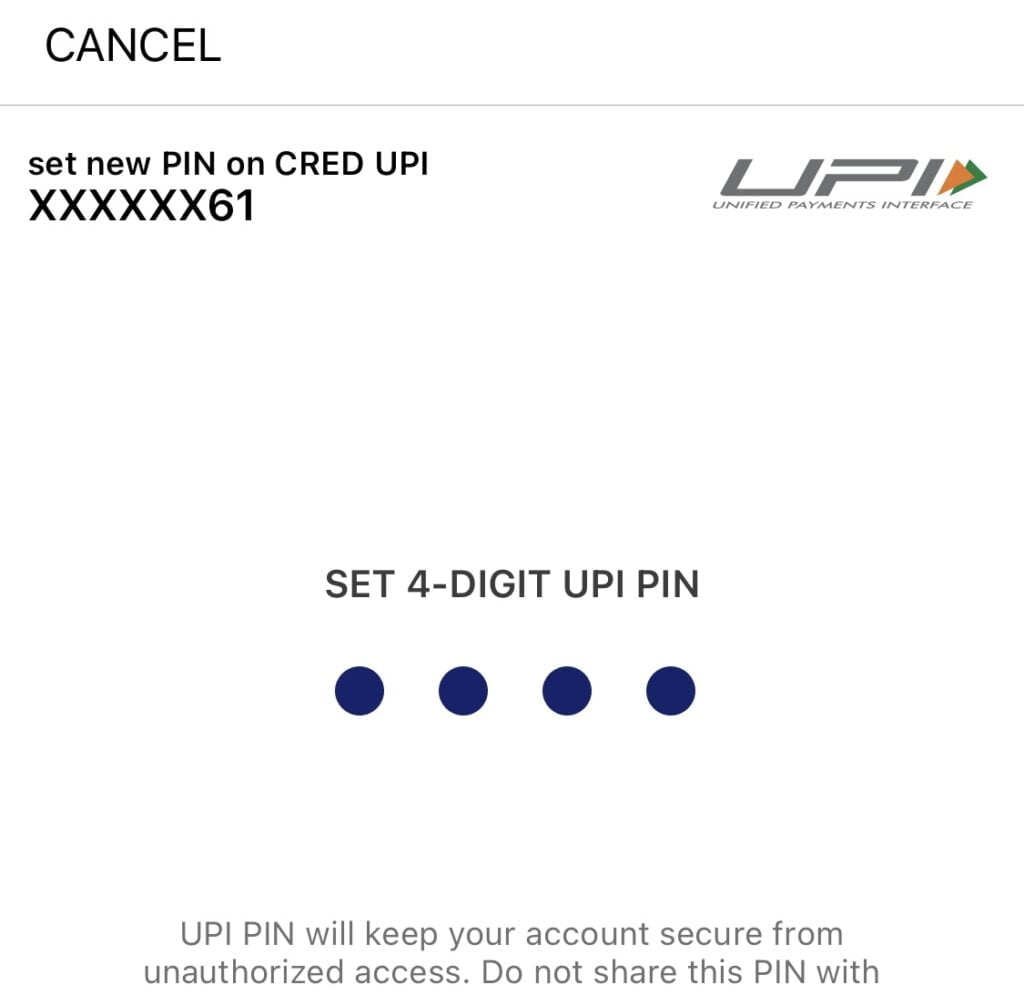

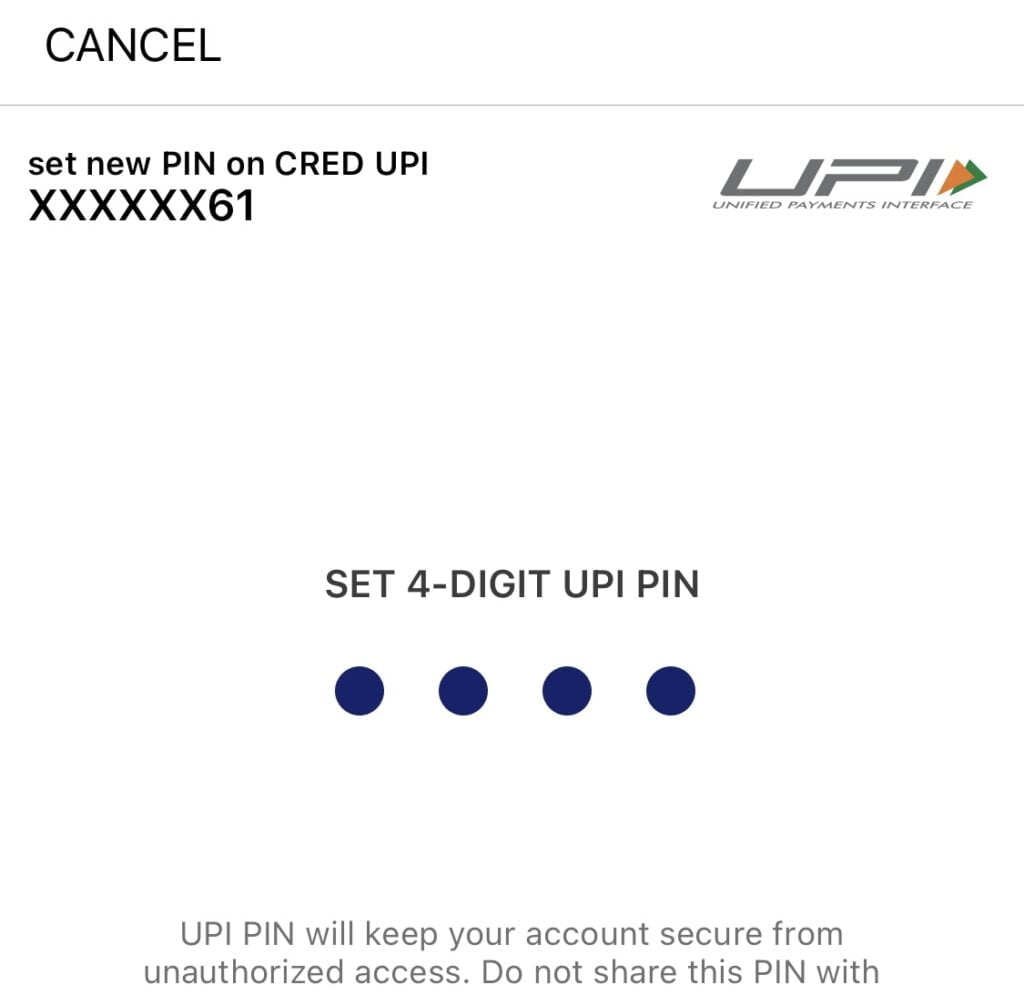

Step 7: Once everything is done, we have to do the OTP verification and four digit, UPI pin registration. as you know when you do any kind of UPI payments at the last, you will get an option to provide your pin for transactions the same way even our rupee credits cards also have those kind of pins. So make sure you remember this pin for your future payments.

