Digital rupee: it is also known as digital currency, is also called as virtual money. It acts as the same as physical money. When it comes to value of digital rupee & physical money are the same, i.e. 5 digital rupee = Rs. 5 cash.

In case RBI issues digital rupee while the banks will manage the distribution of the Central Bank Digital Currency (CBDC). According to Central Bank’s guidelines, you can do any transaction with digital rupee with any merchants and individuals as per requirement.

Note: Currently this is not available for all the customers to enrol this Digital Currency, I have tried with Axis and IDFC bank but could not verify. Recently I have received this below message from Kotak Bank that I am eligible to enrol the Digital Rupees issued by RBI. In this article I will guide you regarding the KYC and wallet of Digital Rupees.

Digital Rupee KYC Process:

Step 1: If you have received any message as mentioned above then you can download the app from play store. In my case it is Kotak so I will download Kotak app for Digital Rupee.

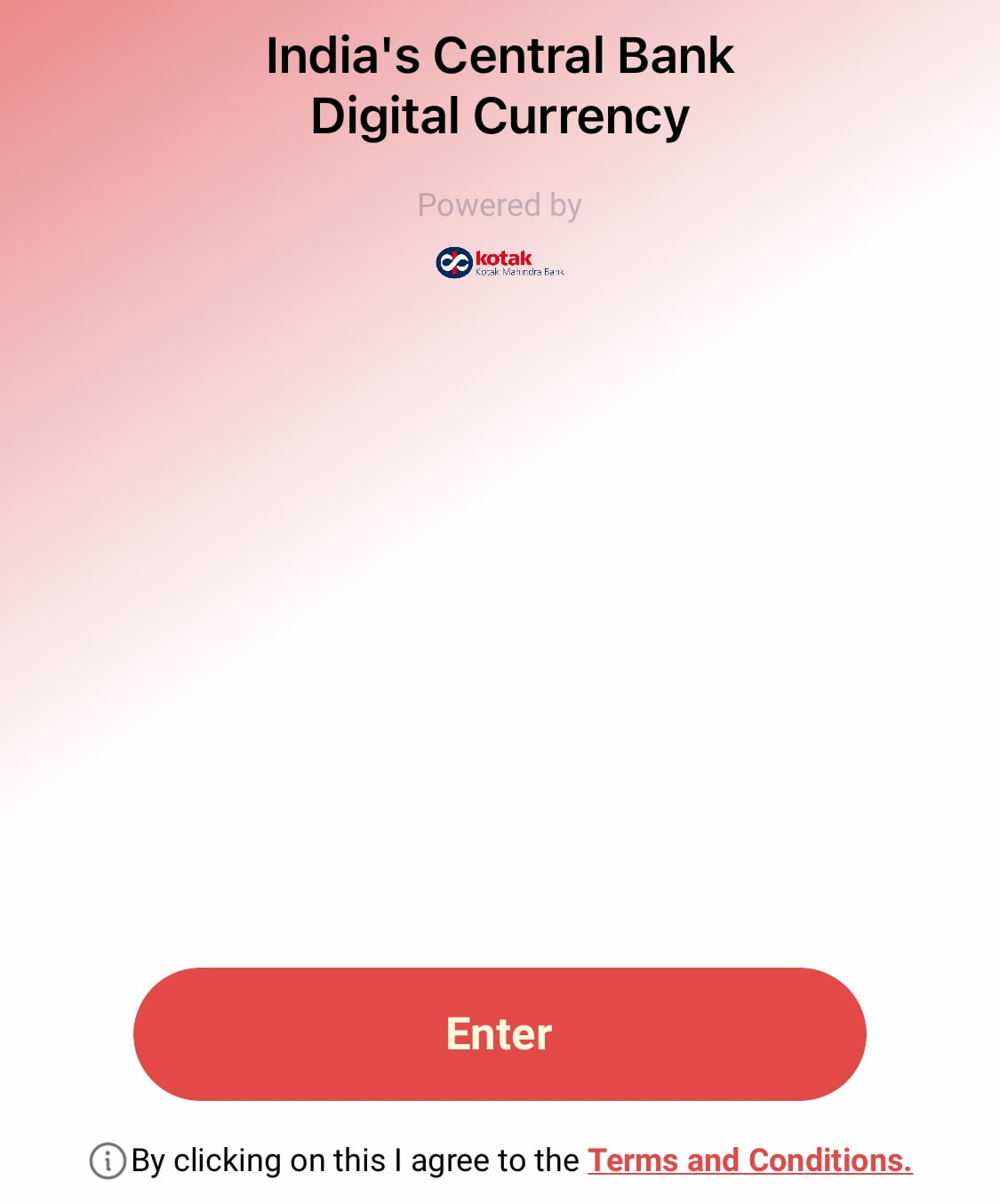

Step 2: Once downloaded open the app, and the home page will give this kinds of similar interface. Just click on enter and proceed further.

Step 3: Accept all the terms and conditions and click on the Accept button mentioned below.

