Kotak Credit Card Loan: Kotak credit card personal loans are nothing but providing you with a loan on a credit card based on your credit history. Now suppose you are using your credit card for past years or months then you will be eligible for this option of credit card loans in Kotak. In this article, we’ll see how can you Avail of your Kotak credit card loan amount in just simple clicks.

Kotak Credit Card Loans

Kotak Credit Card Loans: The table of content refers to both two options the first option will be your Kotak 811 and the second option will be your contact website browser where you can directly log in and Avail of the credit card loan facility

What are quota credit card loans?

Kotak credit card loans or nothing but personal loan against your Kotak credit card. Suppose you don’t want to do any verification or apply for Kotak personal loan than a Kotak CC loan is one of the best options you can move forward with for a personal loan. The best part of this CC loan is that it does not require any verification or submission of documents and also the rate of interest will be as low as possible.

Kotak 811 App Loan

Kotak 811 App Loan: So there are two options in which you can Avail of the Kotak credit card Loan offers. The first option will be your Kotak 811 App and the second option will be your Kotak online website where you can directly log in without using your CRN or any other details.

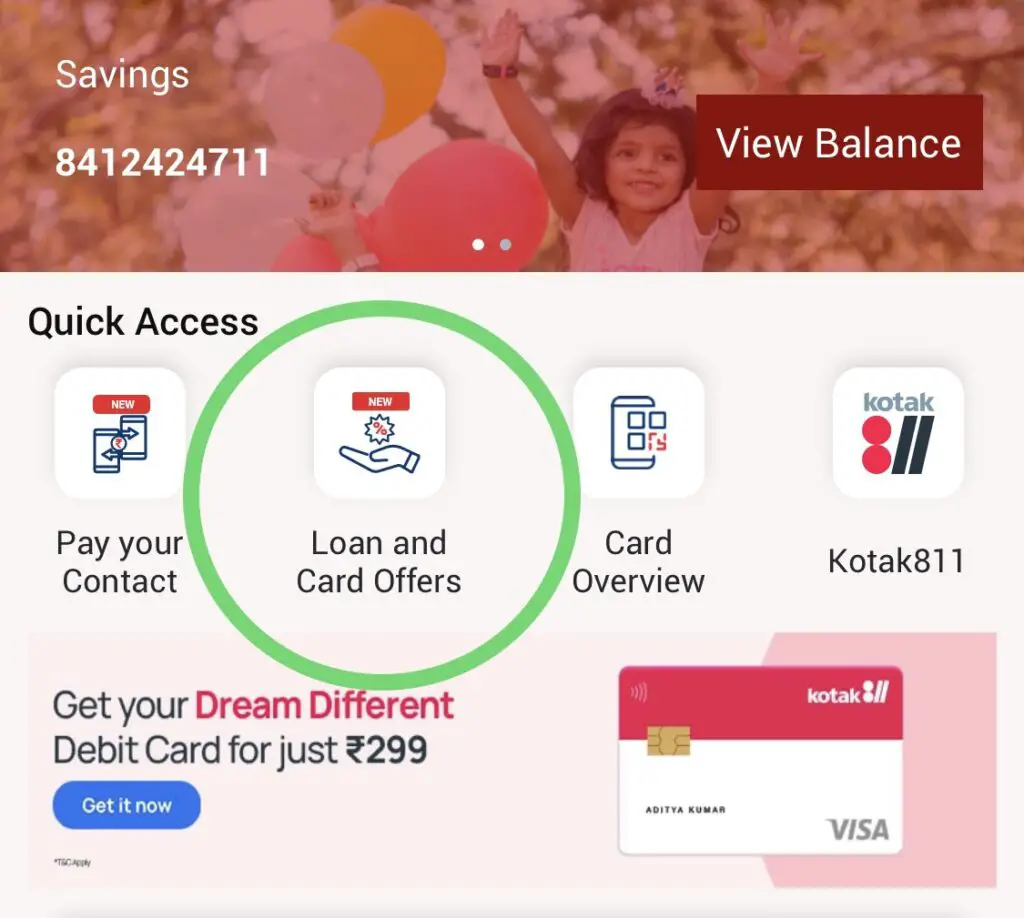

Step 1: In the below image, you can see that I have logged in to my Kotak 811 App, and at the top section, you can see that there is an option for loans and offers.

Suppose you are not getting this option then you can scroll down and search for other offers on your Kotak 811 app generally when you have any offer on your credit card or bank account it will reflect there just click on this option.

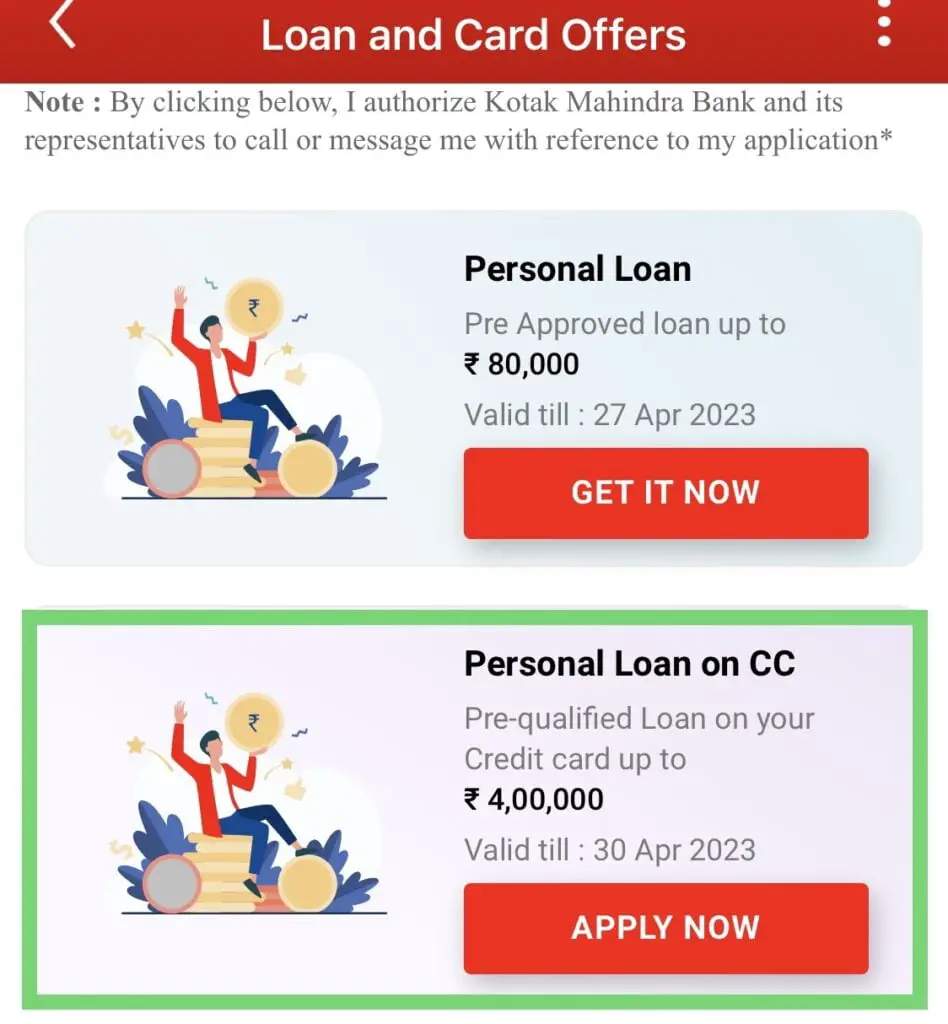

Step 2: In step two you can see there is an option for a “ personal loan on CC ” In my case I am eligible so I’m getting this option if in your case you are not eligible then you have to wait for some time.