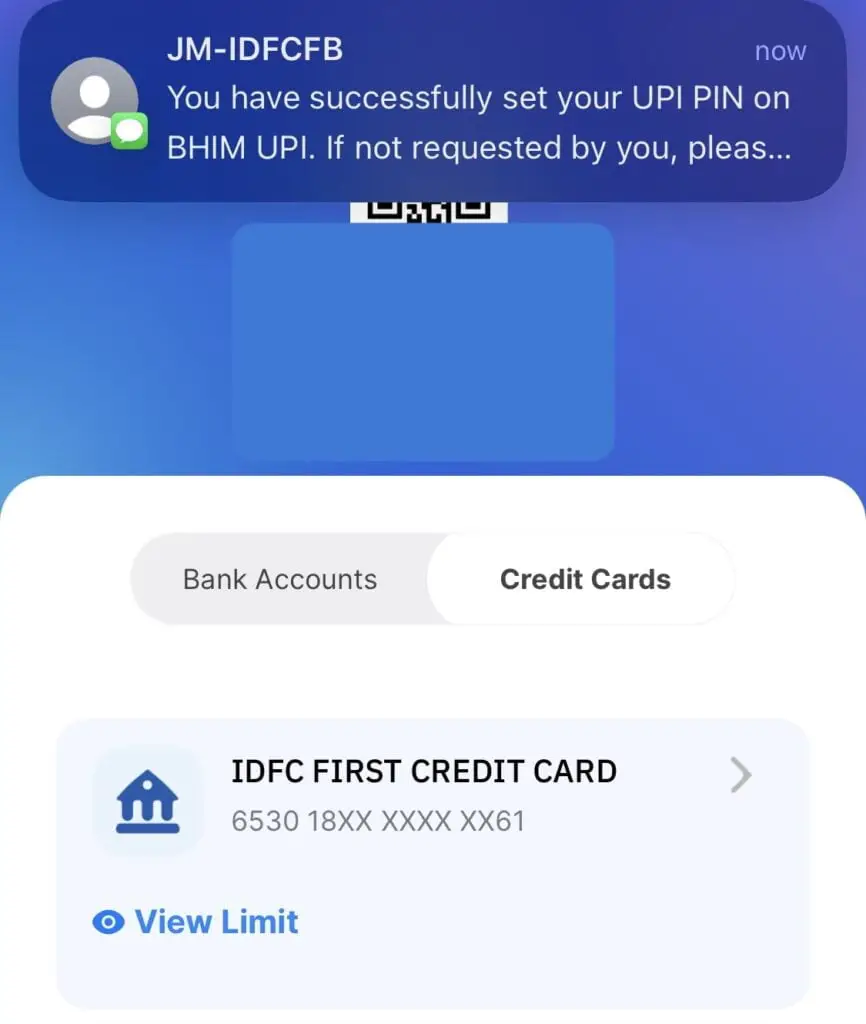

Step 8: now we have successfully added our IDFC bank Rupee credit card to my Hdfc Payzapp and we are good to go for any kind of barcode scan or UPI payments to business account. Also the message in the below image. I got from the bank of successful registration of UPI on my credit card.