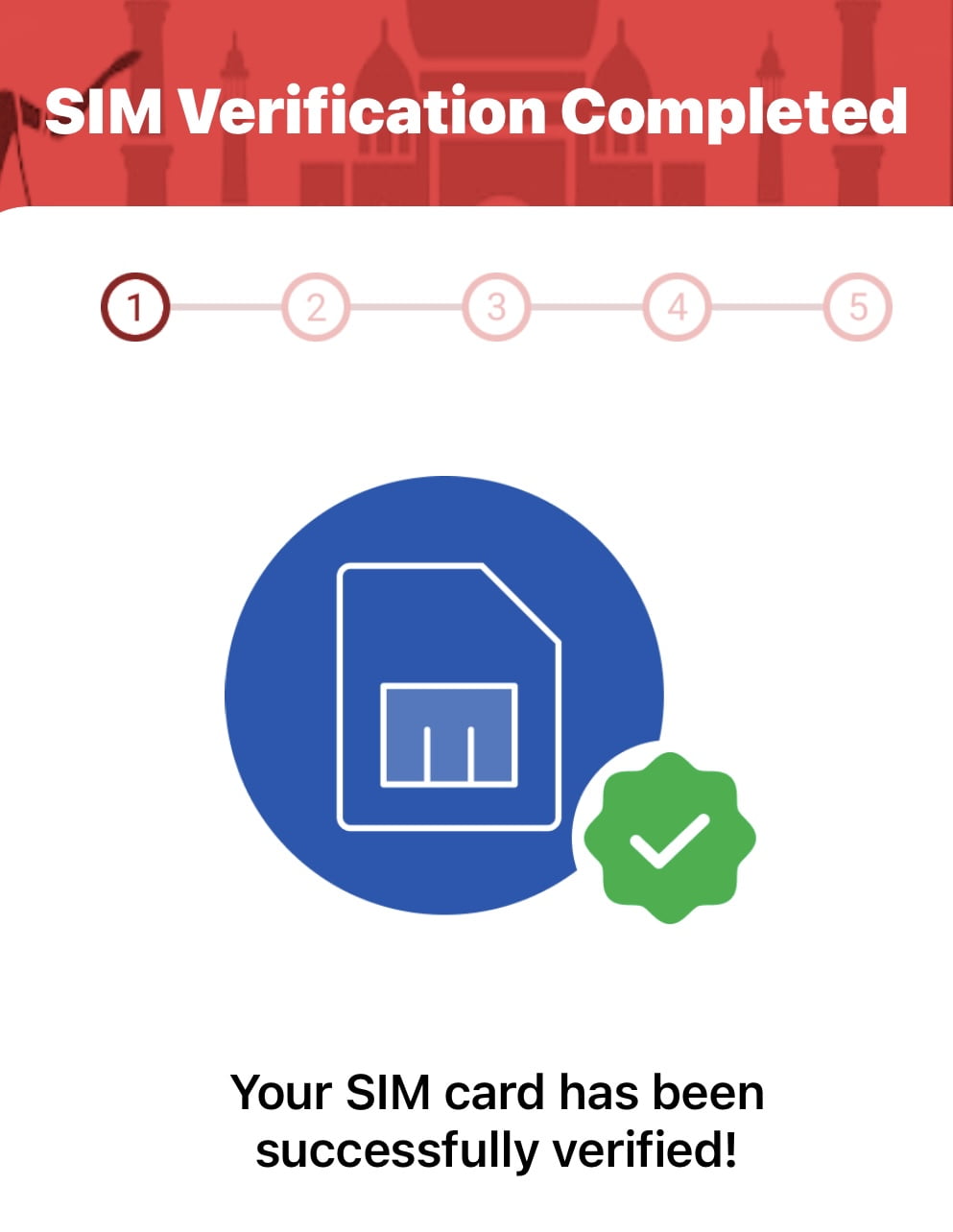

Step 4: Here we have to verify the BANK with SIM card from which you got offer for Digital Currency.