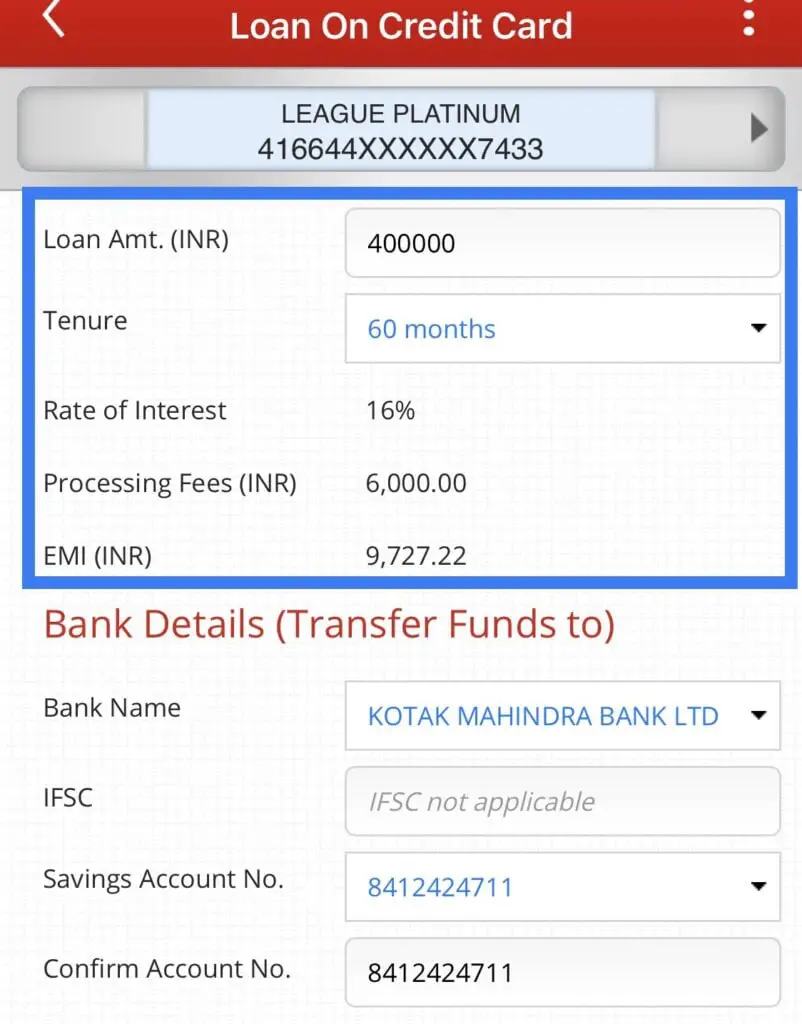

Step 3: As you can see I am eligible for 4 lakhs of personal loan on my credit card and the tenure is 60 months with and rate of interest of up to 16% the processing fee will be 6000 in my case and the EMI amount will be 9,727 per month as per below image.

Also, you can see Bank details below so here by default the Kotak bank account will be provided and suppose if you don’t have a Kotak bank account and you have only a credit card then you can directly log in and you can select whatever bank account you have. Here we have multiple bank account options you can select and put your saving account number and ifsc code so the amount will get credited to that particular account.

