Credit Card Money Transfer: In this blog post, we will see how we can transfer credit card limits to a bank account, compared to other platforms CRED is one of the best apps for doing credit card limit transfers to a bank account. Follow below!

There is no platform where you can get free transfer of money from your HDFC credit card to any of the bank account. But many of the e-commerce website will offer you first time coupon so that the charges amount will be reduced on transfer

Vickey Rajpoot

CRED App

CRED App: Credit is one of the best for your credit card payments, bill payments, UPI transaction and shopping platform as well. The best part about credit app is that you can do credit card rent payment directly to your bank account without any proof or agreement.

I am using my HDFC bank credit card to transfer my credit limit amount from HDFC credit card to one of my bank account with very minimal charges.

Credit card money transfer is not directly supported by any of the platform but we have many loopholes to do your payments from credit card to any bank account with minimum fee charges. Follow the below steps to login into credit app and do your rent payment with absolutely very less interest charges.

Credit Card Money Transfer

Credit Card Money Transfer: Suppose you don’t have money to pay your credit card bill, you can use credit cards to pay your bills. Compare to other platforms we can see below that, there are fewer charges when we use CRED App.

All the details regarding credit card payments and what are the charges is directly supported by credit app itself. For more about the information please click here!

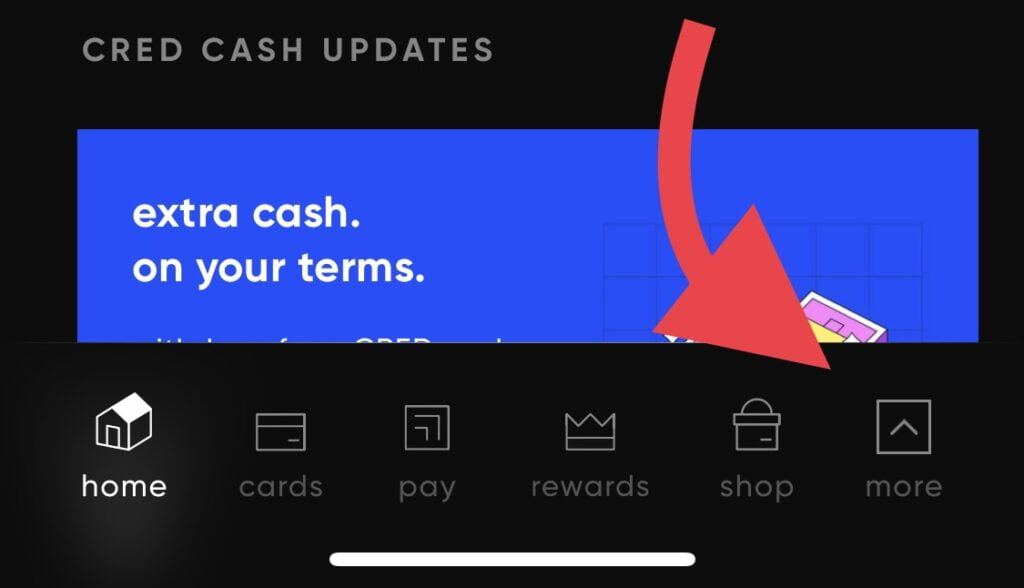

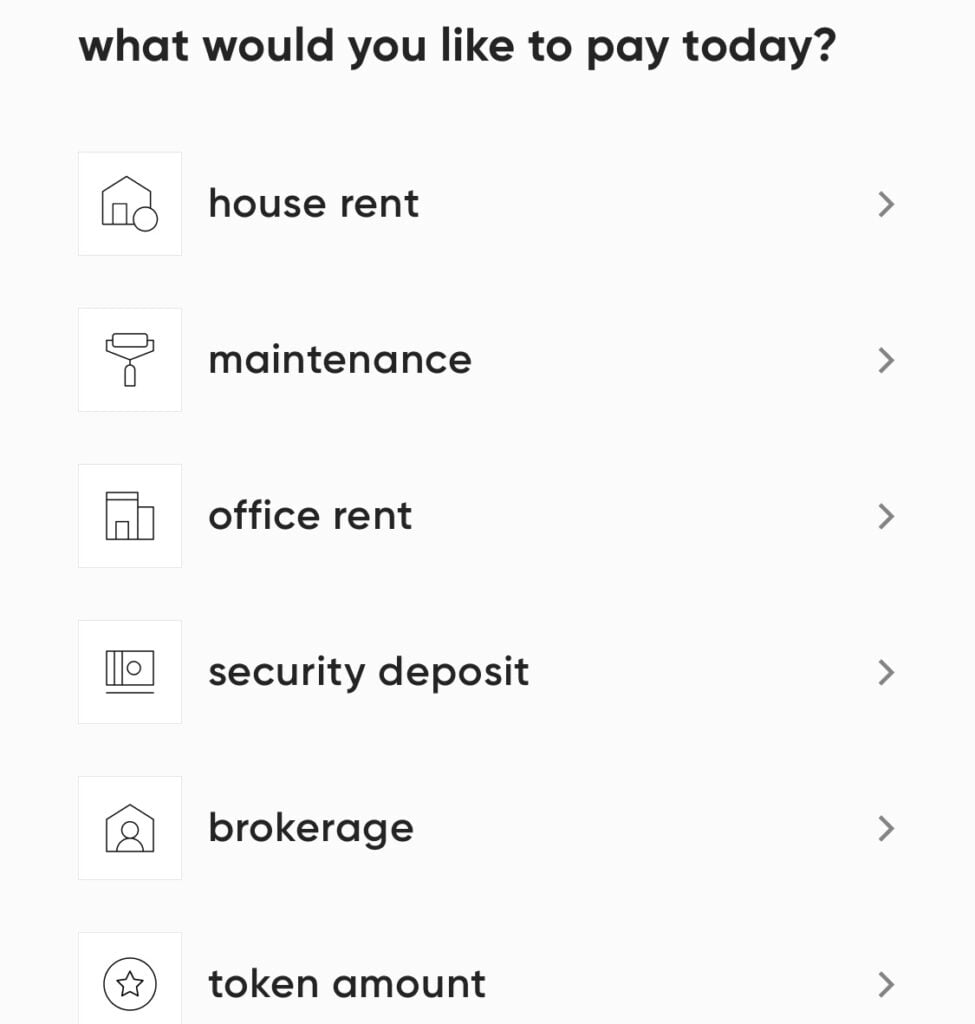

Step 1: Open your CRED App and below you can click on “more” and proceed further.