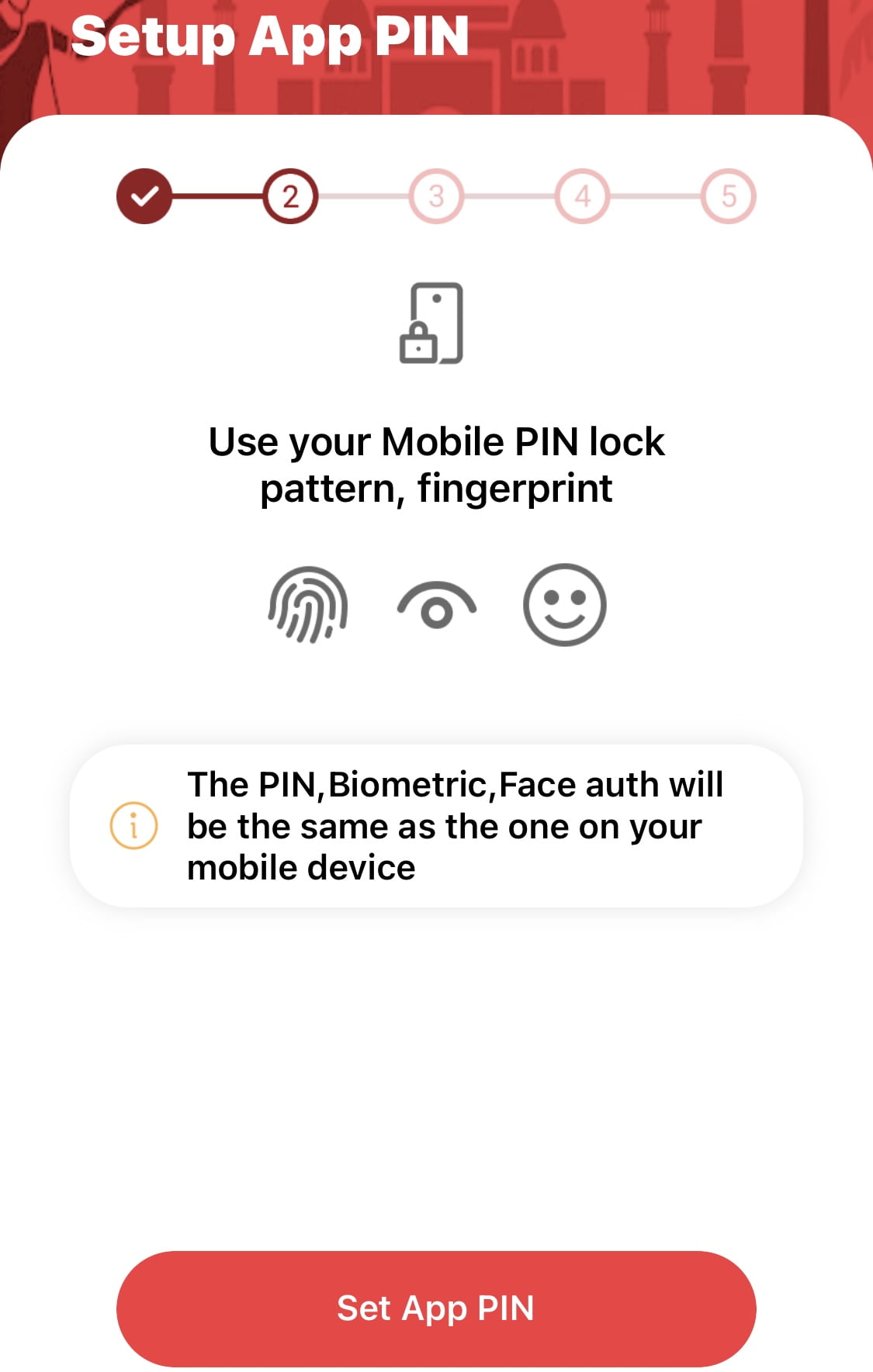

Step 5: Here we have to specify PIN for this app, you an use your biometric as well to open this app.