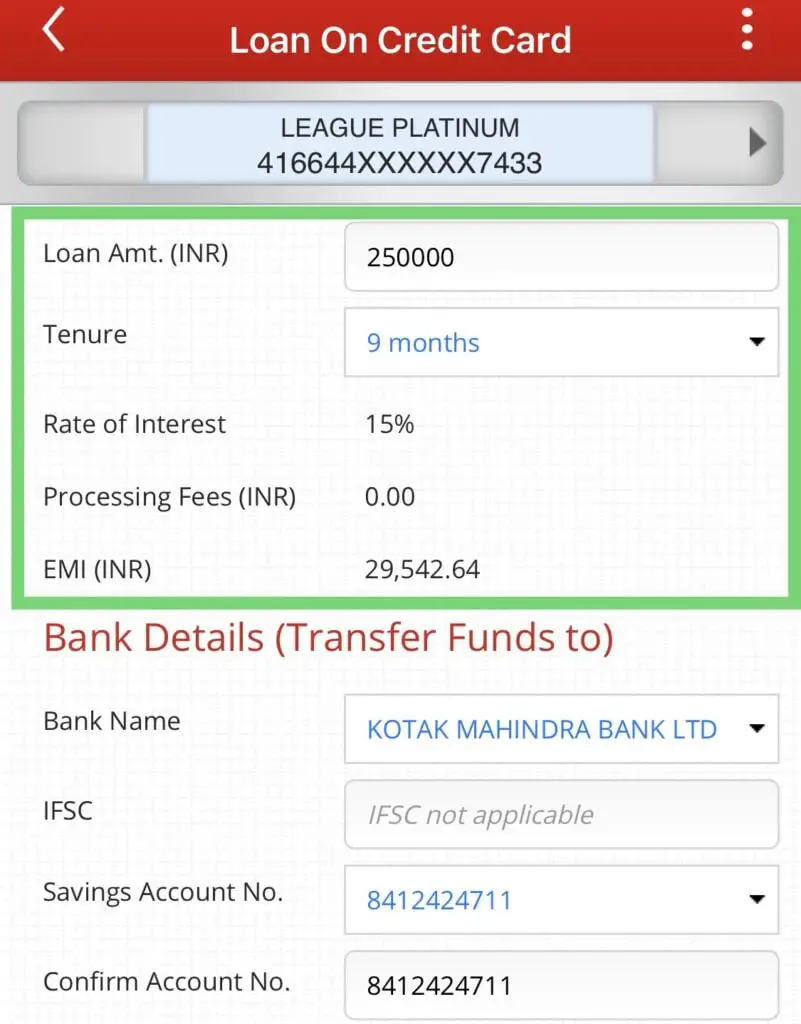

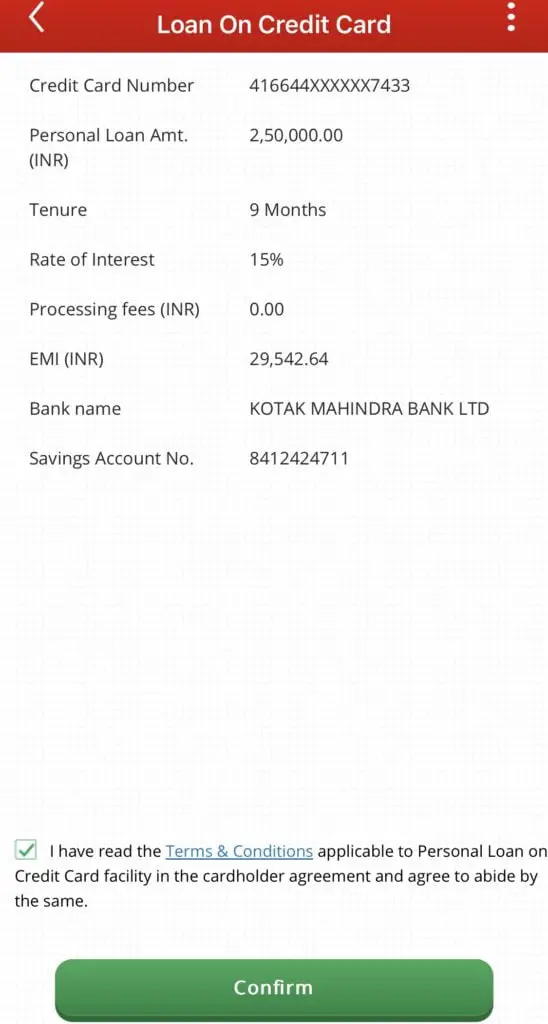

Step 4: As you can see in the below image I have selected 2,50,000 amount here the tenure will be 9 months and the rate of interest will be charged 15% with zero processing fee and the EMI amount will be 29,542 with GST.

Step 5: Below you will get confirmation of all the Loan details on CC and click on “Confirm”

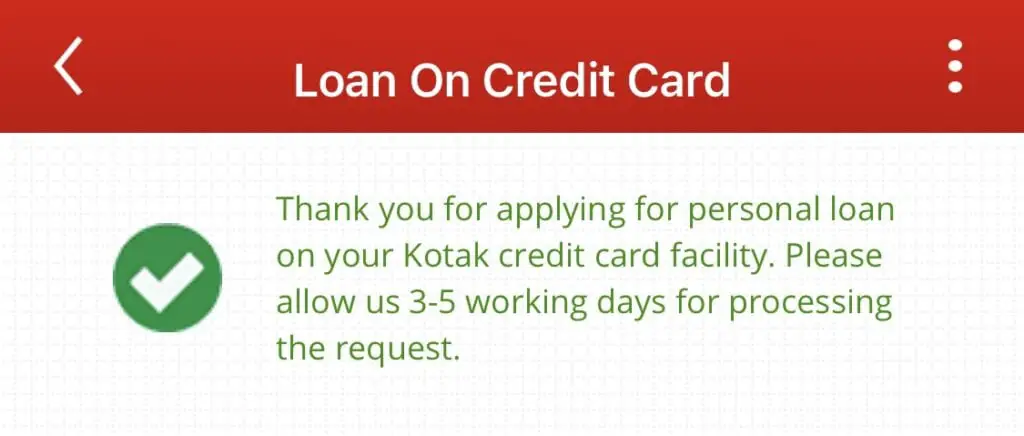

Step 5: Here in the last step, you can see that I have successfully applied for a personal loan on my credit card and it will get approved in 3 to 4 days. Please read the below attached screenshot for more reference.

Kotak Banking Loan

Step 1: If you don’t use Kotak 811 app then you can directly log in to Kotak credit cards and check your loan eligibility.

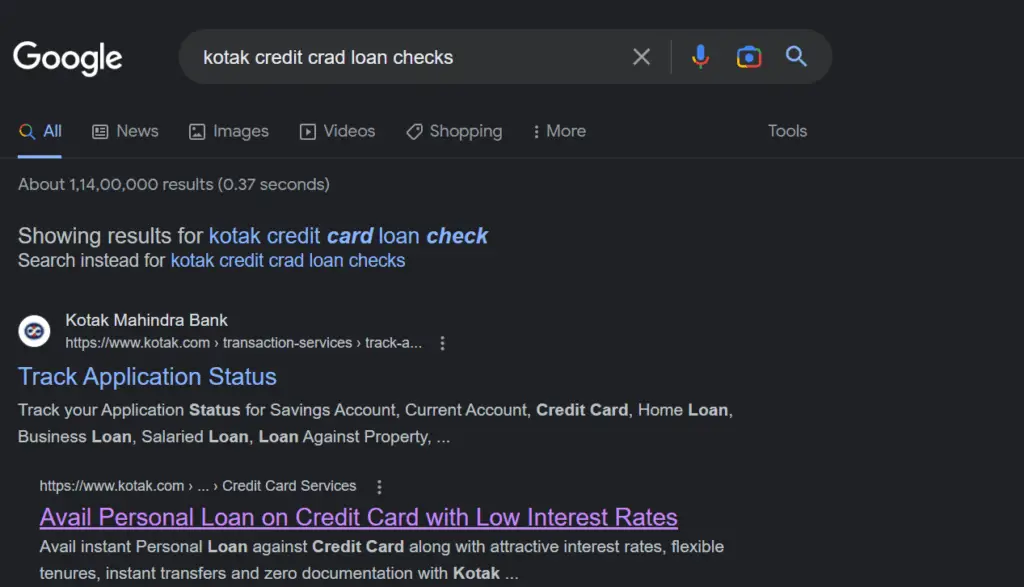

Go to any browser and type Kotak credit card loan checks as you can see in the below image then scroll down and you can find ” Avail personal loan on a credit card with low-interest rate “ just click on that. If not click here to visit site directly!

Step 2: In Step 2 the Kotak website will open as you can see in the below image so there is an option called "apply now” just click on apply now and proceed further.

