SBI Flexi Pay: It is for sure Sbi is offering flex pay option for all its customers where their customers can take loan of a certain amount i.e. certain amount and later they can pay into EMI without blocking the credit limit.

SBI FLEX PAY OPTION GIVES YOU VARIOUS OPTIONS TO PAY YOUR LOAN AMOUNT AT LOWER INTEREST WITH HEIGHT TENURE. ALSO IF YOU TAKE LOAN FROM SBI CREDIT CARD THEN IN FUTURE YOUR CIVIL SCORE, YOUR CREDIT SCORE OR THE CREDIT HISTORY WILL ALSO BE GOOD SO THAT YOU CAN TAKE FURTHER LOANS WITH HIGHER CHANCES TO GET YOUR LOAN APPROVED?

SBI Flexi Pay – Covert your credit card transactions into EMI options

Sbi flex pay great initiative taken by Sbi card to provide their customers or users. Various loan facility or offers in this article or blog will see step-by-step procedure to get your loan sanctioned into your bank account from beginning to last.

Follow the below articles where it its step has been guided to get your loan on bank note. If you don’t have offer of Sbi flex pay, then you will not be eligible to get loan. you will be only eligible for loan if you got any mail or message or notification in the SBI card app regarding Flexi pay option.

Step 1: Go to your SBI Card app and open and login

The flexible option will be available with Offer and also from the home screen below the statement section you can find view account details or above that you can pay EMI so both will land at this page.