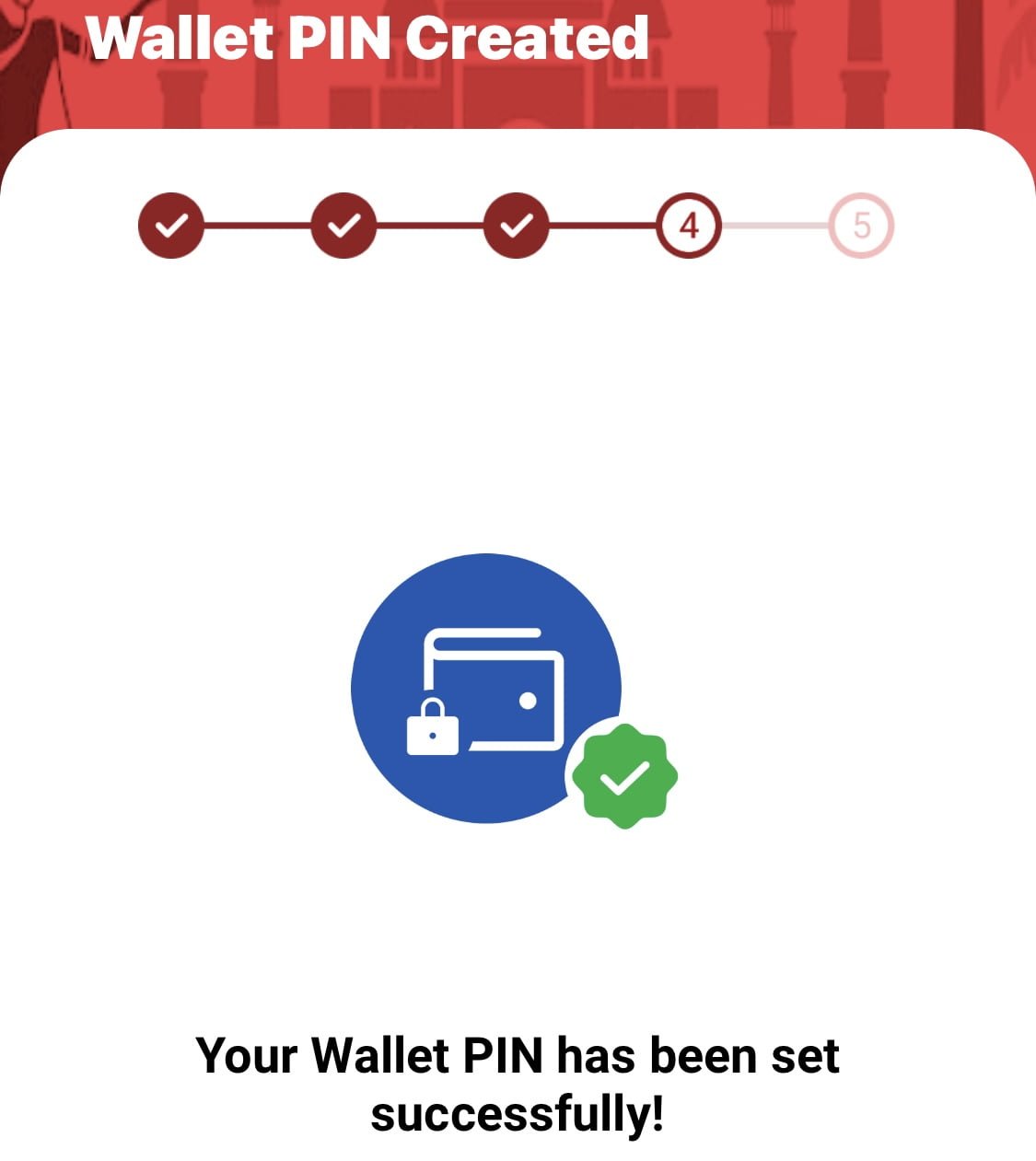

Step 6: Now in this step we will setup wallet pin and proceed further by clicking on the next.