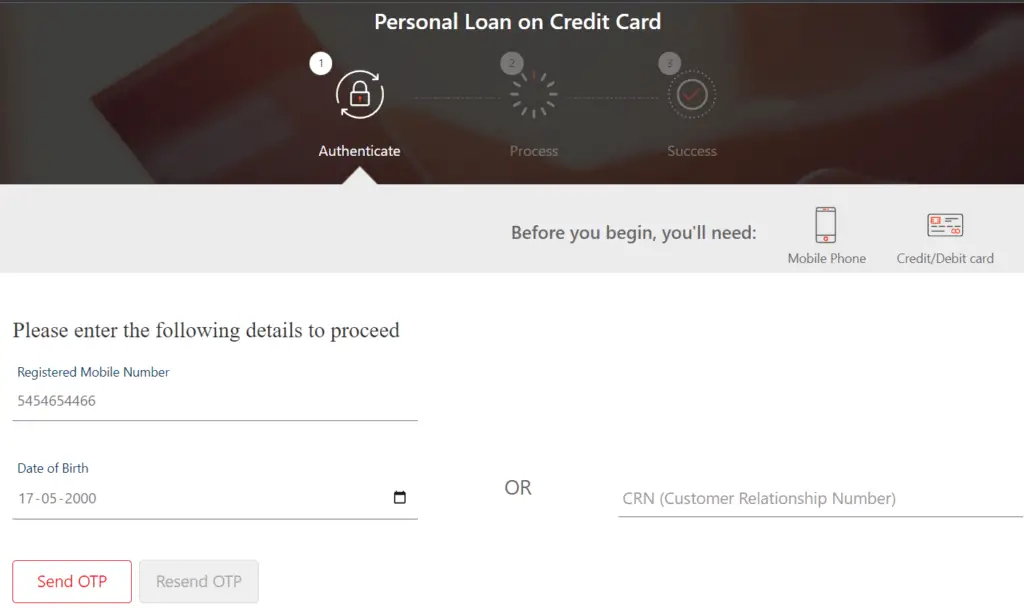

Step 3: So here you have to provide your registered mobile number with your credit card and also the date of birth which is registered in your Kotak credit card also if you want to log in through your CRN number you can use your CRN number. CRN number is basically when you have your Kotak 811 account then you can use your CRN number to log in here.

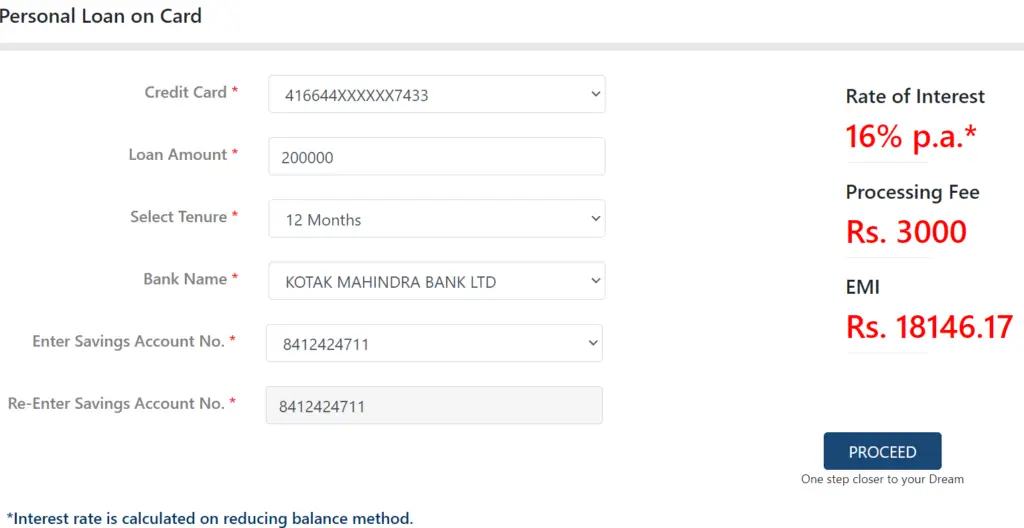

Step 4: So here you can see I have selected the loan amount of 2 lakhs and the tenure I have selected is 12 months for the account which I’m selecting here, the loan amount will get credited to my Kotak bank account as you can see here. On the right side, you can see the rate of interest will be 16% per annum is a yearly basis, the processing fee with be 3,000 and the Emi will be 18,146 rupees per month so check all your details correctly you can proceed further just click on proceed.

Step 5: All the confirmation details will be in this step. Once you confirm the detail then you’ll receive an OTP on the registered mobile number just provide the OTP and you can proceed further and you will get a confirmation mail that “thank you for applying for a personal loan on a credit card facility “ please allow us three to five working days for processing the request.

Watch Video!

Conclusion

If you are really in need of money and you have a Kotak credit card then you can Avail of this facility of personal loan on Kotak credit cards. Kotak Mahindra Bank is one of the best credit card facility providers and credit card as well. So, if you pay all your Kotak credit card bills on time and you are using it for past years you’ll be eligible for this personal loan offer on the credit card. The best part of this is once you apply for a personal loan then your credit card limit will not be blocked here in this case.

Also compared to other banks in the Market Kotak credit card personal loans are quite easy and simple to get. If you have any doubts or concerns please feel free to comment also if you want you can DM us on our social media handle for any queries or questions.

Latest Post Links:

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

One Credit Card Money Transfer In To Bank Account Directly! (kingfishertechtips.in)

Check Loan Details On HDFC Cards – Get EMI Details! (kingfishertechtips.in)

Convert HDFC Credit Card Amount Into EMI – HDFC Smart EMI (kingfishertechtips.in)

SBI Credit Card Loan Offers | Encash – Get Instant Cash (kingfishertechtips.in)

Get Loan On SBI Credit Card – SBI Flexi Pay Option Is Here! (kingfishertechtips.in)

Regular visits listed here are the easiest method to appreciate your energy, which is why why I am going to the website everyday, searching for new, interesting info. Many, thank you Distilling Forum

Very informative post ! There is a lot of information here that can help any business get started with a successful social networking campaign ! situs togel resmi

Thank you for helping people get the information they need. Great stuff as usual. Keep up the great work!!유투벳

The writer has impressed me with the good quality work here. I’ll make sure that I share this article with as many people as I can. I think it’s important to raise awareness about this subject. The only way to do so is by sharing.크레이지알파

That is very helpful for increasing my knowledge in this field. 크레이지알파

That is why advertising which you appropriate search earlier than submitting. It’ll be effortless to write down excellent write-up like that 슬롯무료체험

You have a real talent for writing unique content. I like how you think and the way you express your views in this article. I am impressed by your writing style a lot. Thanks for making my experience more beautiful 슬롯사이트

once i in the beginning commented i seem to have clicked on the -notify me whilst new feedback are brought- checkbox and now each time a comment is brought i am getting 4 emails with the exact equal comment. Is there a way you’re capable of take away me from that provider? Thank you! When i look at your weblog web site in opera, it appears first-rate but whilst starting in net explorer, it has a few overlapping. 유튜벳

hello, your website is really good. We do appreciate your give good results malaysia sportsbook

Great tips and very easy to understand. This will definitely be very useful for me when I get a chance to start my blog. Casino online Malaysia

Nice post. I understand something more challenging on various blogs every day. Bluestacks is an Android emulator that allows users to run mobile apps and games on their PC or Mac. Do you want to enhance the gaming experience on pc and mac? then used bluestack for PC and visit this blog post and enjoy your game. 스포츠중계

More than likely you understand the trend below… 검증사이트

This is often at the same time a good present that many of us seriously enjoyed browsing. It’s not at all on a daily basis which i provide the likeliness to check something. 먹튀없는사이트

Thanks for giving me grateful information. I think this is very important to me. Your post is quite different. That’s why I regularly visit your site. オンカジおすすめ

You will see all styles and models of fashion blogs as being the internet is stuffed with them. 스포츠중계

Thank you a bunch for sharing this with all of us you actually realize what you are talking about! Bookmarked. 홀덤사이트