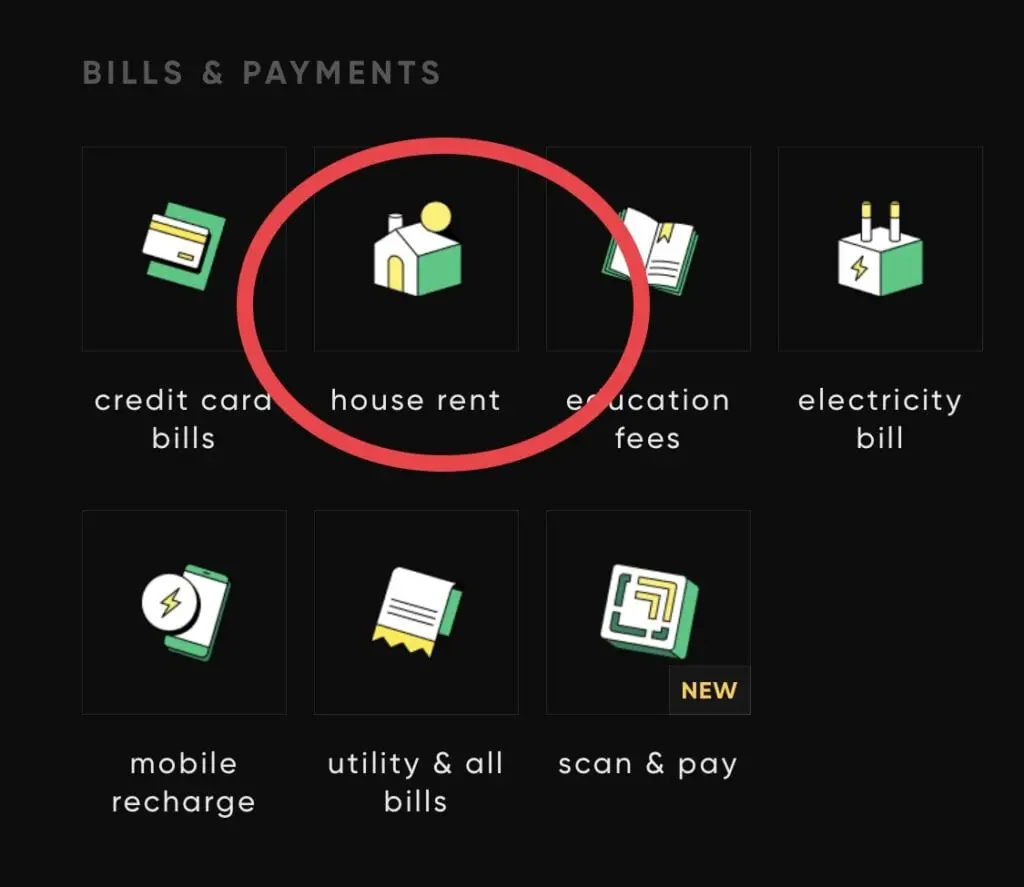

Step 2: Scroll down under Bills and Payment you can see “house rent”

Any late payment fees will result in massive charges of up to 36-46 percent and because of this the Cibil Score or credit score will impact rapidly.