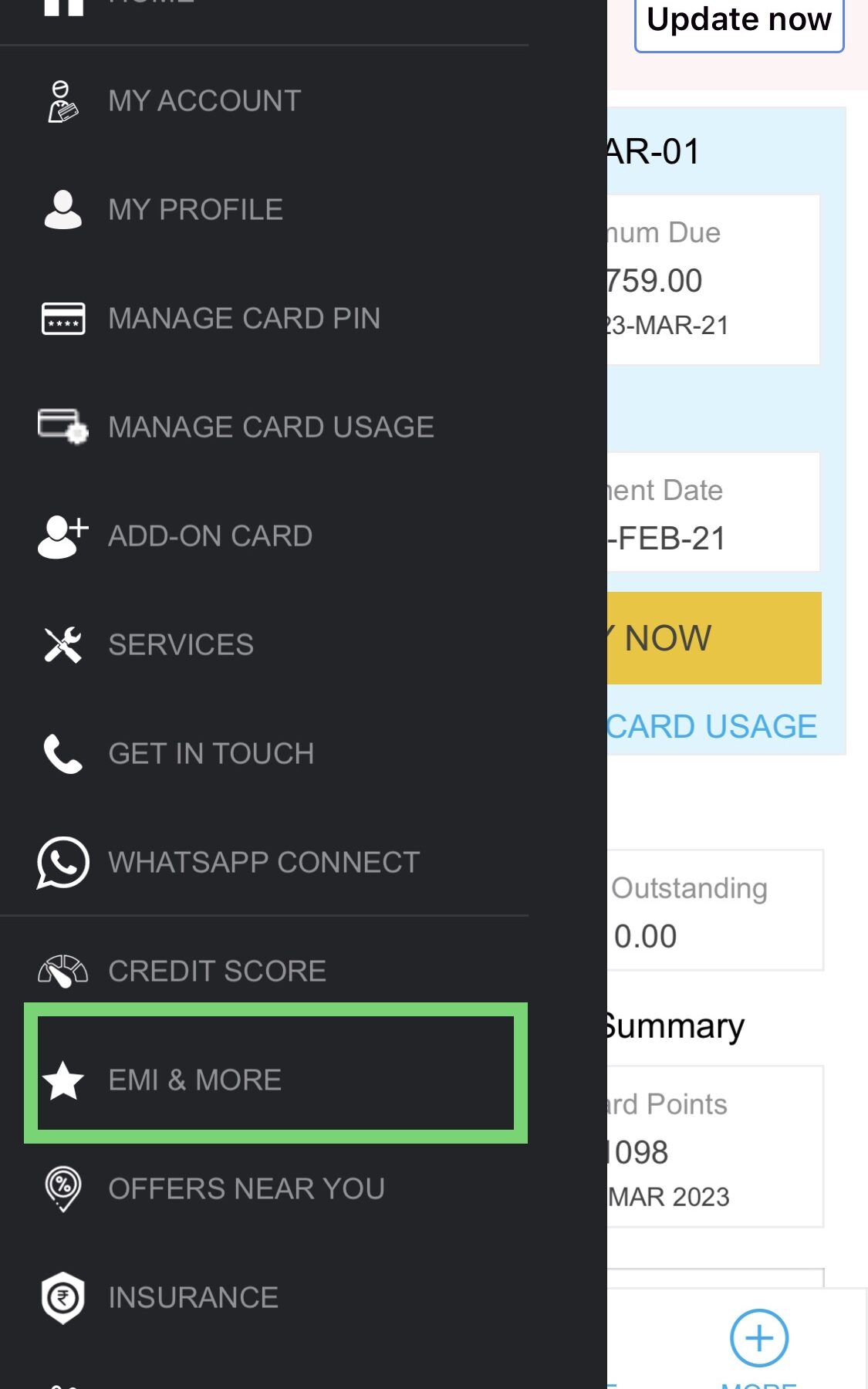

Step 2:On the top, you can, 3 line gear icon click on that and you will see EMI & more option.