CRED App:

Credit Card UPI Payments with credit app as you know credit app is the India’s largest credit card payments app and also we have platforms to support for shopping, UPI payments, UPI bank accounts, scanner etc. so below steps, we can see that I have guided you how can we add our Indian rupay UPI credit cards to credit app and make payments. For more: https://cred.club/upi-on-credit

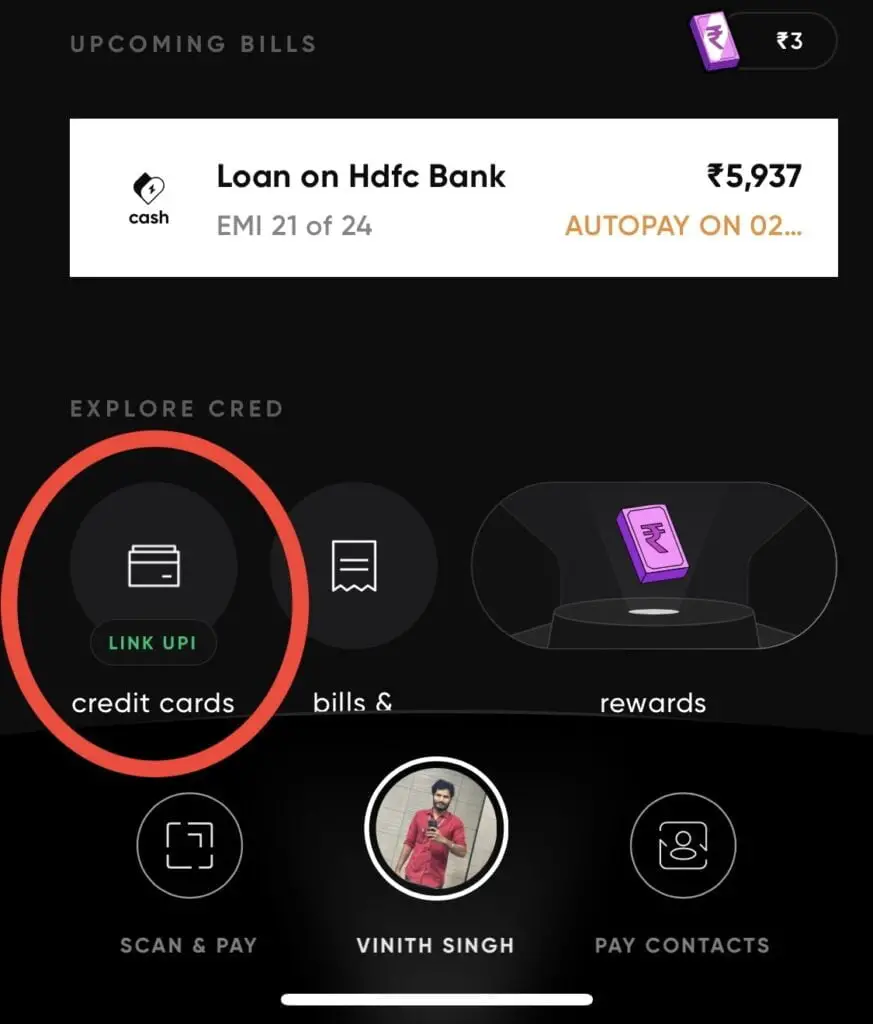

Step 1: Login to your CRED app in the homepage itself, you can see link UPI credit card option as it is showed in the below image but suppose if you don’t find this option then you can directly go to your profile icon or settings icon and there will have one option called link account there you can select and link your credit card. In my case it is visible in the homepage itself. So I will click on this and proceed further.