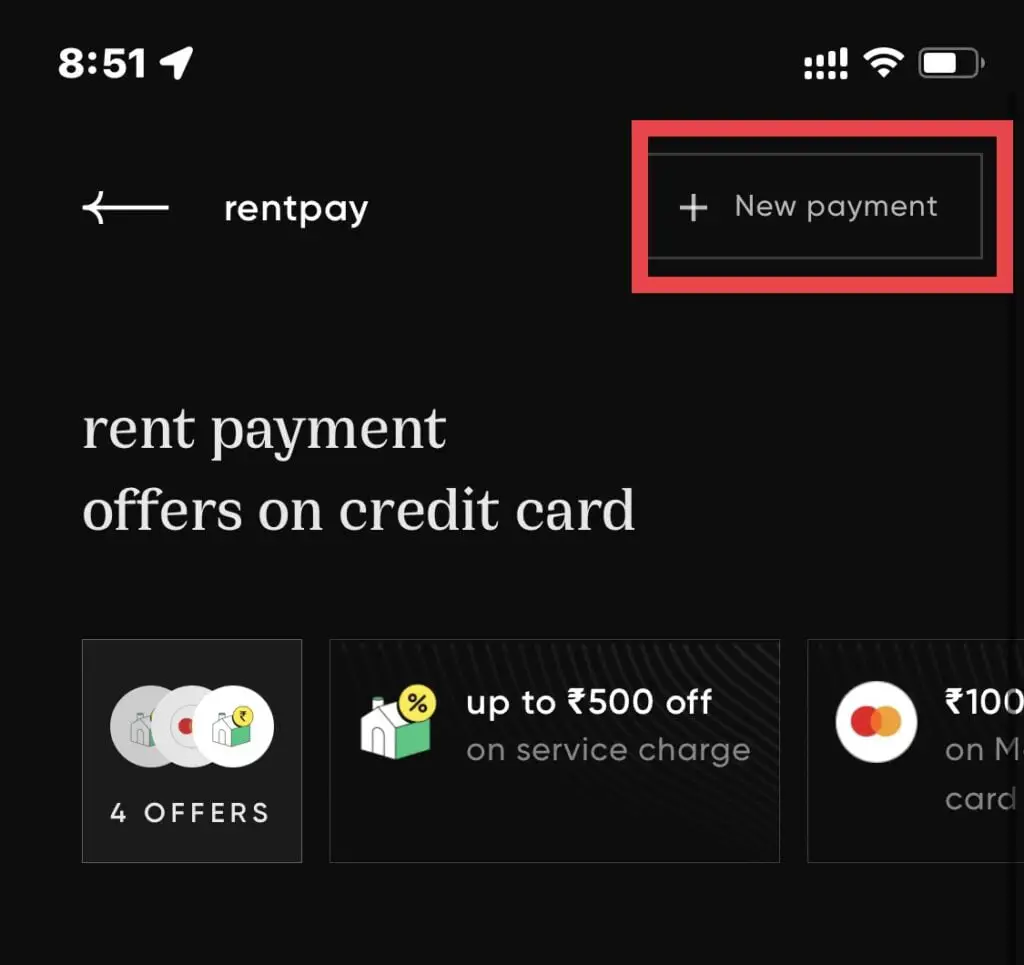

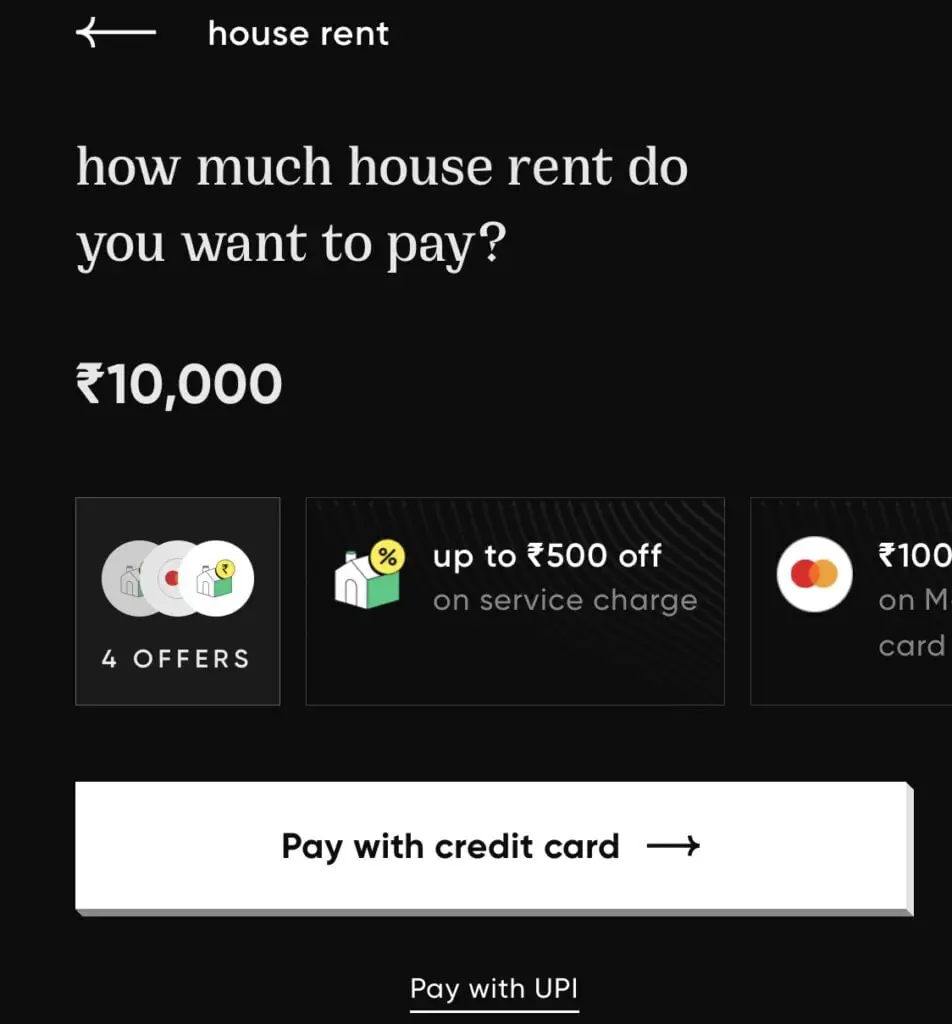

Step 3: Click on the new payment option as it is shown in the below image. In my case, I’m getting this option because already I have added an Account.

- Note: below you can multiple coupons and offers that you can apply to get discounts on service charges.

Step 4: Select any one option from the below list of menus. In my case, I am selecting house rent.

Step 5: Enter the amount which you want to withdraw from your credit cards. In my case, I will withdraw 20,000 and click on pay with a credit card

