Block HDFC Bank Credit Card: It is pretty much self explanatory that once you’re credit card is block stolen or damage, you have to immediately block it for any miss use or any kind of fraud which is going to happen on your credit card or debit card so please take prior caution to block your card.

Ways To Block HDFC Bank Credit Card

There are multiple ways where you can block your credit card or debit card in this blog. I will show you to block your HDFC credit card or debit card using Hdfc app or internet banking and also by calling to Customer Care..

Scroll down for your preferred method of blocking facility and read carefully to all the steps if you’re doing through mobile app or enter banking and if you want to use Customer Care number to call then you can visit the Hdfc website for Customer Care number.

HDFC App

Block HDFC Bank credit card on HDFC Bank App, the steps which I have guided below is as per the updated app but in future if there is an update on this menu has been changed. Then you can directly search or browse in the services or account section for HDFC credit card and then you can block it..

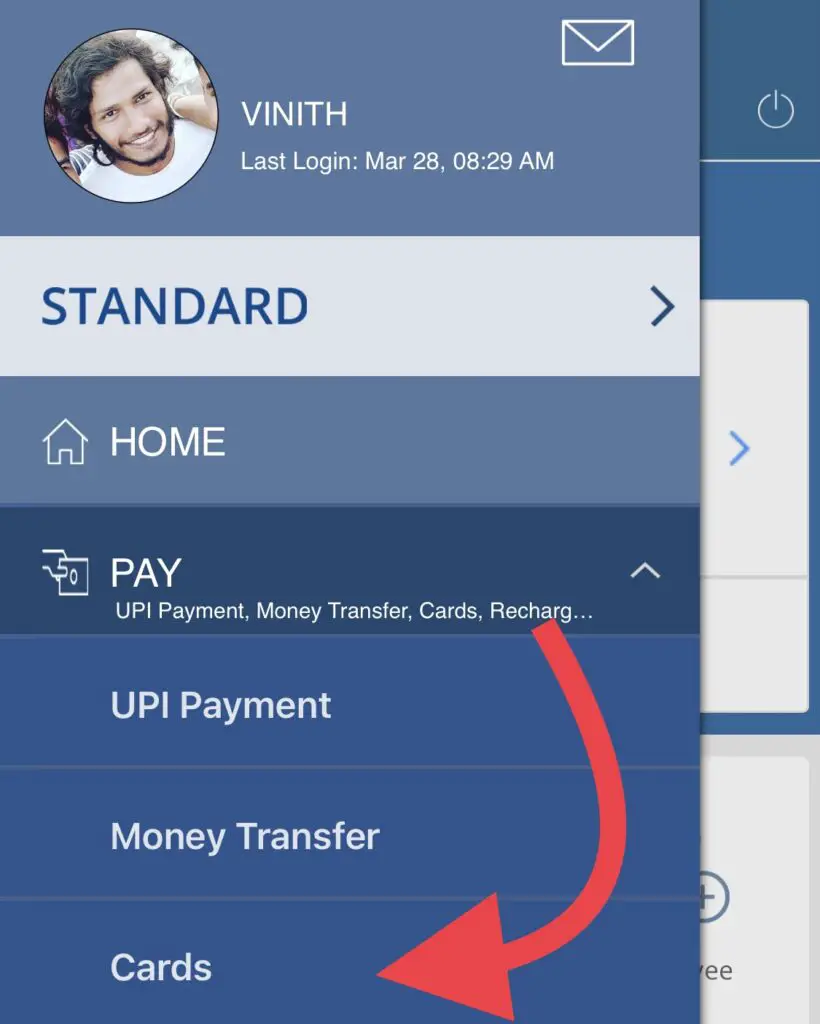

STEP 1: Open your HDFC Bank app if You have registered and proceeded with the below step.

STEP 2: Click on your profile icon and hear the list of menus will be available just click on “Credit Cards” section at the top to block.