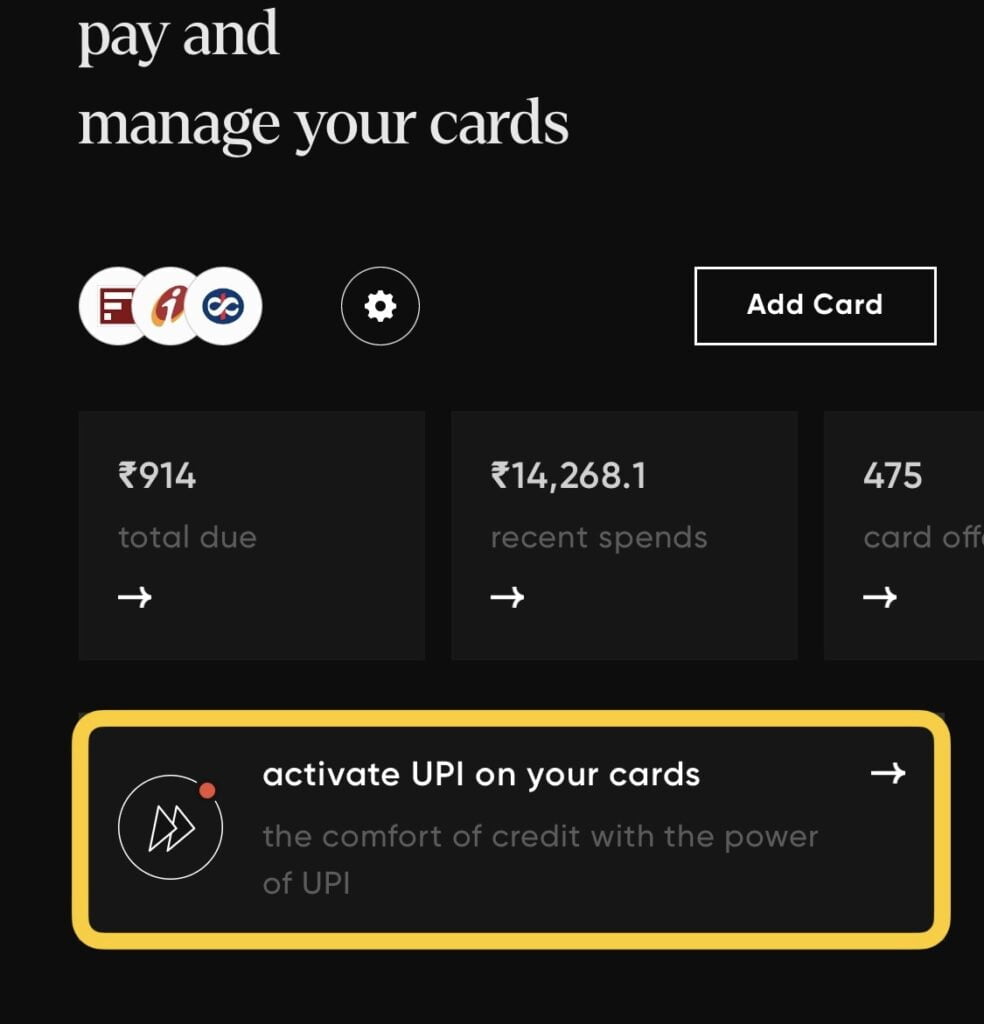

Step 2: As you can see from the below image, we got activate UPI on your card option. Just click on that to add your rupee credit cards to create app for all your payments and bills.