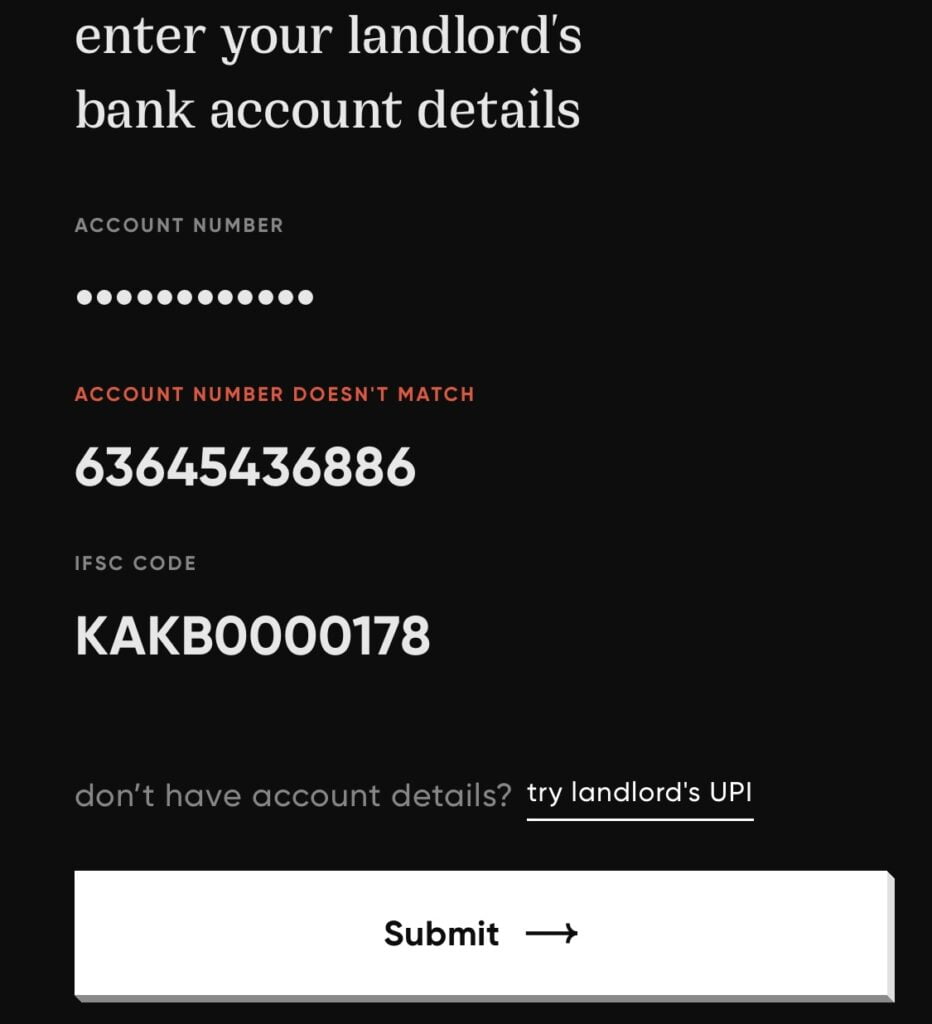

Step 6: Enter your friend’s account in which you can send the amount directly to your bank account and click on submit. Note: Don’t use your personal account.