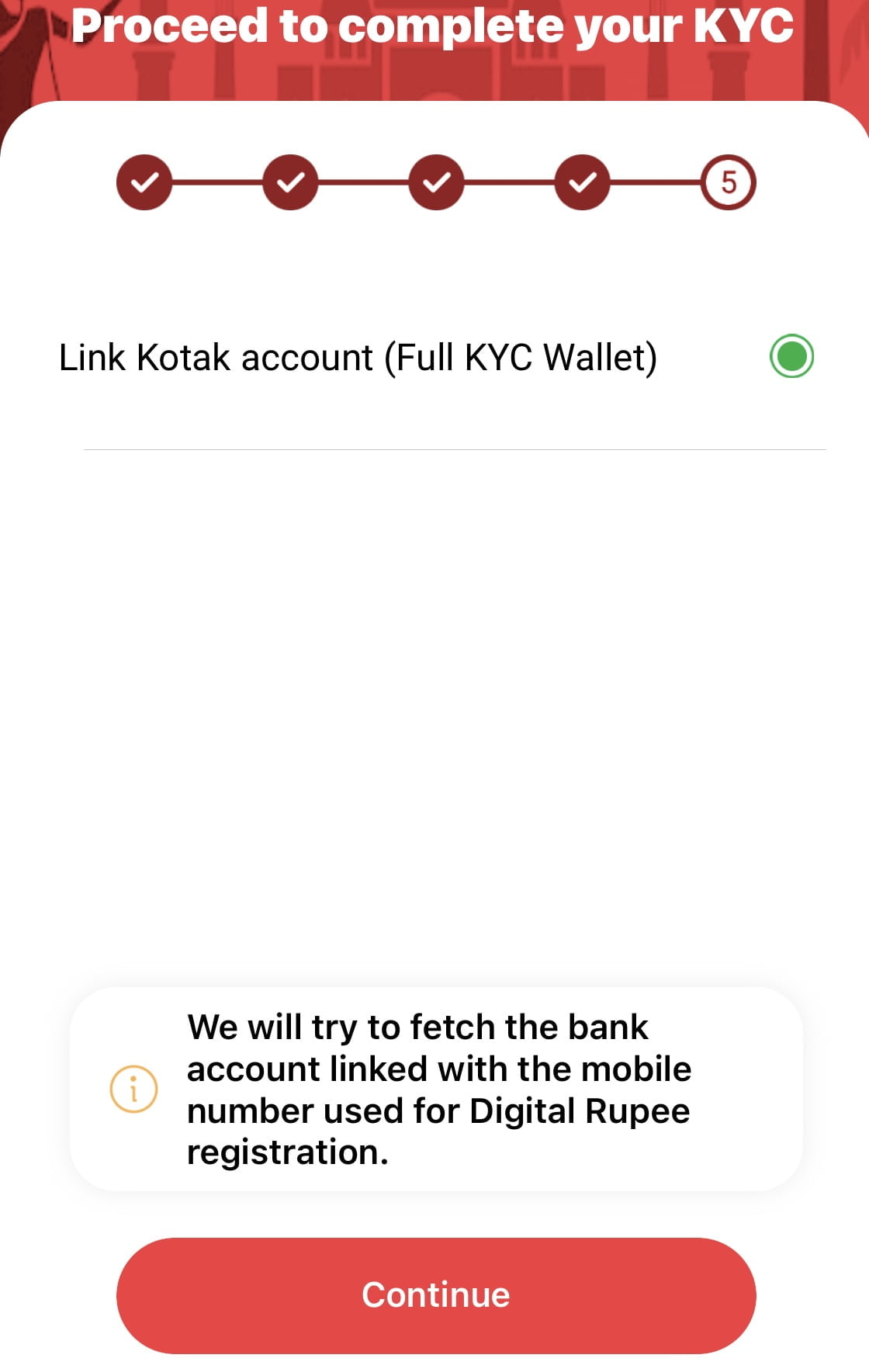

Step 7: Now we have to verify our account with this mobile number to proceed further with this.