It’s really a fantastic website✅ thanks for sharing✅ There’s no doubt i would fully rate it after i read 프라그마틱 정품인증

You will discover all types and designs of fashion blogs since the internet is filled with them. 카지노커뮤니티

Easily, the article is actually the best topic on this registry related issue. I fit in with your conclusions and will eagerly look forward to your next updates. 카지노 커뮤니티

I really like your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to construct my own blog and would like to find out where u got this from. cheers 토토사이트

If you want to be successful in weight loss, you have to focus on more than just how you look. An approach that taps into how you feel, your overall health, and your mental health is often the most efficient. Because no two weight-loss journeys are alike, we asked a bunch of women who’ve accomplished a major weight loss exactly how they did it 카지노 커뮤니티

Thanks for taking the time to discuss this, I feel strongly that love and read more on this topic. If possible, such as gain knowledge, would you mind updating your blog with additional information? It is very useful for me 링크모음

I must show my passion for your kindness for people that require assistance with that content. Your very own commitment to getting the solution up and down had been incredibly valuable and have really allowed ladies just like me to get to their aims. The useful tutorial indicates a whole lot a person like me and much more to my mates. Thanks a lot; from each one of us. 총판모집

it was a wonderful chance to visit this kind of site and I am happy to know. thank you so much for giving us a chance to have this opportunity 스포츠분석

The worst part of it was that the software only worked intermittently and the data was not accurate. You obviously canot confront anyone about what you have discovered if the information is not right 스포츠토토중계

Interesting blog I must say, the facts and information written here are accurate. black leather motorcycle jacket 베팅의민족

Very Nice Blog Thanks for sharing This Useful information. 카지노 커뮤니티

좋은 글을 써 주셔서 감사합니다. 저는 당신의 블로그를 우연히 발견하고 몇 개의 글을 읽었습니다. 나는 당신의 글쓰기 스타일을 좋아합니다 … 토토사이트 케이탑25

I have a hard time describing my thoughts on content, but I really felt I should here. Your article is really great. I like the way you wrote this information 온카시티

Thanks for sharing the information keep updating, looking forward to more post. Nice post ! I love its your site after reading ! thanks for sharing. It’s very interesting. And it’s fun. This is a timeless article. I also write articles. whatsminer

Fantastic article! It’s packed with valuable information that’s incredibly helpful. The way you’ve explained everything makes it so easy to grasp. Thank you for sharing this knowledge! I’m eager to explore more on this topic, whatsminer

Yes, the biggest online stalls and bookies in Indonesia offer you online slot game games that have the highest RTP slots. Play microgaming online slot games on our site 벳톡주소

You will see all styles and models of fashion blogs as being the internet is stuffed with them. 레플리카

물론, 귀하의 블로그에 대한 링크를 제공하겠습니다. 공유해 주셔서 감사합니다. 온라인으로 돈을 버는 방법에 대한 블로그를 발전시키고 있습니다. 온라인으로 수익을 창출하는 방법은 생각보다 훨씬 간단할 수 있습니다. 감사합니다. 이 주제에 대한 정보를 오랫동안 찾고 있었는데, 지금까지 찾은 것 중에서 귀하의 정보가 가장 훌륭합니다. 리니지 프리서버

Nice collection. Thanks for sharing HTS솔루션

Hi there, just became alert to your blog through Google, and found that it’s really informative. I am gonna watch out for brussels. I’ll be grateful if you continue this in future. Numerous people will be benefited from your writing. Cheers! I’d must verify with you here. Which isn’t something I often do! I enjoy studying a publish that can make people think. Also, thanks for permitting me to remark! 무료스포츠중계

My brother recommended I might like this website. He was totally right. This put up actually made my day. You can not consider just how so much time I had spent for this information! Thanks! you’ve gotten an ideal weblog right here! would you like to make some invite posts on my weblog? 토토사이트

Thank you again for all the knowledge you distribute,Good post. I was very interested in the article, it’s quite inspiring I should admit. I like visiting you site since I always come across interesting articles like this one.Great Job, I greatly appreciate that.Do Keep sharing! Regards 레플리카시계

You ave made some decent points there. I looked on the net for more info about the issue and found most people will go along with your views on this website.You might comment on the order system of the blog. You should chat it’s splendid. Your blog audit would swell up your visitors. I was very pleased to find this site asicmining

Heya! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing many months of hard work due to no back up. Do you have any solutions to protect against hackers asicmining

useful information on topics that plenty are interested on for this wonderful post.Admiring the time and effort you put into your b!.. 온라인홀덤

Well, this got me thinking what other workouts are good for those of us who find ourselves on the road or have limited equipment options. 카지노 커뮤니티

Helloo It was very useful for me – you like it – thank you for your useful content 블랙잭사이트

At this time I am going away to do my breakfast, afterward having my breakfast coming again to read additional news. 카지노사이트

I can give you the address Here you will learn how to do it correctly. Read and write something good 카지노사이트

This is very educational content and written well for a change. It’s nice to see that some people still understand how to write a quality post! 유투벳

I think about it is most required for making more on this get engaged オンカジ おすすめ

Positive site, where did u come up with the information on this posting? I’m pleased I discovered it though, ill be checking back soon to find out what additional posts you include. 야맵

Thank you for taking the time to publish this information very useful! 바카라사이트

it was a wonderful chance to visit this kind of site and I am happy to know. thank you so much for giving us a chance to have this opportunity.. 카지노 커뮤니티

I am very happy to discover your post as it will become on top in my collection of favorite blogs to visit. 바카라사이트

Thankfulness to my father who shared with me regarding this web site, this weblog is genuinely remarkable. 해선솔루션

“It’s amazing to visit this web site and reading the views of all mates regarding this piece of writing, while I am also eager of getting experience.

” 해선솔루션 분양

The post is really superb. It’s varied accessory information that consists during a basic and necessary method. Thanks for sharing this text. The substance is genuinely composed. This web do my paper for me log is frequently sharing useful actualities. Keep sharing a lot of posts. opmap

Brilliant demonstrated data. I thank you about that. Clearly it will be unbelievably helpful for my future endeavors. Should see some different posts on a practically identical subject! opstar

The post is really superb. It’s varied accessory information that consists during a basic and necessary method. Thanks for sharing this text. The substance is genuinely composed. This web do my paper for me log is frequently sharing useful actualities. Keep sharing a lot of posts. 알밤

Great it was amazing post. It is awesome discussion to understand easily about the importance of service. Very narrative ! Thanks,it is nice and very effective article here. 프라그마틱 정품

An interesting dialogue is price comment. I feel that it is best to write more on this matter, it may not be a taboo topic however usually individuals are not enough to talk on such topics. To the next. Cheers. opart

Thanks For sharing this Superb article.I use this Article to show my assignment in college.it is useful For me Great Work. 인달

❤ I favor the idea, such a good deal mlb중계

I recently found many useful information in your website especially this blog page. Among the lots of comments on your articles. Thanks for sharing. 부산달리기

Excellent article. Very interesting to read. I really love to read such nice article. Thanks! keep rocking 스포츠티비중계