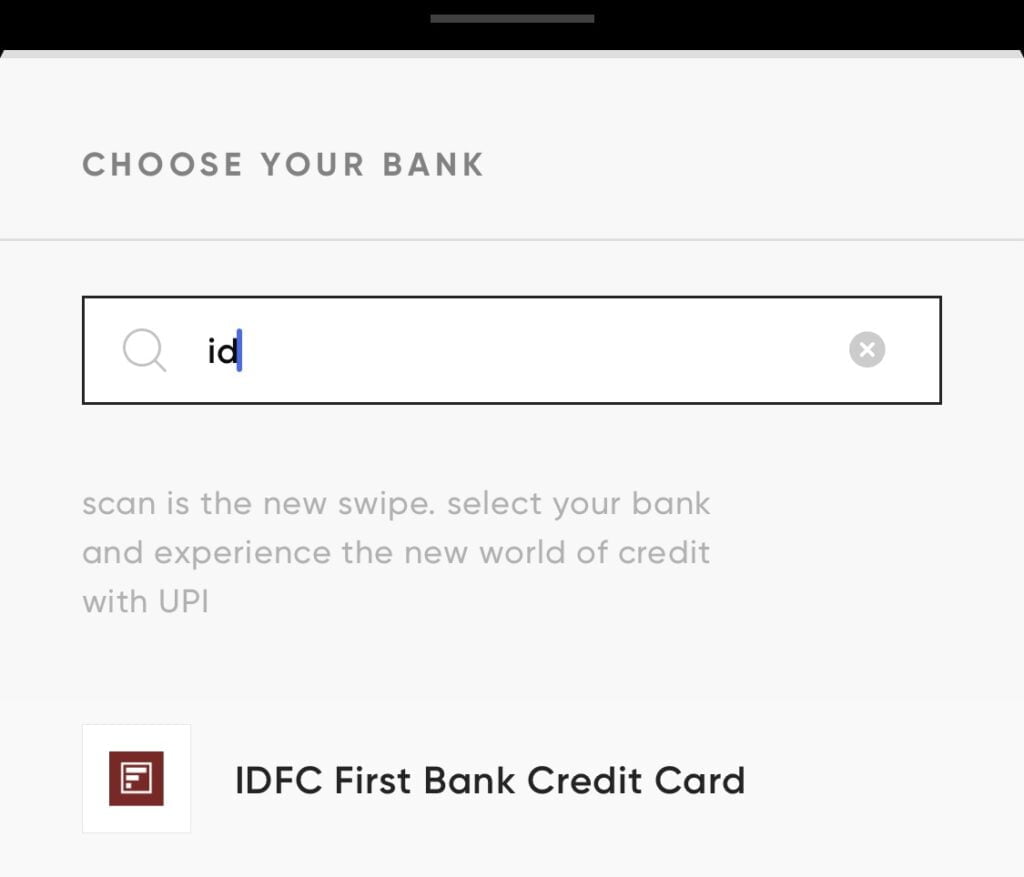

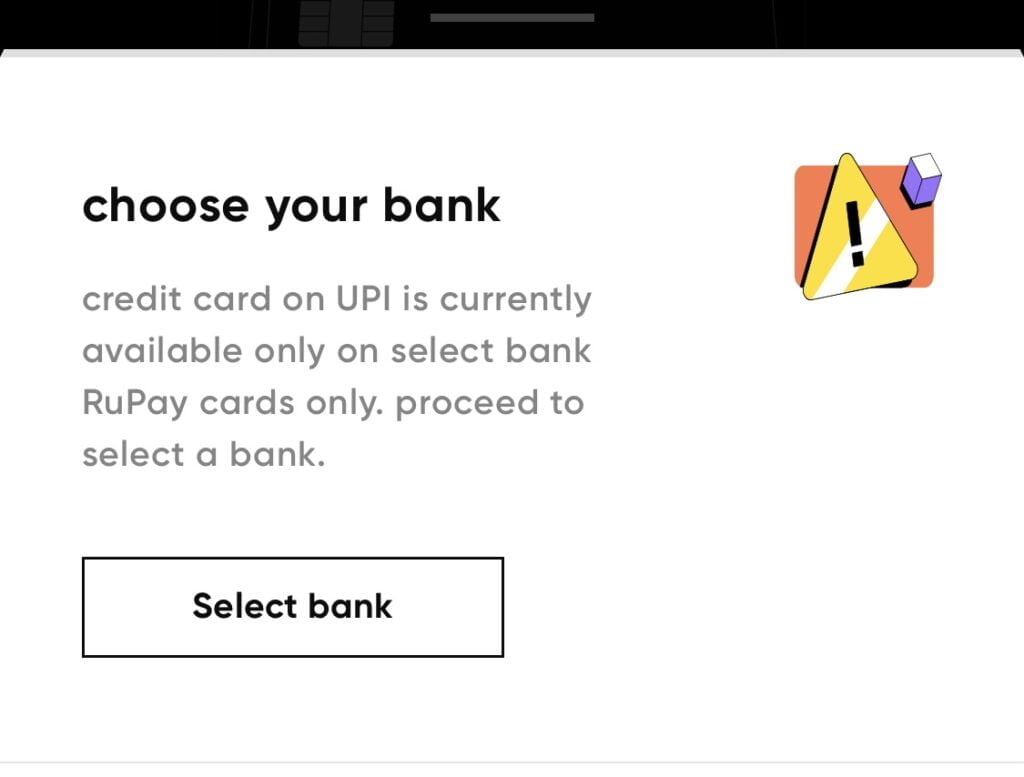

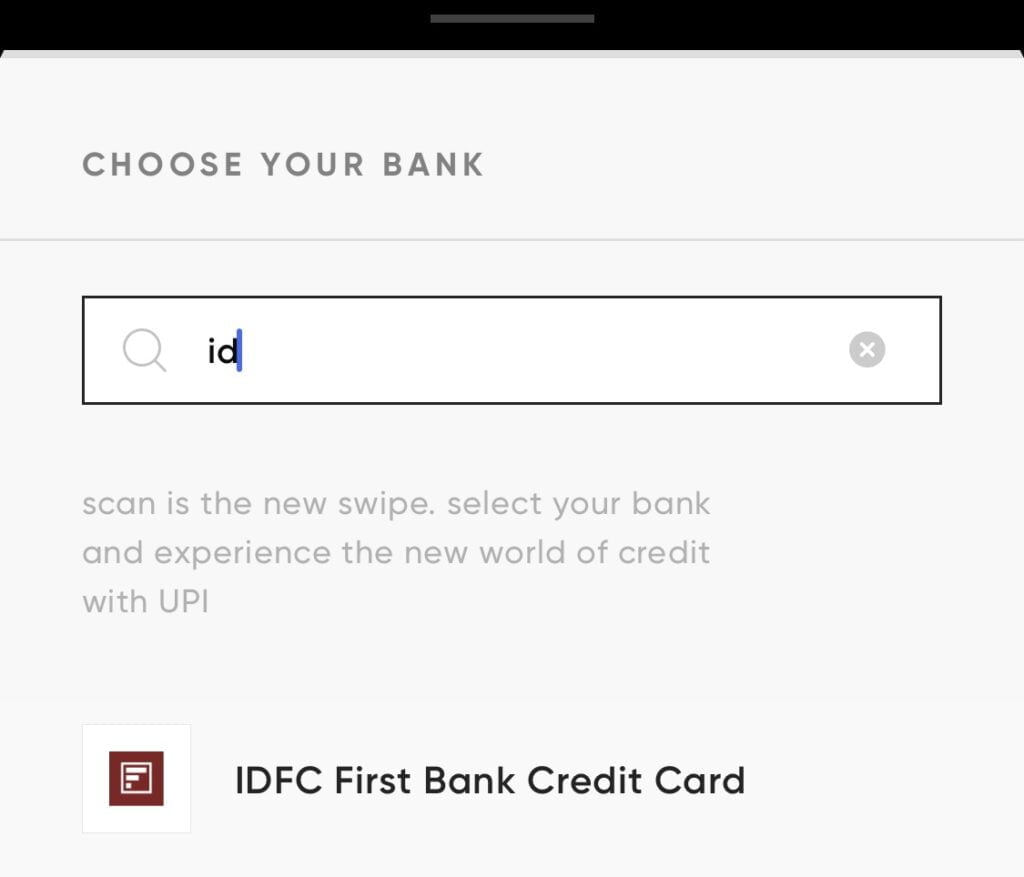

Step 3: Here you can see we got an option to choose the bank account which has provided the credit card. In my case I have IDFC bank Rupee credit card so I will add and proceed further.

Step 4: Select the credit card associated to your bank. In my case it is IDFC Bnak no matter what bank you have in India. Generally all the top banks of India provide rupay credit cards for UPI payments.