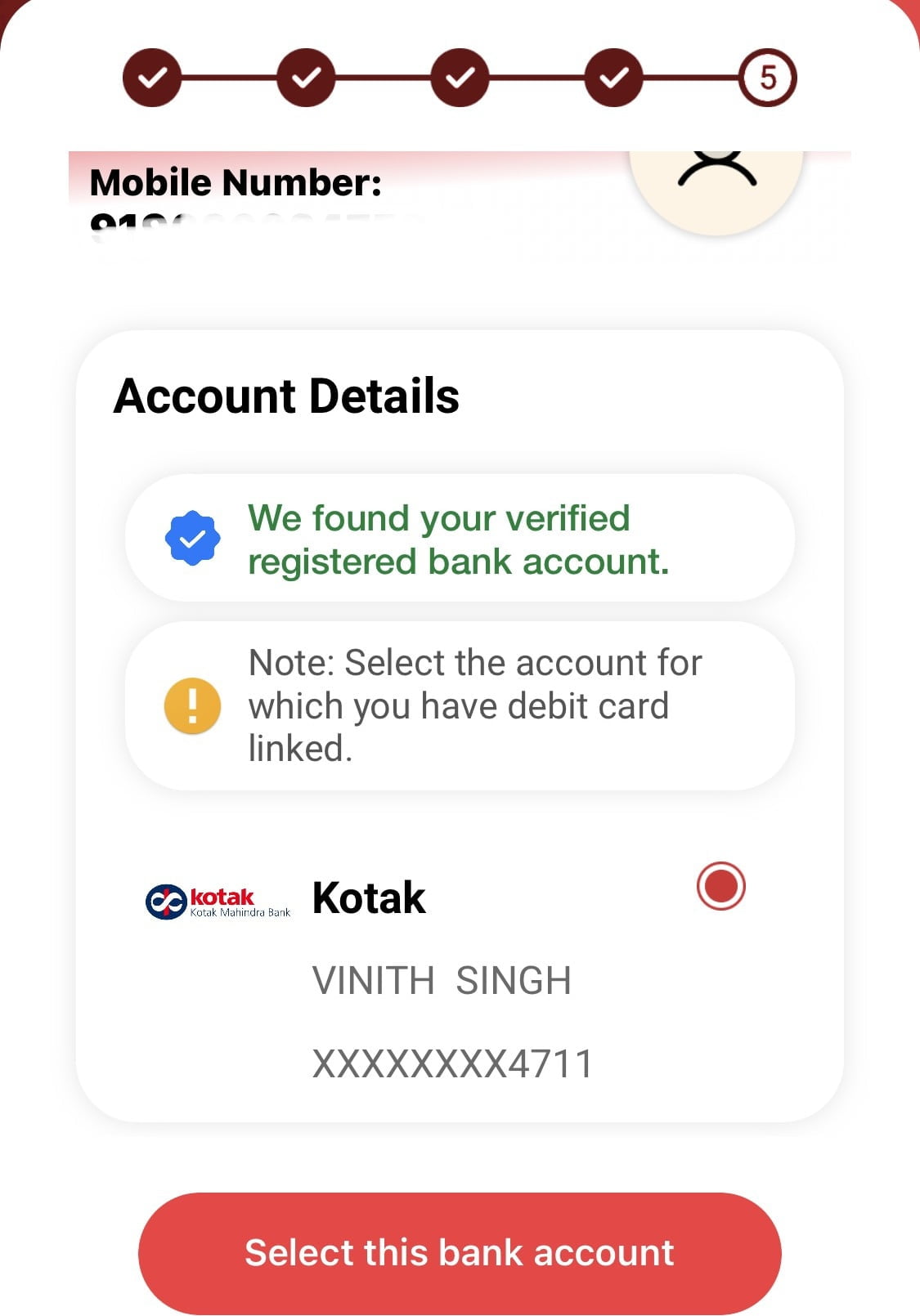

Step 8: Now we have verified my Kotak Bank account and now we will continue by selecting this account.