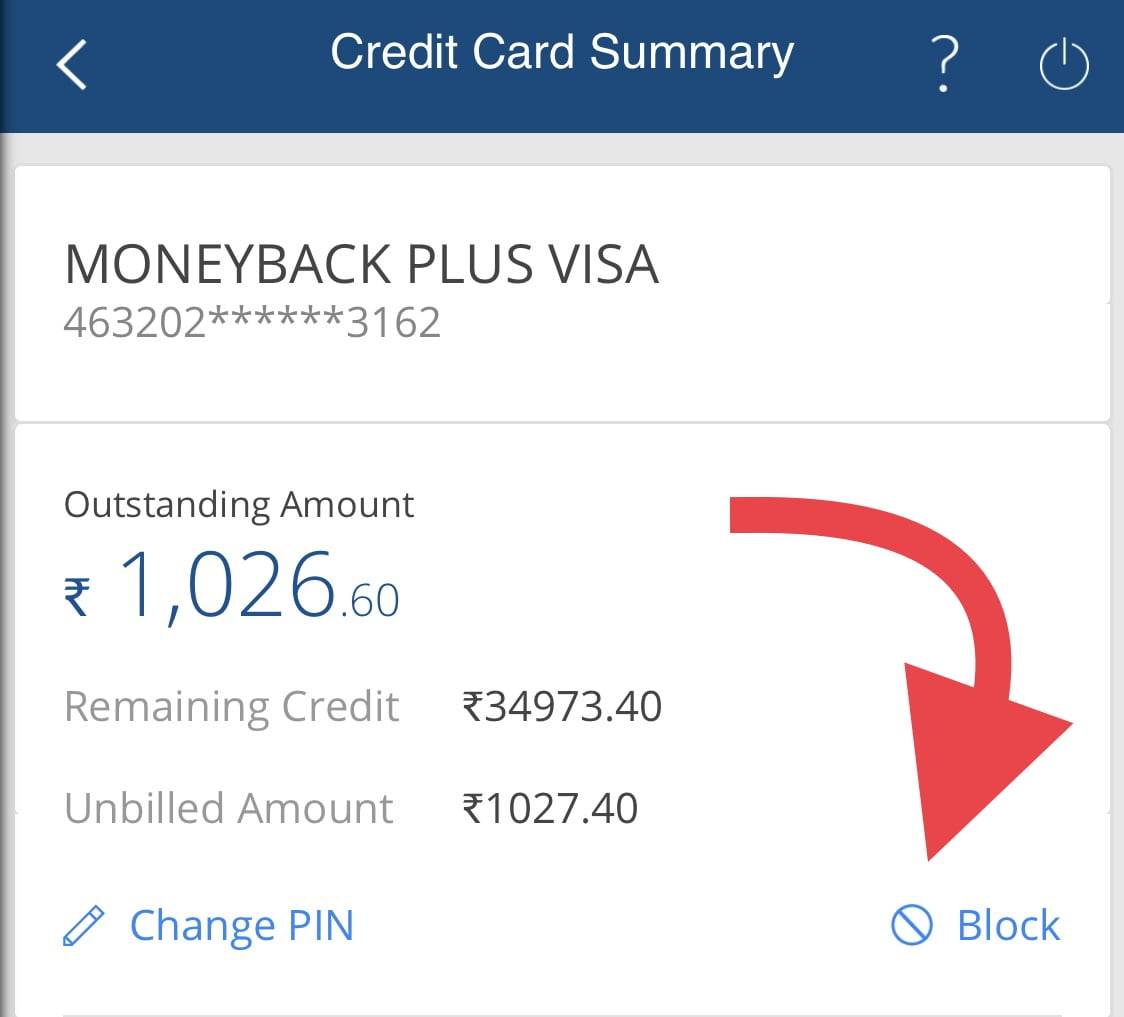

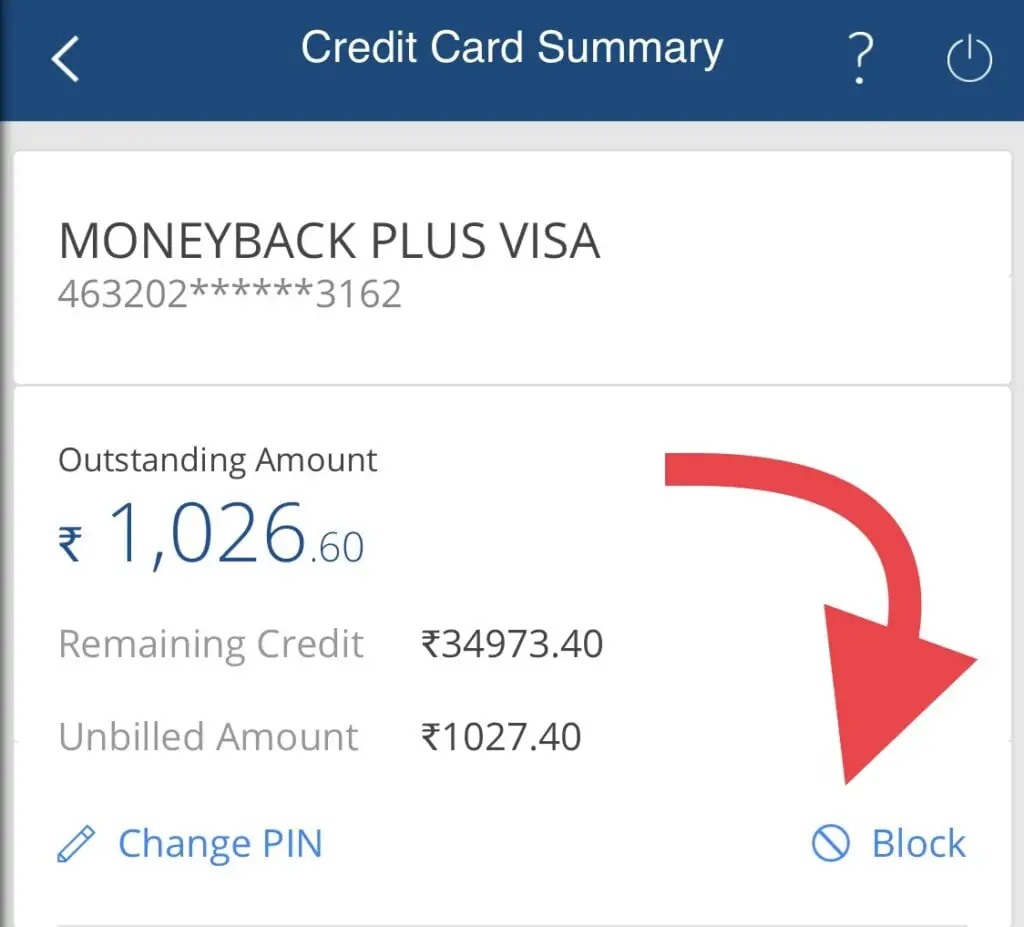

STEP 3: Select credit card you want to block in the left pan.

Note: Please select the correct credit card because once you block the credit card, you can’t unblock it no matter what you try but ultimately you have to get one new card which will be replacement of your existing card.

STEP 4: Search and click on “Block Card” or “Report Lost/Stolen Card” option.

