PAN Aadhar Link: Indians must immediately link their Aadhar with PAN as required by the government. The prior deadline for linking your Aadhar and PAN was March 2022, however the new date is March 2023. The issue is that the Indian government has provided you time to link your Aadhar number and PAN without paying any fees for the preceding months, but if you want to do so after March 2022, a fine of 1000 rupees will be imposed as penalty on each individual.

Who is immune from the Pan-Aadhaar linking?

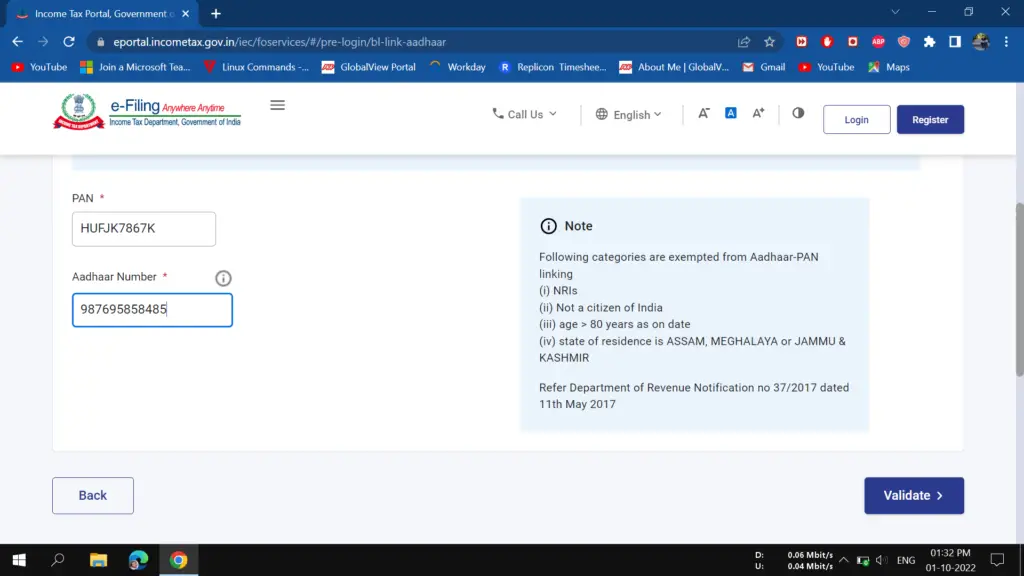

While the requirement is applicable to all Indian citizens, some groups of people are exempt from the Aadhaar-PAN connection. The exempted people you can find on the official website.

PAN Aadhar Link Status

Suppose you want to link your PAN and Aadhar from this particular website then you can do it by clicking on the same website. Now, if you want to update the details from here then a Fine of 1000 will be imposed to you as Fine when you Link the documents.

Why the government mandated that PAN be linked to Aadhaar cards?

In order to combat the problem of duplicate PANs, the Income-tax Department of India made it essential to use Aadhaar with PAN. The IT department found instances where a single person had numerous PANs or when multiple people shared a single PAN number. As a result, the tax collecting procedure was inaccurate, and it was challenging to locate and follow taxpayers. Aadhaar-PAN linkage was deemed necessary to build a reliable way of de-duplicating the PAN database.