Step 9: Now we have to verify the account by entering last 6 digit of my debit card number. It is same as PhonePe and GooglePay.

Digital Rupee KYC Wallet Info:

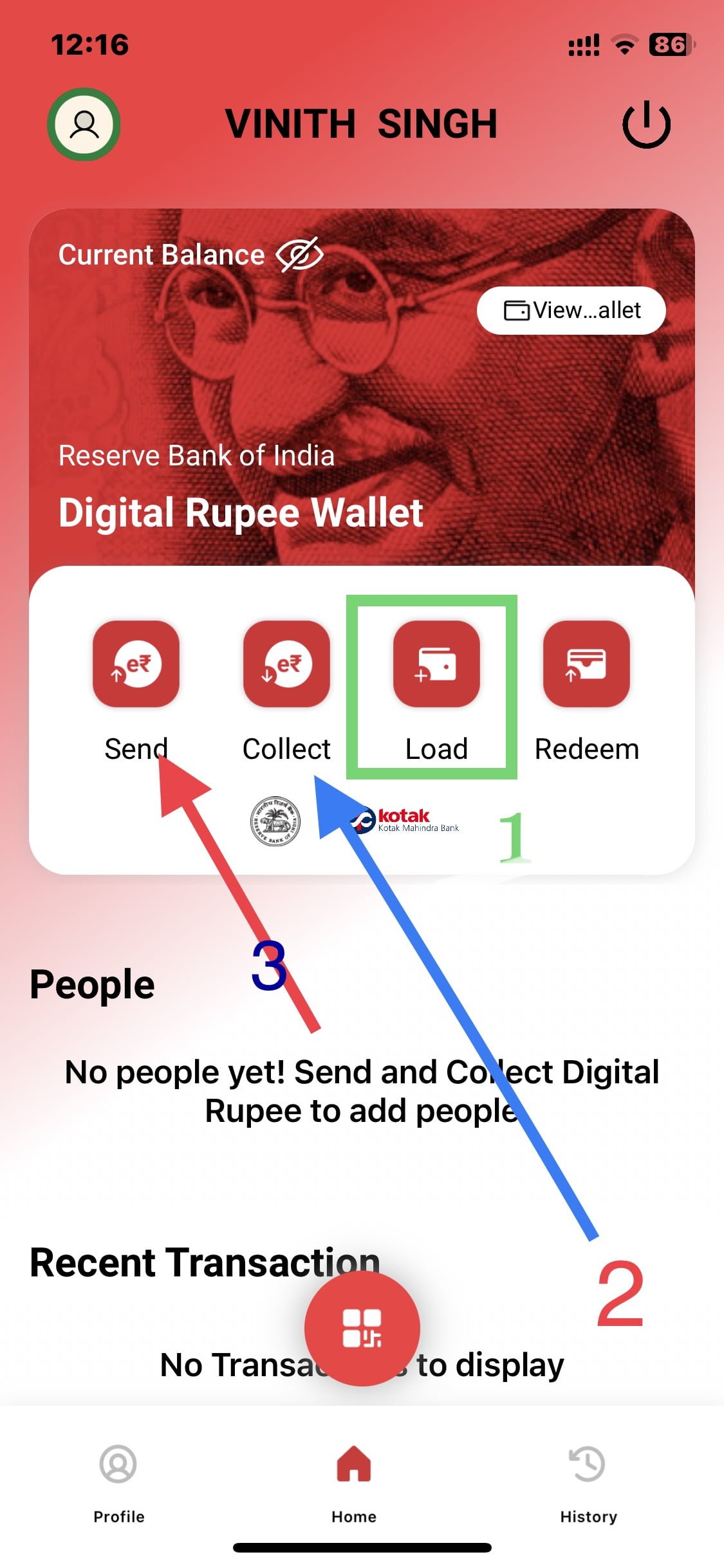

Step 10: Once done with all the steps above, you will be redirected t the home page of the digital currency as you can see below. Now here we have 4 major options Send, Collect, Load and Redeem. We will first focus on the “Load” option to load the digital currency as you can see below.