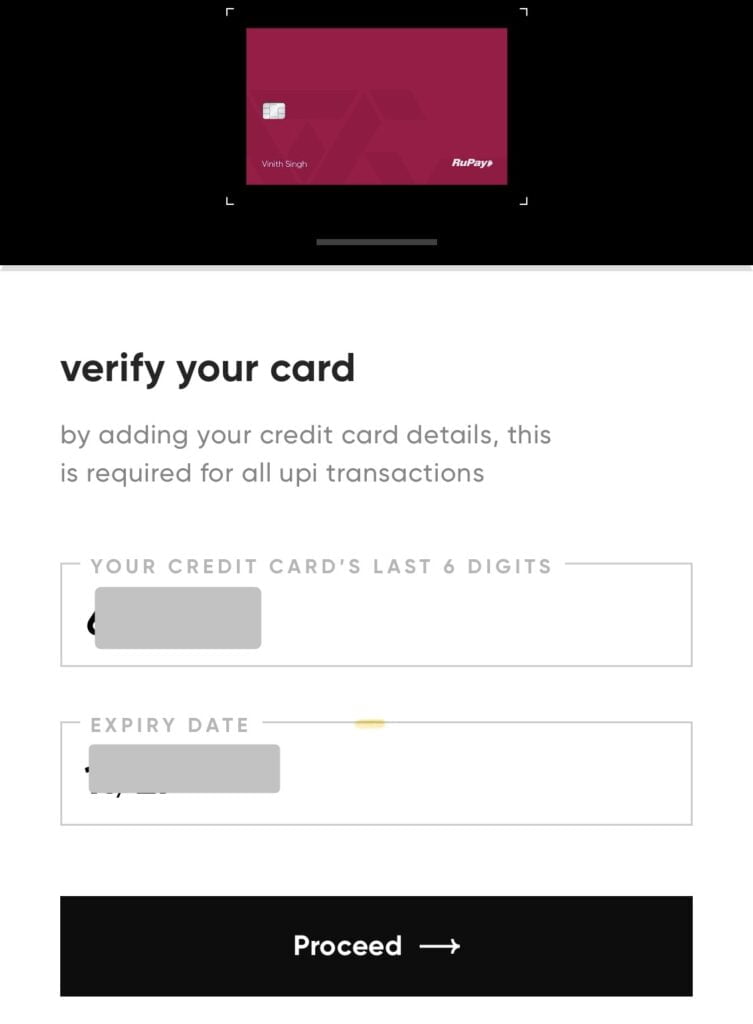

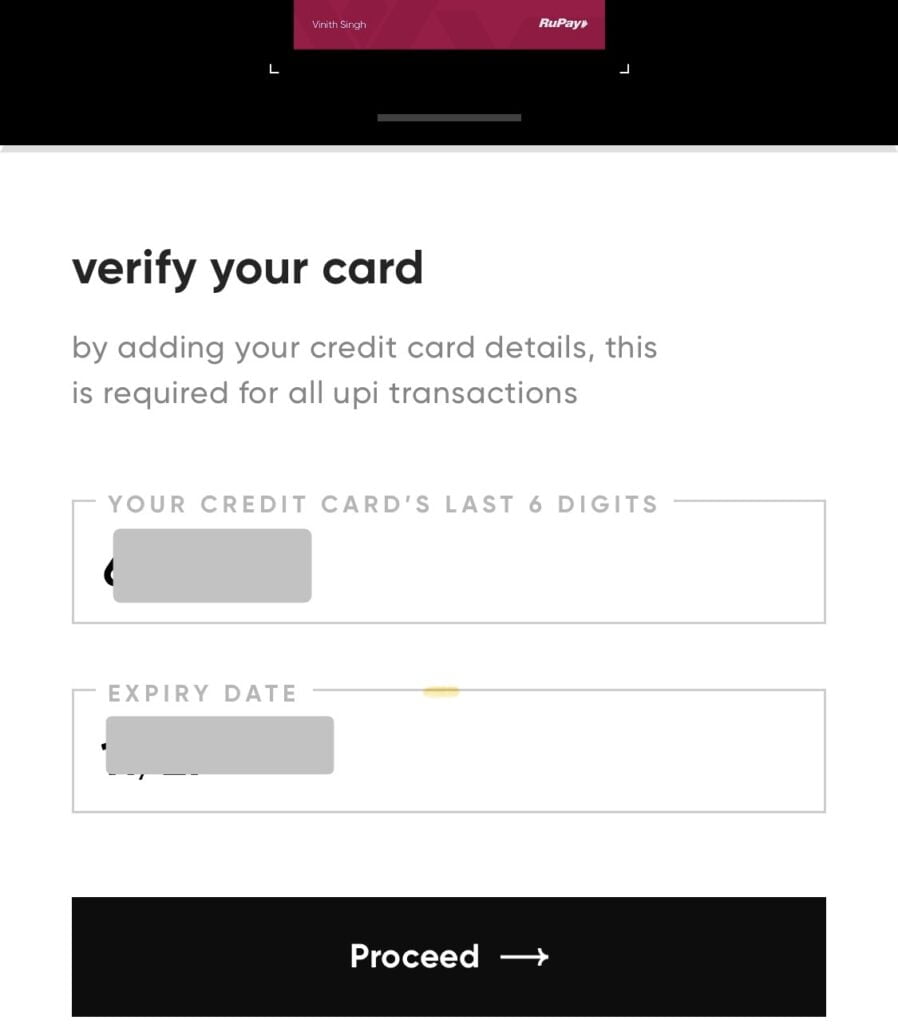

Step 5: Once done, the credit will fetch already details and it will ask for verification so in the verification you have to use your six digit of your credit card number and month and date which is also called as expiry for the card.

Step 6: ONCE VERIFIED, YOU CAN SEE THAT I HAVE TO PROVIDE ONE PIN FOR ALL MY PAYMENTS. SUPPOSE IF YOU’RE DOING ANY PAYMENTS TO BARCODE OR SCANNER OR BUSINESS ACCOUNT AT THE LAST, YOU HAVE TO PROVIDE PIN NUMBER ALL THE TIME WHENEVER YOU DO A SINGLE TRANSACTION, SO PLEASE REMEMBER THIS UPI PIN FOR YOUR FURTHER UPI PAYMENTS.