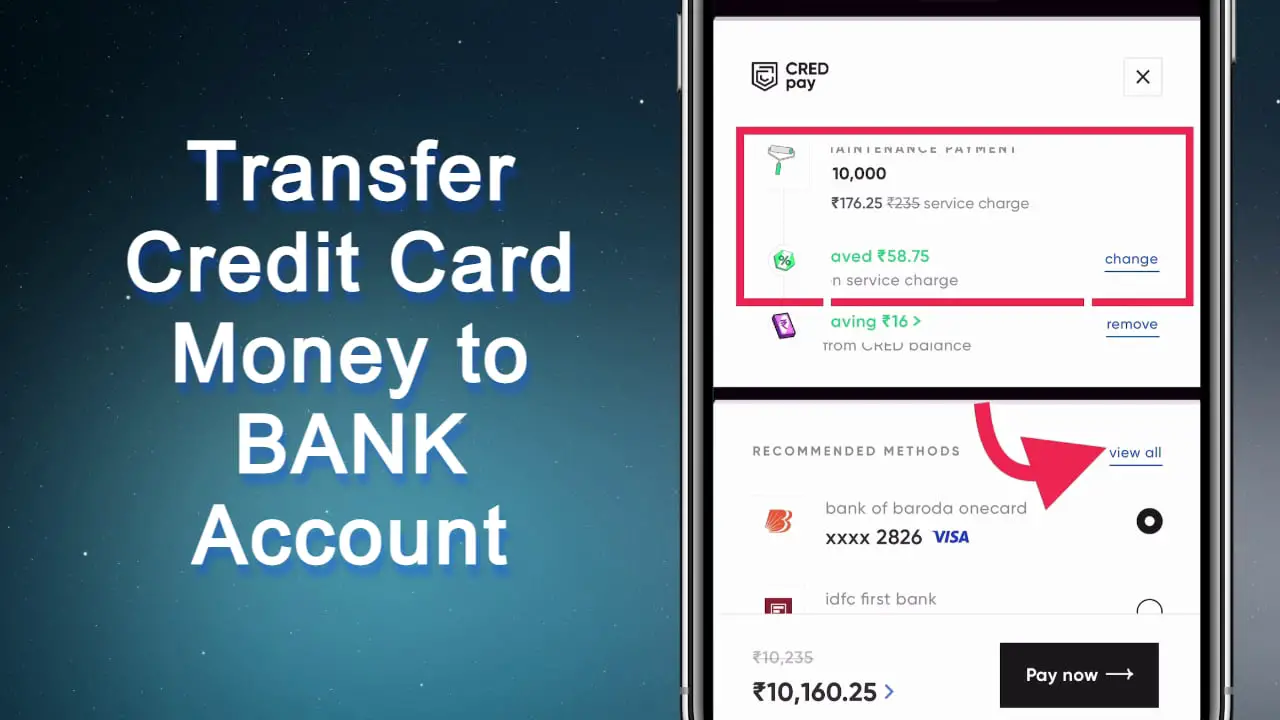

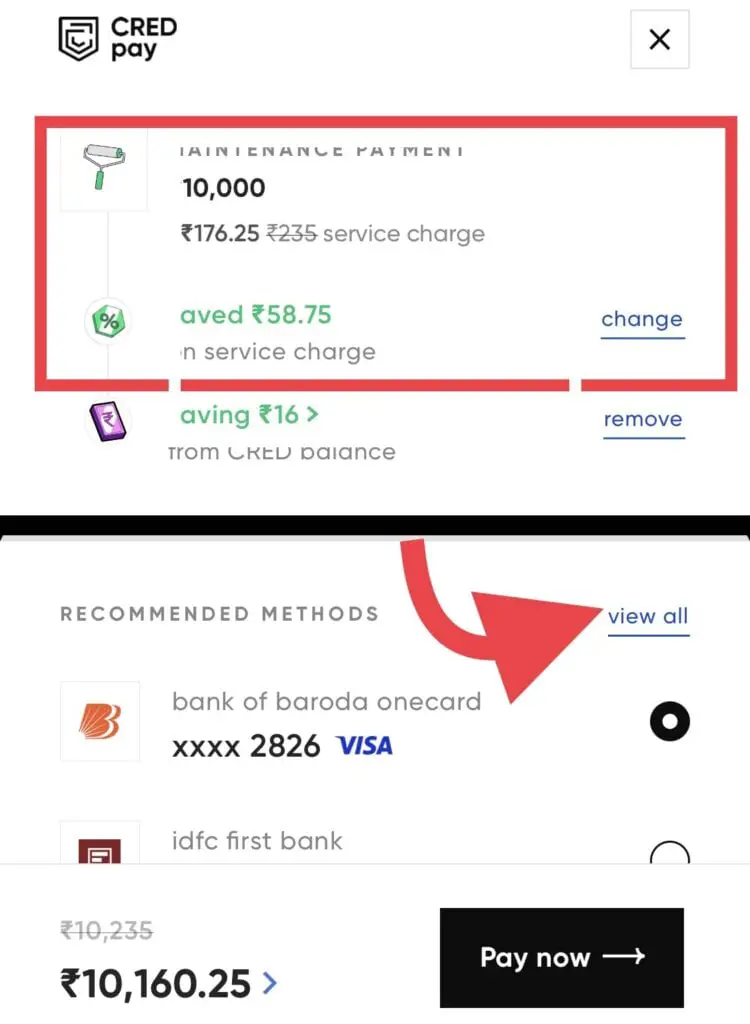

Step 7: See carefully the service charges added below. If you want, you can default coupon applied to the service charge.