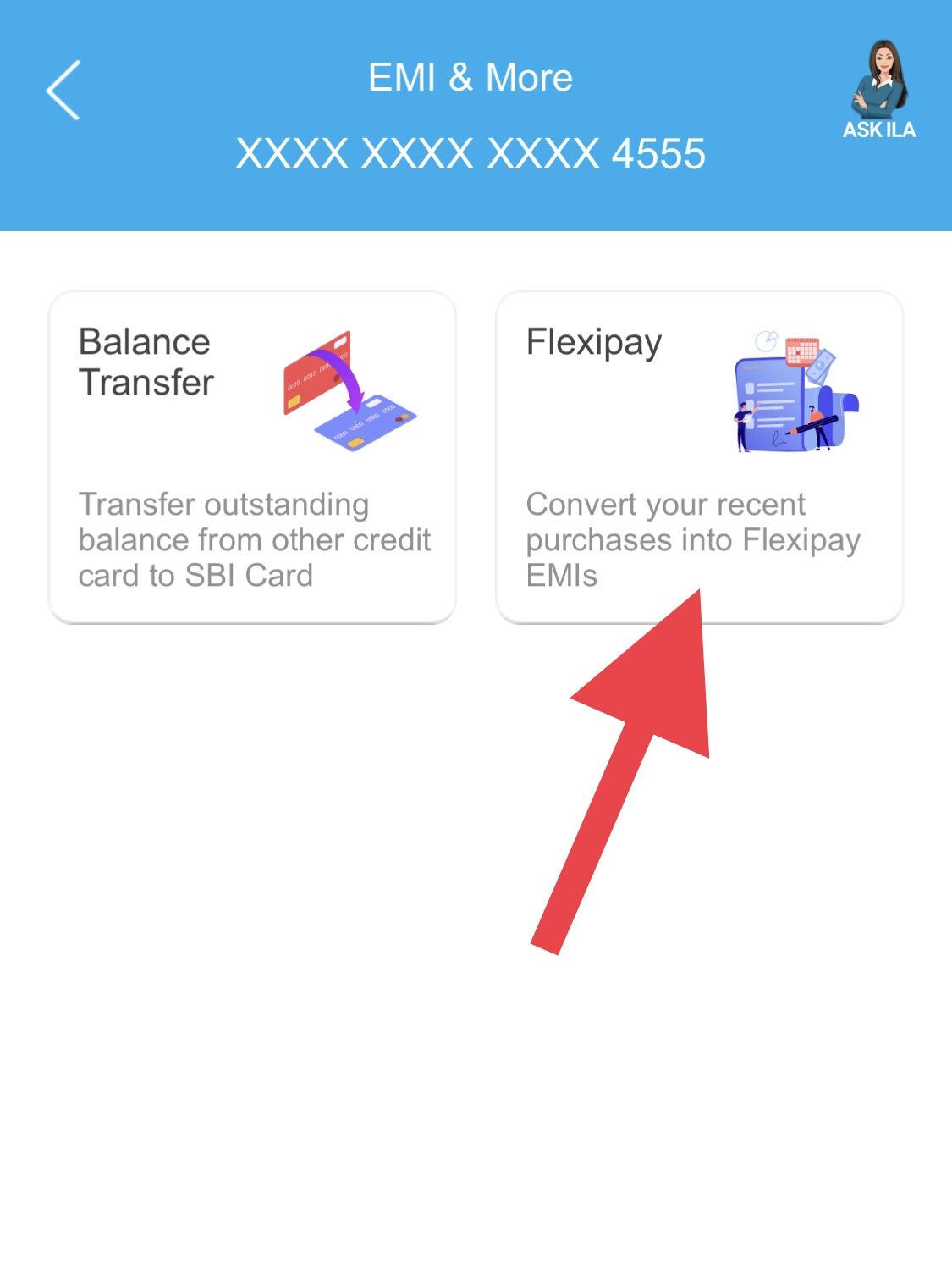

- Click on Flexi Pay option

Once your credit card bill will get generated, all your EMI’s will get added into your credit card billing cycle and then you can pay your bills. So, it is totally up to you either you are going for the first option or the second option. So, if you opt any of these options, either option one or option 2. Ultimately, you have to follow the same steps as above. The only difference will come in the EMI selection part.