I genuinely like you’re making style, inconceivable information, thankyou for posting buy web traffic

I would like to thank you for the efforts you have made in writing this article. I am hoping the same best work from you in the future as well. In fact your creative writing abilities has inspired me to start my own Blog Engine blog now. Really the blogging is spreading its wings rapidly. Your write up is a fine example of it. buy web traffic

Nice to be visiting your blog again, it has been months for me. Well this article that i’ve been waited for so long. I need this article to complete my assignment in the college, and it has the same topic with your article. Thanks, great share 유투벳

You re in point of fact a just right webmaster. The website loading speed is amazing. It kind of feels that you’re doing any distinctive trick. Moreover, The contents are masterpiece. you have done a fantastic activity on this subject 스포츠분석

Thanks for a wonderful share. Your article has proved your hard work and experience you have got in this field. Brilliant .i love it reading . Pretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I’ll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. I really thank you for the valuable info on this great subject and look forward to more great posts. Thanks a lot for enjoying this beauty article with me 크레이지알파

Normally I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, very nice post. Nice to be visiting your blog again, it has been months for me. Well this article that i’ve been waited for so long. I need this article to complete my assignment in the college, and it has same topic with your article. Thanks, great share 크레이지슬롯

I really appreciate the kind of topics you post here. Thanks for sharing us a great information that is actually helpful. Good day.Set aside my effort to peruse every one of the remarks, however, I truly delighted in the article. It ended up being Very useful to me and I am certain to all the analysts here. 크레이지슬롯

I need to to thank you for this excellent read!! I definitely enjoyed every little bit of it. I have you saved as a favorite to look at new stuff you post 온라인카지노

I definitely enjoying every little bit of it. It is a great website and nice share. I want to thank you. Good job! You guys do a great blog, and have some great contents. Keep up the good work. what a brilliant post I have come across and believe me I have been searching out for this similar kind of post for past a week and hardly came across this. Thank you very much and will look for more postings from you 크레이지슬롯

I really enjoyed your blog Thanks for sharing such an informative post. Check it out. 프라그마틱 정품확인

Very informative post! There is a lot of information here that can help any business get started with a successful social networking campaign.I found your this post while searching for some related information on blog search…Its a good post..keep posting and update the information 카지노사이트

We can see that we need to develop policies to deal with this trend. 링크모음

I simply want to tell you that I am new to weblog and definitely liked this blog site. Very likely I’m going to bookmark your blog . You absolutely have wonderful stories. Cheers for sharing with us your blog 토토커뮤니티

I really appreciate the kind of topics you post here. Thanks for sharing us a great information that is actually helpful. Good day.Set aside my effort to peruse every one of the remarks, however, I truly delighted in the article. It ended up being Very useful to me and I am certain to all the analysts here. 해외문자

You have performed a great job on this article. It’s very precise and highly qualitative. You have even managed to make it readable and easy to read. You have some real writing talent. Thank you so much 해외축구중계

Thanks for the nice blog. It was very useful for me. I’m happy I found this blog. Thank you for sharing with us, I too always learn something new from your post. 총판모집

My dear goodness! an amazing article guy. Many thanks Nevertheless I’m going through problem with third really simply syndication . Have no idea exactly why Unable to subscribe to that. Will there be anybody acquiring comparable rss or atom downside? Anyone who knows generously reply. Thnkx 벳톡

That is really interesting, You’re a very professional blogger.I’ve joined your feed and sit up for in quest of more of your magnificent post. Also, I’ve shared your website in my social networksAlso visit my web page … 슬롯사이트

I haven’t any word to appreciate this post…..Really i am impressed from this post….the person who create this post it was a great human..thanks for shared this with us.Thank you because you have been willing to share information with us해외문자

Hello, this weekend is good for me, since this time i am reading this enormous informative article here at my home.I haven’t any word to appreciate this post…..Really i am impressed from this post….the person who create this post it was a great human..thanks for shared this with us.This is such a great resource that you are providing and you give it away for free. I love seeing blog that understand the value. Im glad to have found this post as its such an interesting one! I am always on the lookout for quality posts and articles so i suppose im lucky to have found this! I hope you will be adding more in the future… 크레이지알파

Discover the premier slot community guiding you to authentic, certified slot sites. Join us for access to original, verified slot platforms and exclusive offers. Our platform ensures a secure and genuine gaming experience for all members. Explore the best in slot entertainment with our trusted community. 슬롯사이트

You delivered such an impressive piece to read, giving every subject enlightenment for us to gain information. Thanks for sharing such information with us due to which my several concepts have been cleared. 로얄클럽

Awesome article, it was exceptionally helpful! I simply began in this and I’m becoming more acquainted with it better! Cheers, keep doing awesome Prof Peter Horby, an expert in infectious diseases at University of Oxford, said: “A safe, affordable, and effective oral antiviral would be a huge advance in the fight against Covid. 슬롯생활

Nice post. I was continuously checking this blog and I am impressed! Extremely useful info particularly the last part 🙂 I care for such information much. I was seeking this particular info for a long time. Thank you and good luck. 케이탑25

I acquired several exquisite data. I? Ve been preserving an eye fixed in this era for a few time. It? Utes attention-grabbing the way it keeps abso 온라인카지노

I am glad to be a visitor of this unadulterated web site, thanks for this rare info! 에볼루션

Great sites are not planned medium-term. Great sites aren’t made in a quick. Great sites require significant investment, determination, arranging, an astounding background of bearing, notwithstanding the main point 주소야

I learnt a lot from this, thanks so much. Nice clear and explanations too. 온라인카지노

Uncommon tips and clear. This will be to a great degree supportive for me when I get a chance to start my blog 메이저놀이터

Awesome Stress Management tips. It helps me to reduce my stress. I’d love to follow your blog daily. Thank you. jasa pbn murah

Great info! I recently came across your blog and have been reading along. 카지노사이트

Very good article, I enjoyed reading your post, very good part, I want to tweet this to my followers. Thank you オンカジ入金不要ボーナス

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 슬롯사이트

Hi! I know this is somewhat off topic but I was wondering if you knew where I could get 프라그마틱 정품인증

i read your article its good for humanity thanks for sharing this its very informative 토토사이트

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 2025년 슬롯사이트 순위

I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you post 베팅의민족

Impressive web site, Distinguished feedback that I can tackle. Im moving forward and may apply to my current job as a pet sitter, which is very enjoyable, but I need to additional expand. Regards 유트벳

I definitely enjoying every little bit of it. It is a great website and nice share. I want to thank you. Good job! You guys do a great blog, and have some great contents. Keep up the good work 카지노커뮤니티

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 토토사이트 먹튀검증

Acknowledges for paper such a beneficial composition, I stumbled beside your blog besides decipher a limited announce. I want your technique of inscription. 카지노사이트

Very descriptive post, I liked that a lot. Nate Diaz

I am happy to find this post very useful for me, as it contains lot of information. I always prefer to read the quality content and this thing I found in you post. Thanks for sharing 호빵맨토토

“This is a wonderful article, Given so much info in it, These type of articles keeps the users interest in the website, and keep on sharing more … good luck.