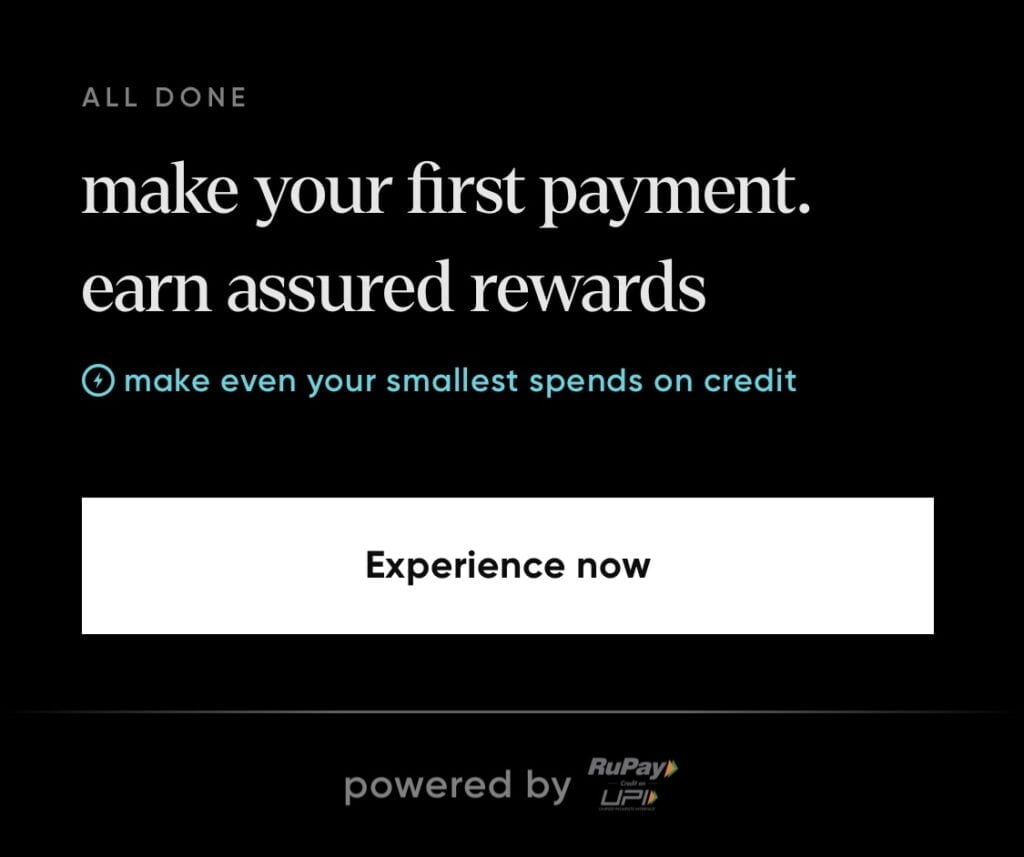

Step 7: At the final step, you will see this kind of screen where it says, make your first payment and on assured rewards or cashback from trade. So if you register your credit card with credit, you will also get cashback as rupee money in your credit wallet, you can use it later for your credit card bills, shopping recharge and many more payment options.

PhonePe App:

Many people in India uses PhonePe or Google pay for majority of their payments. As you know PhonePe has largest market share when it comes to UPI payments and in PhonePe. We have options to add your credit card as well.

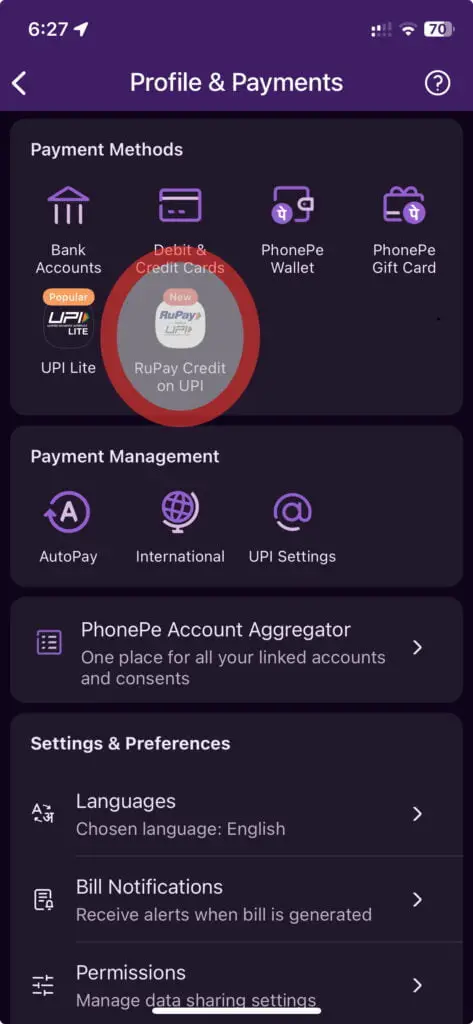

you can just go to your profile icon as you can see in the below image. I’m not going to guide you with all the steps but it is similar to Payzapp app and Cred app. once you click on the settings icon or profile gear icon, you can find this options as listed below.

As you can see we have a new option added in PhonePe that is Rupa UPI credit card. So just click on that and select your bank account. Then provide the OTP and proceed further with the registration process as we have done in the above app apps..

Watch YT Videos

Latest Post Links:

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

CRED: Daily Earn Up To ₹1000 Using CRED App – Offers (kingfishertechtips.in)

Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)

EPFO: How To Find/Know Your UAN? – Kingfisher Tech Tips

EPFO-Change Mobile Number In UAN || How To Update? (kingfishertechtips.in)

Activate Your UAN Number On EPFO Portal — Step By Step! (kingfishertechtips.in)