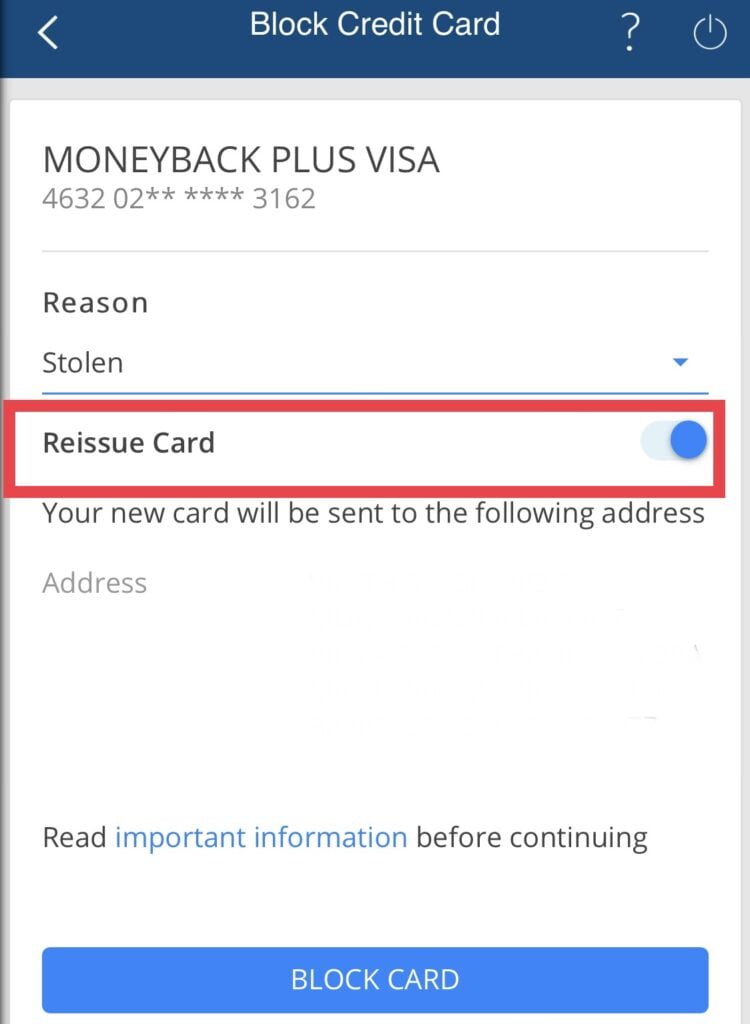

STEP 5: Please read instructions provided below while blocking the card to confirm the card block request.

Note: If you need new card in place of your block card, enable the above “Reissue” option. Because once your card is blocked, you cannot unblock it so make sure if you want card, then click on the reissue.

Reissue of card doesn’t mean that you will get the same existing card. The model or name of the card will be same but the number which is available on your present card which you’re blocking will not be same it will completely different.

HDFC Customer Care

If you’re not aware of Hdfc app and Internet banking, then you can register it using my YouTube video link where I have guided you how to create account or net banking.

Suppose if you want to block your credit card just by directly calling to Customer Care, then you can follow this below steps to do that. Click Here!

STEP 1: Visit the HDFC Bank website to get the customer care number because the number will keep changing and I don’t want to create any spam on my channel giving some different number.

STEP 2: Once you call to that number, it will ask for your preferred type of language in the IVR. Just select the option and letter proceed further to talk to the executive.

STEP 3: Ask/Request to block your credit card by giving them proper details.

STEP 4: Provide/Give last 4-digit card number with all the required details and other necessary information to the representative on the call.

Your HDFC Bank credit card will be blocked after completing the above-mentioned steps, and you won’t be able to use it for any additional purchases until you unblock it.

HDFC Net Banking

As mentioned above, if you have user ID and password, you can directly login into your enter banking and follow the below steps to block your card.

- Once you login to your Hdfc banking at the dashboard or homepage. You will find credit card option option at the menu bar. Just click on that and proceed further with the next step.

- In the left side of credit card section if you expand under request option you can find credit card hot listing. Just click on that and select the card which you want to block it and proceed further.

- Select the reason why you want to block it and also if you want to re-issue the card, click on Rishu of hotlist card and di new card will be delivered at your doorstep within seven working days.

Conclusion

You cannot make online purchases with a banned card since they will be rejected. Moreover, the ATM card reader won’t read the card, won’t accept the PIN, or will once more reject the transaction. You are essentially lowering the amount of money accessible for spending if you have two distinct credit cards and close one of them. As a result, it will undoubtedly affect your credit score.

Latest Post Links:

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

CRED: Daily Earn Up To ₹1000 Using CRED App – Offers (kingfishertechtips.in)

Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)