” 링크모음 링크팡

I think about it is most required for making more on this get engaged 레드불토토

I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you post 슬롯생활

Acknowledges for paper such a beneficial composition, I stumbled beside your blog besides decipher a limited announce. I want your technique of inscription. 토토커뮤니티

I think about it is most required for making more on this get engaged 레드벨벳토토

Hey! This is my first comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading through 분석픽

Acknowledges for paper such a beneficial composition, I stumbled beside your blog besides decipher a limited announce. I want your technique of inscription. 온라인카지노

Such a very useful article. Very interesting to read this article.I would like to thank you for the efforts you had made for writing this awesome article. 원벳원

Impressive web site, Distinguished feedback that I can tackle. Im moving forward and may apply to my current job as a pet sitter, which is very enjoyable, but I need to additional expand. Regards 유투벳

This Academic article is very good, infect it’s good to find such a useful content on your website. For education purpose you can look forward to the Assignment help Online .Our assignment experts works hard to live up to the expectations and provide total peace of mind. ezclasswork

Such a very useful article. Very interesting to read this article.I would like to thank you for the efforts you had made for writing this awesome article. 캡포탈

“This is a wonderful article, Given so much info in it, These type of articles keeps the users interest in the website, and keep on sharing more … good luck.

” 해외야구중계

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 토토커뮤니티

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 토토사이트

I can’t believe focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material without a doubt. It is one of the greatest contents 볼트카지노 도메인 주소

I think you could expand this topic even more. Interested to see more! 슬롯나라

i read your article its good for humanity thanks for sharing this its very informative 보스카지노 도메인 주소

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 바카라사이트

Personally I think overjoyed I discovered the blogs. 크레이지슬롯

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 네임드카지노 도메인 주소

Acknowledges for paper such a beneficial composition, I stumbled beside your blog besides decipher a limited announce. I want your technique of inscription. 슬롯

Very descriptive post, I liked that a lot. 토토사이트

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 카지노사이트

So it is intriguing and great composed and see what they think about other individuals. Polijsten

I’m constantly searching on the internet for posts that will help me. Too much is clearly to learn about this. I believe you created good quality items in Functions also. Keep working, congrats! 2500kVA WYE WYE

You have observed very interesting points ! ps decent internet site . 크레이지슬롯

This is a great article, Given such a great amount of information in it, These kind of articles keeps the clients enthusiasm for the site, and continue sharing more … 검증 슬롯사이트

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post 메이저놀이터

You finished certain dependable focuses there. I completed a pursuit regarding the matter and discovered about all people will concur with your blog. 비닉스구매

I’m constantly searching on the internet for posts that will help me. Too much is clearly to learn about this. I believe you created good quality items in Functions also. Keep working, congrats! 2500kVA WYE WYE

Personally I think overjoyed I discovered the blogs. 크레이지슬롯 슬롯나라

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 라바카지노 도메인 주소

This is a great article, Given such a great amount of information in it, These kind of articles keeps the clients enthusiasm for the site, and continue sharing more … 쇼미더벳 도메인 주소

Acknowledges for paper such a beneficial composition, I stumbled beside your blog besides decipher a limited announce. I want your technique of inscription. 쇼미더벳 도메인 주소

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 대물카지노 도메인 주소

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 지니카지노 도메인 주소

Impressive web site, Distinguished feedback that I can tackle. Im moving forward and may apply to my current job as a pet sitter, which is very enjoyable, but I need to additional expand. Regards 고광렬카지노 도메인 주소

This blog really convinced me to do it! Thanks, very good post 텐바이텐

Personally I think overjoyed I discovered the blogs. 아벤

우리는이 사이트를 방문하고 싶습니다. 여기에서 얻을 수있는 많은 유용한 정보가 있습니다. 유투토토

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 풀빠따 도메인 주소

https://hukum.upnvj.ac.id/download/surat-permohonan-ujian-tengah-semester-uts-susulan/#comment-2915363

This is a great article, Given such a great amount of information in it, These kind of articles keeps the clients enthusiasm for the site, and continue sharing more … 아벤카지노 도메인 주소

The post is written in very a good manner and it contains many useful information for me 도날드덕 카지노 사이트 주소

Interesting post. I Have Been wondering about this issue. so thanks for posting. Pretty cool post.It ‘s really very nice and Useful post.Thanks 스마일 도메인 주소

I loved your blog article.Thanks Again. Keep writing. 총판구인구직

Our platform helps you identify and avoid online scam gambling sites. We provide comprehensive reviews, user feedback, and verified ratings to ensure you gamble safely. Stay informed with our regularly updated blacklist of fraudulent websites. Trust us to guide you to secure and reputable gambling platforms. 주소야

Your work is very good and I appreciate you and hopping for some more informative posts 슬롯사이트

Major thankies for the blog. 온라인홀덤

In the wake of perusing your article I was stunned. I realize that you clarify it exceptionally well. What’s more, I trust that different perusers will likewise encounter how I feel in the wake of perusing your article. 실시간중계

Interesting information and attractive.This blog is really rocking… Yes, the post is very interesting and I really like it.I never seen articles like this. I meant it’s so knowledgeable, informative, and good looking site

온카114

I needed to thank you for this extraordinary read!! I unquestionably appreciating every single piece of it I have you bookmarked to look at new stuff you post 해외야구중계

The world hopes for more passionate writers like you who aren’t afraid to say how they believe. 슬롯사이트

Keep on working, great job! antminer

There are many cable service providers in the US, but not all of them may operate in your area. To solve this issue, Cabletv.us has come up with a solution to find service providers based on your address 슬롯사이트

I’m always searching out a few unfastened kinds of stuff over the net. there are also some agencies which give unfastened samples. superb and interesting article. extraordinary matters you’ve got usually shared with us. thanks 슬롯사이트

You developed something that individuals could understand along with making the subject outstanding for every person. As a matter of fact, First of all let me tell you, you have got a great blog .I am interested in looking for more of such topics and would like to have further information 슬롯사이트

For those of you who like playing online games, you are definitely looking for a trusted and popular site, and of course one that can provide jackpots to members who have joined the trusted site. Make sure you’re always up-to-date! Visit our website for more complete information. 카지노사이트

Offers a variety of online games with high-quality themes and attractive music. Famous for super fast service and attractive features. Don’t miss out. For more complete information, visit the website 카지노사이트

Unlock today’s top-performing games with RTP Live! Our site offers precise RTP forecasts and the latest updates from Pragmatic Play, so you can maximize your gaming experience. 온라인카지노

page layout and design. Excellent choice of colors! 온라인카지노

Positive site, where did u come up with the information on this posting?I have read a few of the articles on your website now, and I really like your style. Thanks a million and please keep up the effective work.I learn some new stuff from it too, thanks for sharing your information. 온라인카지노