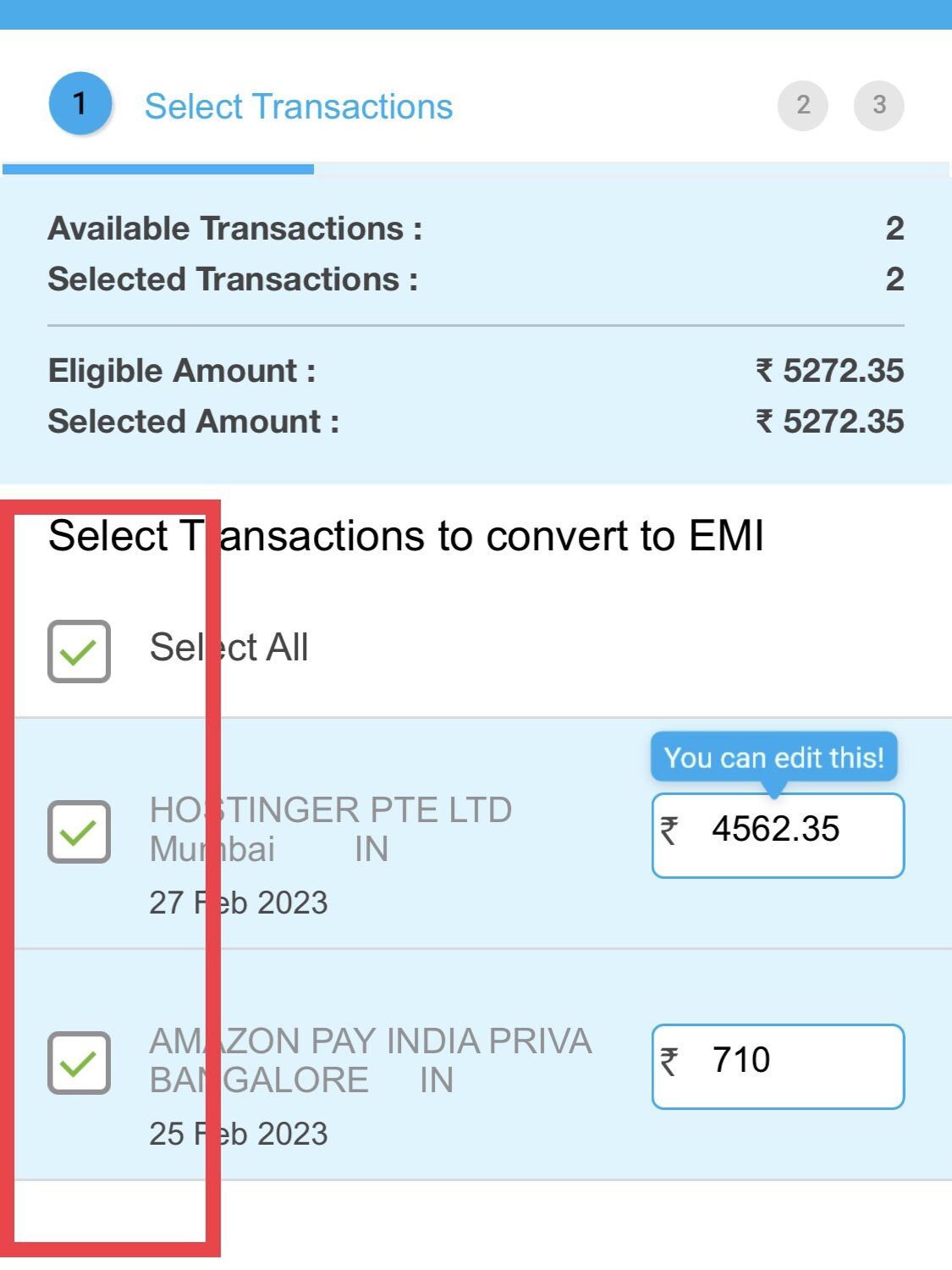

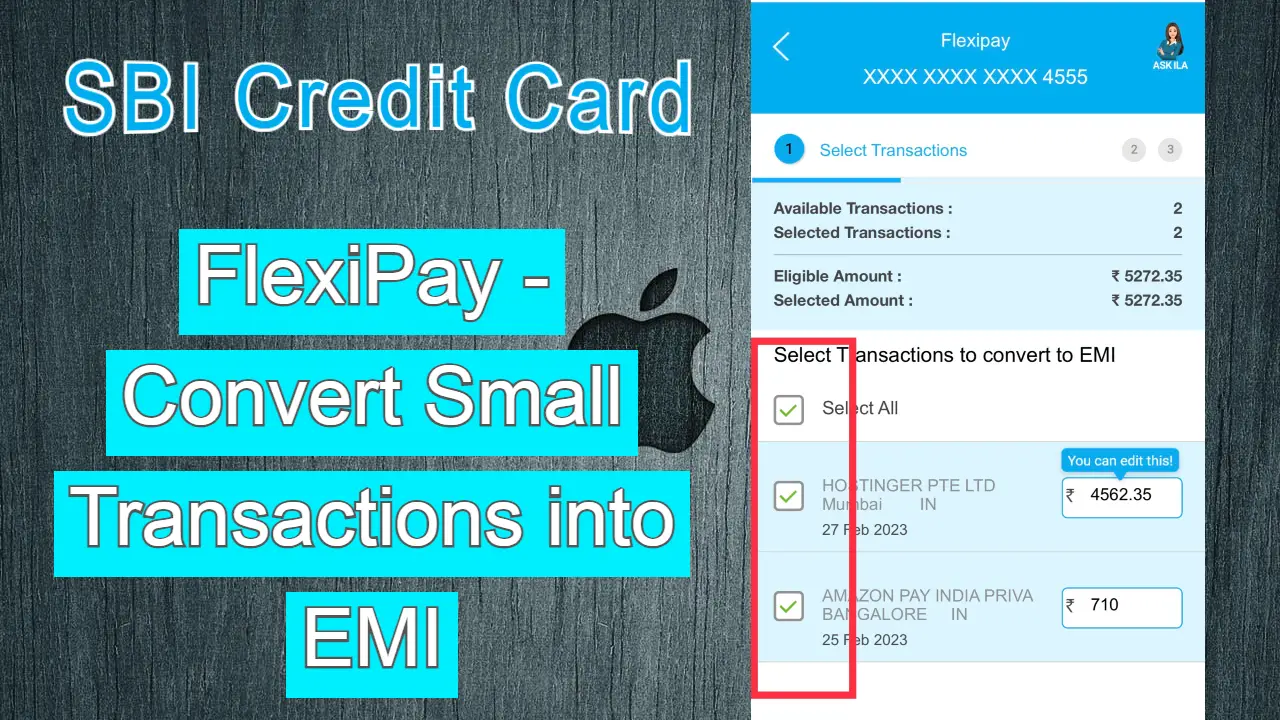

- Tick/Check the option which you want to convert to EMI

- >> Now you can select multiple transactions if your amount is Less than 2500

- Note: Please do these transactions (convert to EMI options only before 4 days of your billing date)