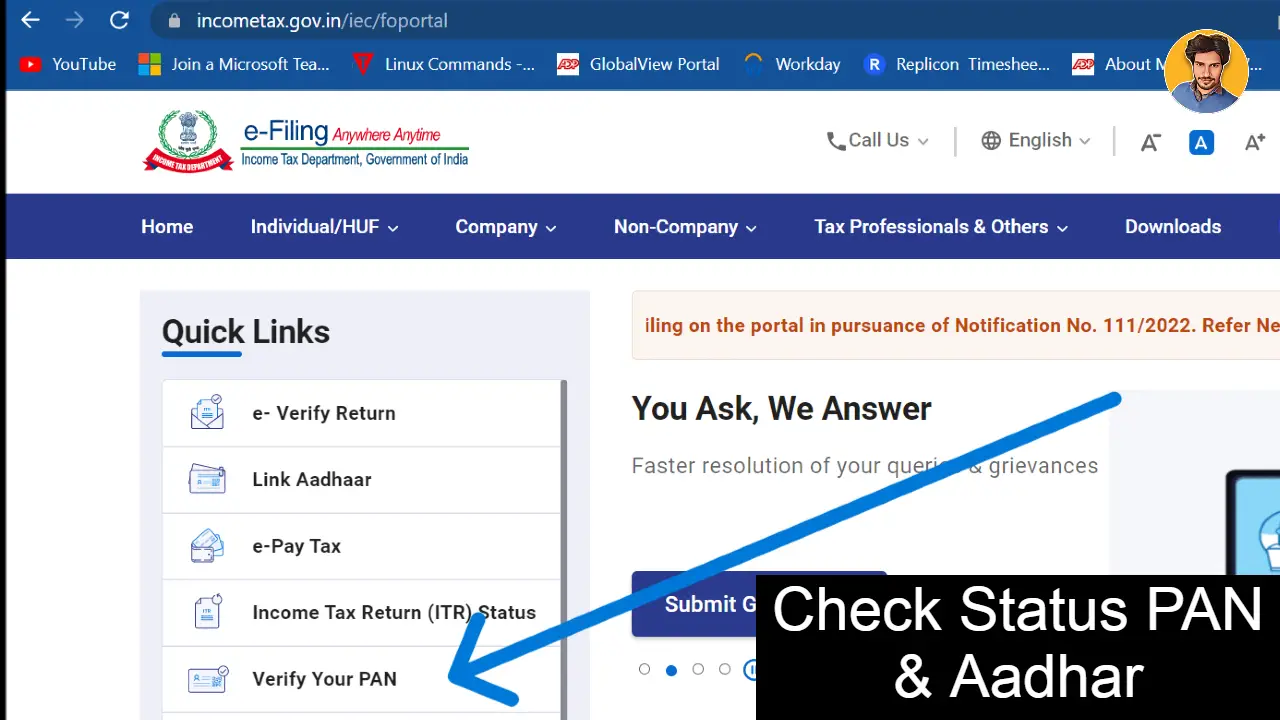

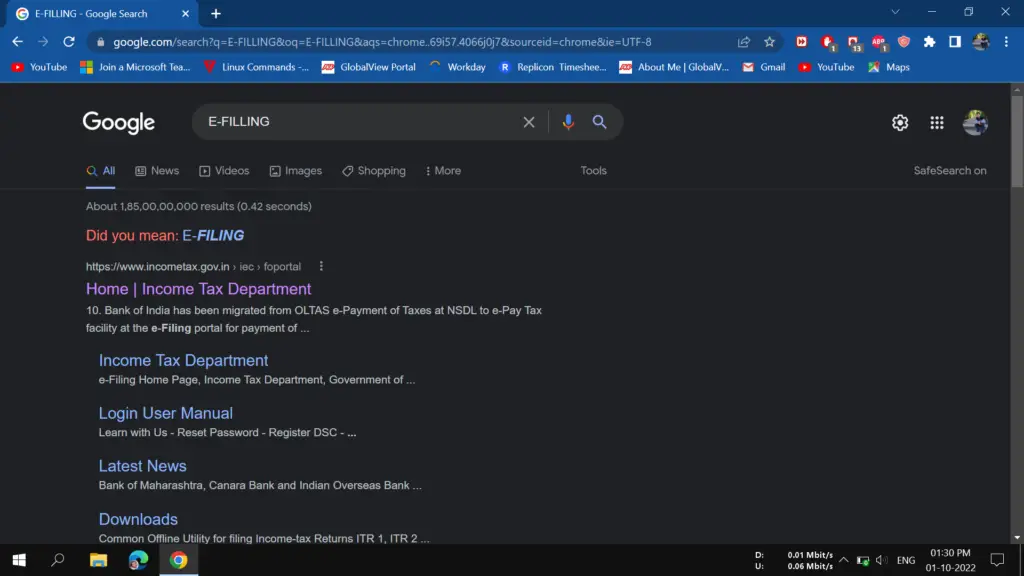

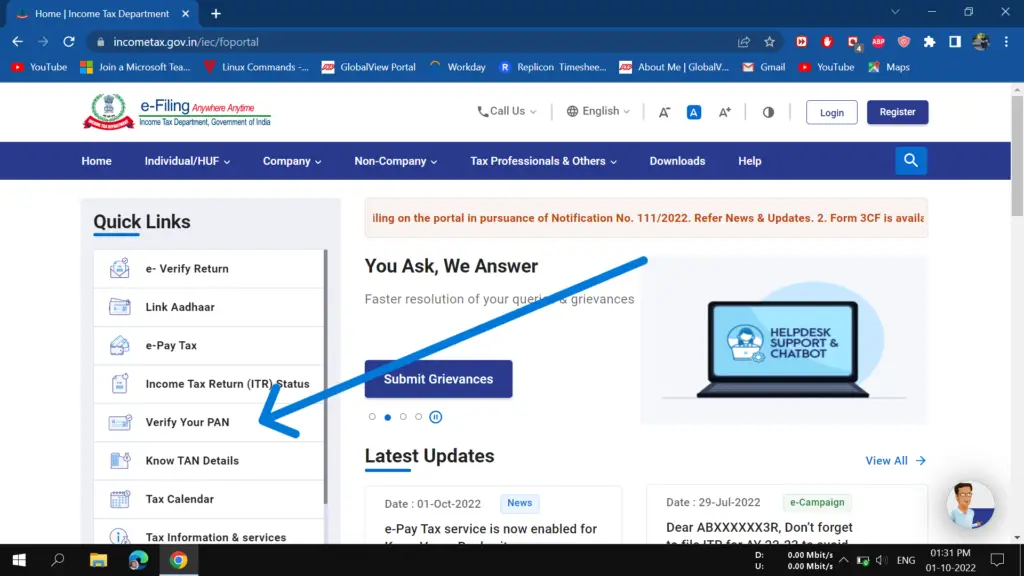

- Visit the Site: https://www.incometax.gov.in/iec/foportal/

Note: Please don’t pay any extra amount to any of the vendors or services to link your Aadhaar and pan on any website. This is the official website of income tax which is government of India side. Please check the links properly before clicking on the site or linking your PAN or Aadhar Card.

2. Click on verify your pan, as shown in the screenshot

The Central Board of Direct Taxes (CBDT) released a circular in March 2022 indicating that linking the Aadhaar number to the PAN was a requirement for everyone who received a PAN on or before July 1, 2017. Prior to March 31, 2023, the Aadhaar and PAN cards must be linked. The PAN will stop functioning if this is not done.

3. Insert/Give your PAN Card number and Aadhar Number to proceed further.

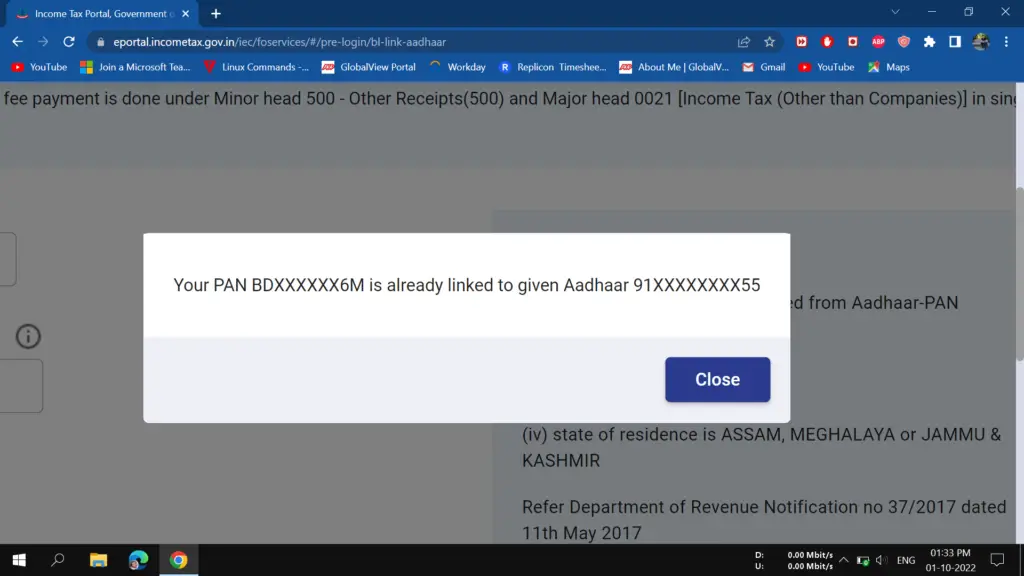

4.Submit the request and you can see if your Aadhar and PAN is LINKED or not?

The PAN card will lose its ability to start any financial activities if it is not linked by the due date. SEBI, the Securities and Exchange Board of India, has issued a notification requiring the linking of the two identity cards in order to conduct trades on financial exchanges like the NSE and BSE.

Watch for more!

Conclusion

We saw each step how can we check the link status of Aadhar and Pan? If you really want to use your PAN card in all your banks and also able to make transactions on your account, then your Aadhar and pan must be linked together.

If you have any concern or questions, please feel free to comment down below and also make sure to bookmark this website for all new updates. Also, if required you can also contact our social media handles for more information.

Latest Post Links:

- One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

- Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

- Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

- SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

- Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

- Refer And Earn Using ONE Card App || Earn Online Using App! (kingfishertechtips.in)

- Digital Rupee: How To Create Account And Use E-Rupee – CBDC (kingfishertechtips.in)

- EPFO: How To Find/Know Your UAN? – Kingfisher Tech Tips

- Activate Your UAN Number On EPFO Portal — Step By Step! (kingfishertechtips.in)