“Very nice post. I just stumbled upon your blog and wanted to say that I’ve truly enjoyed browsing your blog posts. In any case I will be subscribing to your feed and I hope you write again soon 라이브스코어

We are a leading pharmacy supplier providing legal medicines and pharmaceuticals to customers throughout Sweden, Denmark and Norway. 카지노사이트

We are a group of volunteers and starting a new scheme in our community. Your site provided us with helpful info to work on. You have performed a formidable activity and our entire neighborhood will be thankful to you.| I just want to mention I am new to blogging and site-building and really savored this blog site. Very likely I’m likely to bookmark your blog post . You surely come with tremendous article content. Appreciate it for sharing with us your web-site. 슬롯사이트

Hello, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam responses? If so how do you stop it, any plugin or anything you can advise? I get so much lately it’s driving me crazy so any assistance is very much appreciated.| 프라그마틱 정품

Greetings, I think your blog could be having internet browser compatibility issues. When I look at your website in Safari, it looks fine however, when opening in IE, it has some overlapping issues. I merely wanted to give you a quick heads up! Apart from that, great website!| 온라인 카지노

Hello, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam responses? If so how do you stop it, any plugin or anything you can advise? I get so much lately it’s driving me crazy so any assistance is very much appreciated.| 먹튀

I’m impressed, I must say. Actually rarely do you encounter a blog that’s both educative and entertaining, and let me tell you, you’ve got hit the nail to the head. Your notion is outstanding; the issue is an issue that not enough people are speaking intelligently about. I am very happy that we found this at my look for something about it. 온라인카지노

Does your blog have a contact page? I’m having a tough time locating it but, I’d like to shoot you an e-mail. I’ve got some ideas for your blog you might be interested in hearing. Either way, great blog and I look forward to seeing it grow over time.| 온라인카지노

Greetings, I think your blog could be having internet browser compatibility issues. When I look at your website in Safari, it looks fine however, when opening in IE, it has some overlapping issues. I merely wanted to give you a quick heads up! Apart from that, great website!| 주소야

Article submission websites provide a platform for authors and businesses to publish and promote their content, increasing their online visibility, driving traffic to their websites, and improving their search engine rankings through high-quality backlinks and targeted audience engagement 토토사이트

“Everything is very open with a really clear clarification of the challenges. It was definitely informative. Your site is very helpful. Thanks for sharing! 온카시티

Glad to chat your blog, I seem to be forward to more reliable articles and I think we all wish to thank so many good articles, blog to share with us. 온카114

Fantastic site. Plenty of helpful info here. I’m sending it to several pals ans also sharing in delicious. And certainly, thanks to your sweat! 해외야구중계

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing! 슬롯사이트

Article submission websites provide a platform for authors and businesses to publish and promote their content, increasing their online visibility, driving traffic to their websites, and improving their search engine rankings through high-quality backlinks and targeted audience engagement 카지노사이트

I have read your article, it is very informative and helpful for me. I admire the valuable information you offer in your articles. Thanks for posting it

オンカジおすすめ

Great information is often observed on this online weblog. 카마그라구매

I appreciated your work very thanks 토토사이트

지금 귀하의 웹 사이트에서 몇 개의 웹 로그 게시물을 조사한 후 귀하의 블로깅 방법이 정말 마음에 듭니다. 북마크 웹 사이트 기록에 북마크를 추가했으며 곧 다시 확인할 예정입니다. Pls는 효과적으로 내 사이트를 확인하고 당신이 생각하는 것을 알려주십시오. 컴퓨터 및 액세서리 풀빠따벳

Nice concept revealed your blog thanks for sharing is a best feature and latest.

antminer s19

We are really grateful for your blog post. You will find a lot of approaches after visiting your post. I was exactly searching for. Thanks for such post and please keep it up. Great work. Solarscreen

토토사이트

This is a fabulous post I seen by virtue of offer it. It is genuinely what I expected to see look for in future you will continue subsequent to sharing such an extraordinary post j.k

It offers various information usage fees and content payment services, and you can purchase gift certificates such as Google gift cards and then 소액결제현금화 cash them out. The small payment limit may be initially set low and adjusted based on the user’s credit rating and payment history.

https://toto-app.com

https://totoyo365.com/

토토사이트 토토톡

Bu site, bonus sağlayıcısı kılığına girmiş tam bir dolandırıcılık. Asla gelmeyen sözde ‘ücretsiz’ bir bonus için çemberlerden atlıyorsunuz. Tam bir çöp. Yetişkin Porno

Tam bir kandırmaca! Deneme bonusu verdiklerini söylüyorlar ama kayıt olduktan sonra hiçbir şey yok Çocuk Pornosu

Bu siteyi bildirin ve Google’a bildirin, dolandırılıyorlar Çocuk Pornosu

Siktir git dolandırıcı, insanların bu tür büyük dolandırıcılıklarını hiç görmedim Çocuk Pornosu

Siktir git dolandırıcı, paramı geri ver. İnsanlar bu siteye girmez Çocuk Pornosu

Tamamen Sahtekarlık, Bu sitelere asla girmeyin. Onlar Hırsız Çocuk Pornosu

Tamamen Sahtekarlık, Bu sitelere asla girmeyin. Onlar Hırsız Çocuk Pornosu

Truly, this article is really one of the very best in the history of articles. I am a antique ’Article’ collector and I sometimes read some new articles if I find them interesting. And I found this one pretty fascinating and it should go into my collection. Very good work! Yetişkin Porno

I really loved reading your blog. It was very well authored and easy to undertand. Unlike additional blogs I have read which are really not tht good. I also found your posts very interesting. In fact after reading, I had to go show it to my friend and he ejoyed it as well! Yetişkin Porno

awesome blogging. nice to read it, Yetişkin Porno

Very nice article. I enjoyed reading your post. very nice share. I want to twit this to my followers. Thanks !. Yetişkin Porno

Tam bir kandırmaca! Deneme bonusu verdiklerini söylüyorlar ama kayıt olduktan sonra hiçbir şey yok Çocuk Pornosu

Siktir git dolandırıcı, insanların bu tür büyük dolandırıcılıklarını hiç görmedim Çocuk Pornosu

Bonus sistemi karmaşık ve şeffaf değil. Ne kazandığın belli ne de nasıl çekeceğin. Çocuk Pornosu

Bu Dolandırıcıların Sitelerine Girmeyin: Yetişkin Porno

Ne şaka ama. Sizi gösterişli bonus vaatleriyle cezbediyorlar, sonra da üzerinize imkansız kurallardan oluşan bir duvar örüyorlar. Burada zamanınızı boşa harcamayın. Yetişkin Porno

Hey, Dolandırıcı Paramı geri ver, aksi takdirde sana dava açacağım Japon pornoları

Arayüz çok kötü, bonusu bulmak bile dert. Ayrıca destek ekibi yok gibi bir şey. Çocuk Pornosu

Tamamen Sahtekarlık, Bu sitelere asla girmeyin. Onlar Hırsız Japon pornoları

NBA중계