- >> Now you can select multiple transactions if your amount is Less than 2500

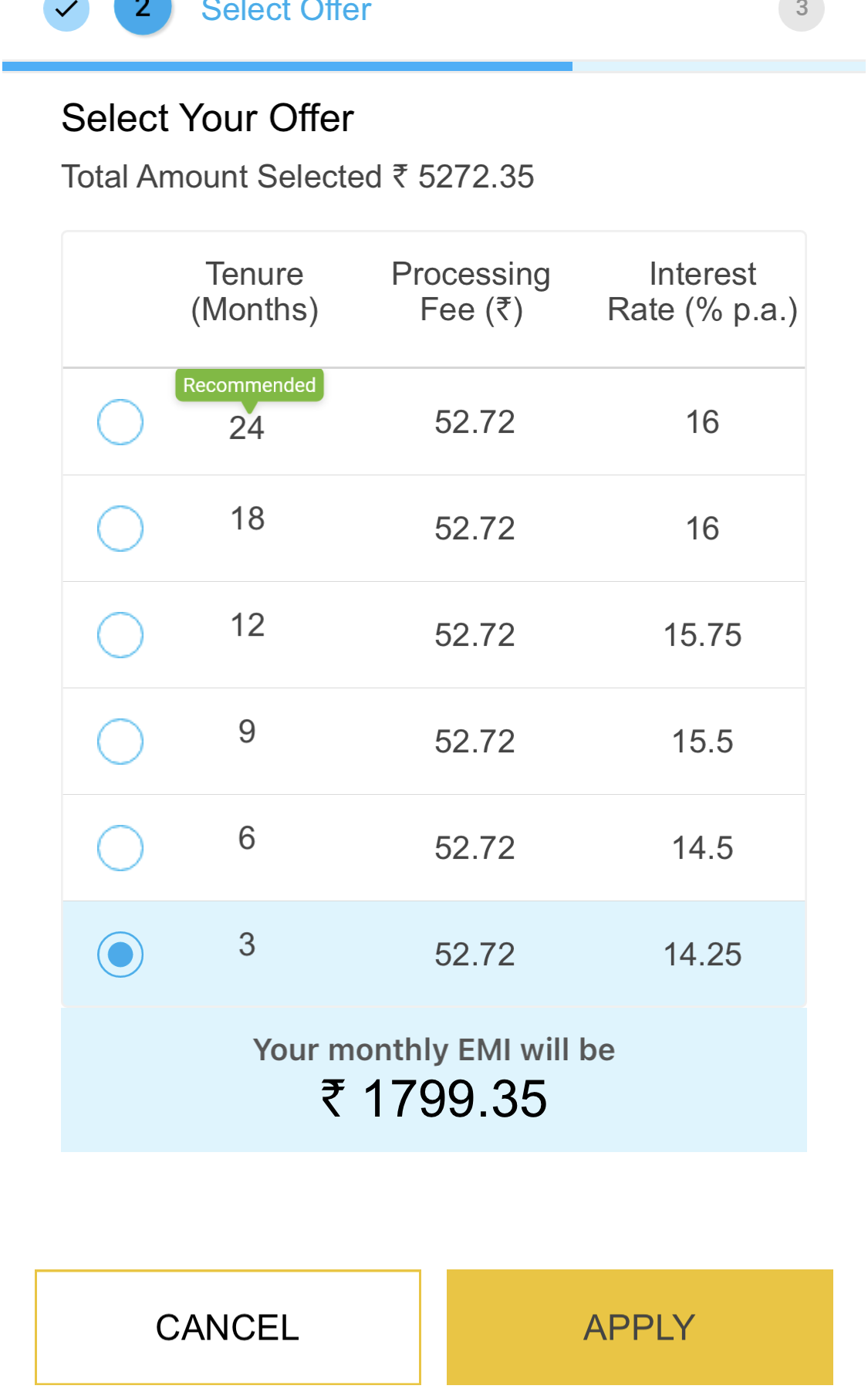

- Select the EMI options you want to select according to the process further

- click on apply and your EMI conversion will be completed

Watch YouTube Video!

Conclusion

In this post as we saw how to avail flexi pay option in SBI credit card. So, when it comes to flexi pay, there are 2 possibilities. The first possibility is that suppose if you want to use flexi play, you can directly use flexi pay without converting it to EMI. And the second option is that you can convert your flexi pay amount into EMI’s and all your EMI’s will get added to your credit card bills.

Latest Post Links:

- One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

- Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

- Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

- SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

- Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

- Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

- Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)

- EPFO: How To Find/Know Your UAN? – Kingfisher Tech Tips

- Activate Your UAN Number On EPFO Portal — Step By Step! (kingfishertechtips.in)

HI