Also, below you can see the Recommended method to pay (select the credit card you want to use, if you have not added the credit card, firstly you have to add the credit card by going back to the main menu)

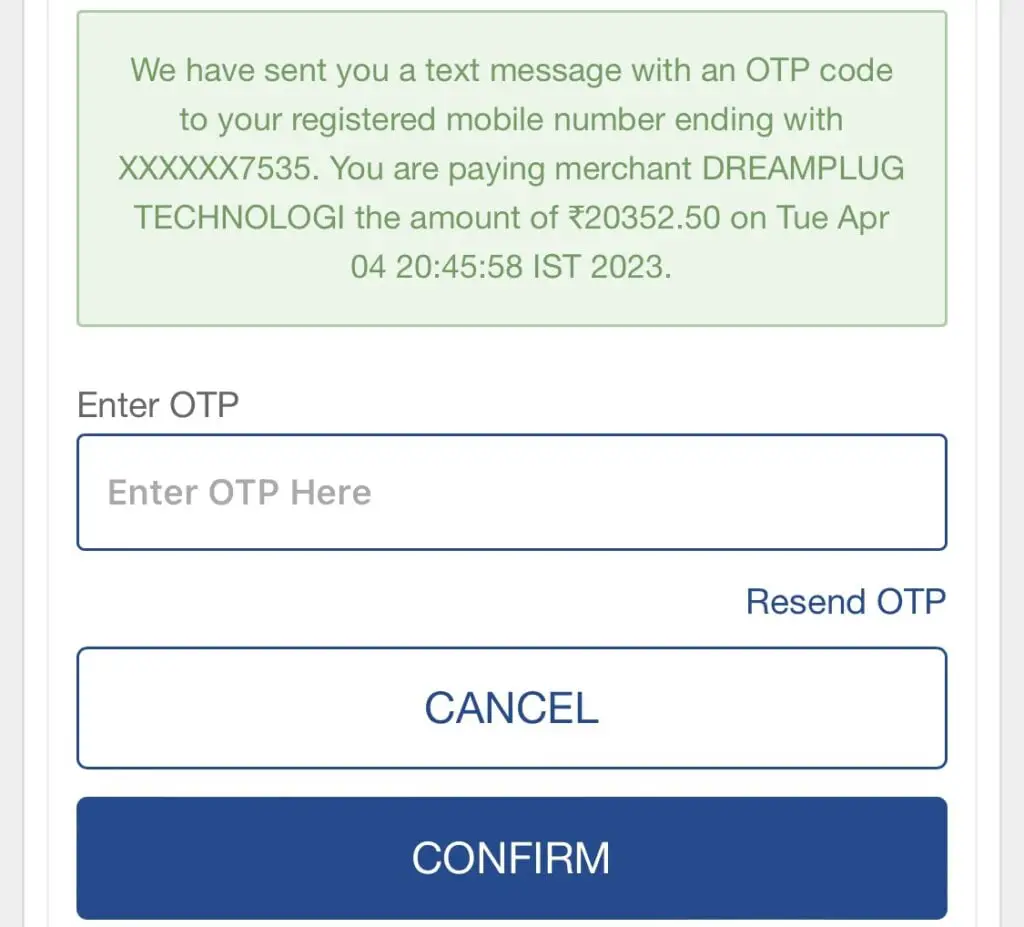

Step 8: OTP will be received on the mobile number. Put the OTP and proceed further! OTP will be sent to your HDFC credit card register mobile number provide the OTP and proceed further.

Step 9: In the last step you can see that 20,000 has been Deposited from the account. Once you do the payment, within 5-10 minutes of time it will get deposited to your account which you have used in Step 6.

Rewards you earn: By creating a handy little software that keeps track of your credit cards, due dates, and balance, Kunal Shah and the CRED team alleviate the discomfort associated with owning several credit cards. Even better, you may get 1 CRED point for every Re.1 you put on your credit card! In essence, you are being compensated for using your credit card.

Refer Video!

Conclusion

Cred app is one of the best credit card facility providers all over India. Cred app you can do shopping, bill payments, rent pay with minimum charges, rewards points earning, and also get Cred cash each time, you do payments on the Cred app.

Ultimately if you have a credit card then this is the only app in India that give you all the facilities to manage your credit card bills and other services offered by credit cards. If you have followed all the above steps, then I am pretty sure that you can transfer your credit card limit into your bank account with minimum charges. If you have any queries, please free to reach out to us on our social media handles, and also you can comment below for other questions.

Latest Post Links:

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)