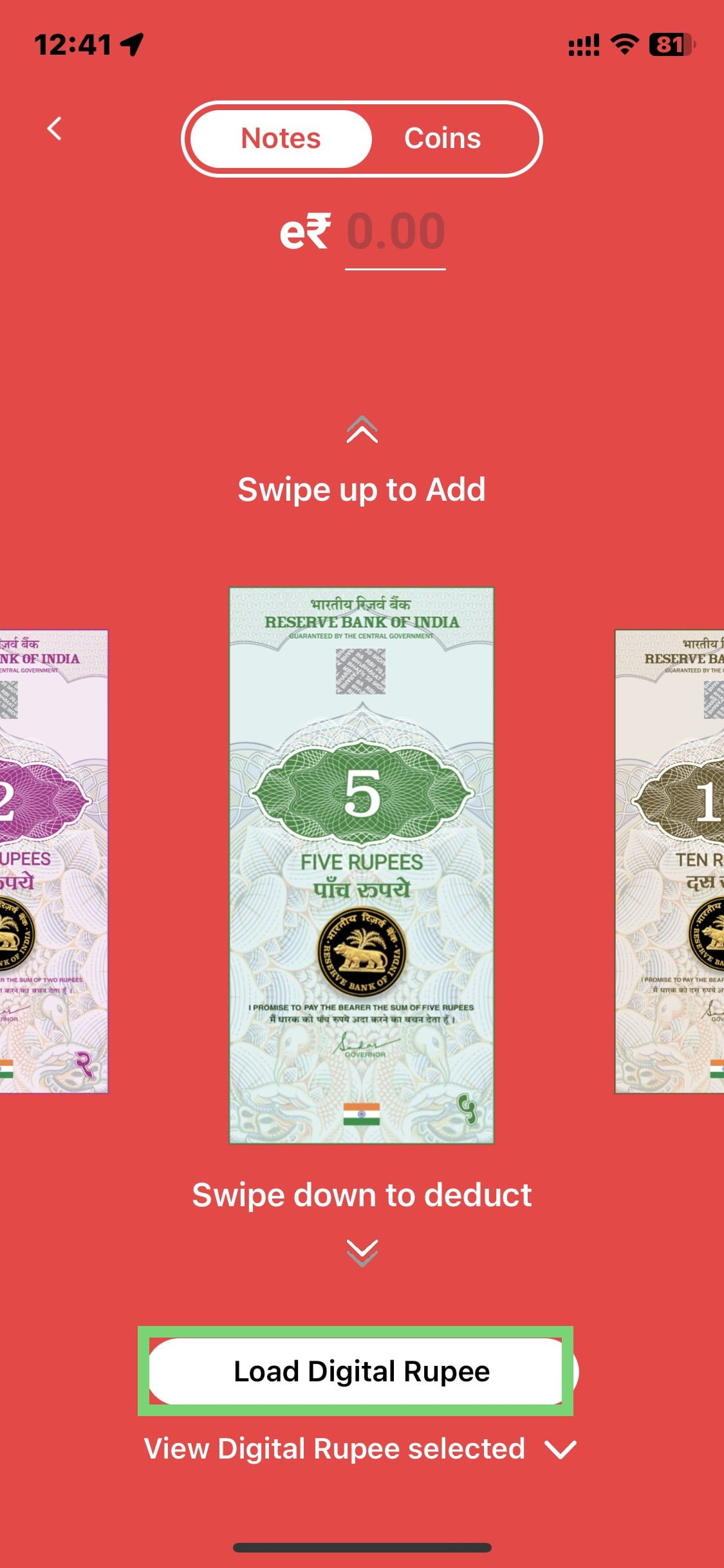

Step 11: Once you click on notes, so you will find different kind of note such as physical kind of notes, such as 1, 2, 3, 10, 20, 50, 100, Rs.500 and 2000 etc. Now if you “swipe up” then notes will get added if you “swipe down” then the notes will get deleted so depending on the requirement of the notes just add and you can see at the top and also if you want Coins you can add 50 paise coin, 1 rupee coin and 2 rupee coin.

Once selected, click on load digital rupee below and proceed further to note the physical notes and coins to your wallet as mentioned in the below image.

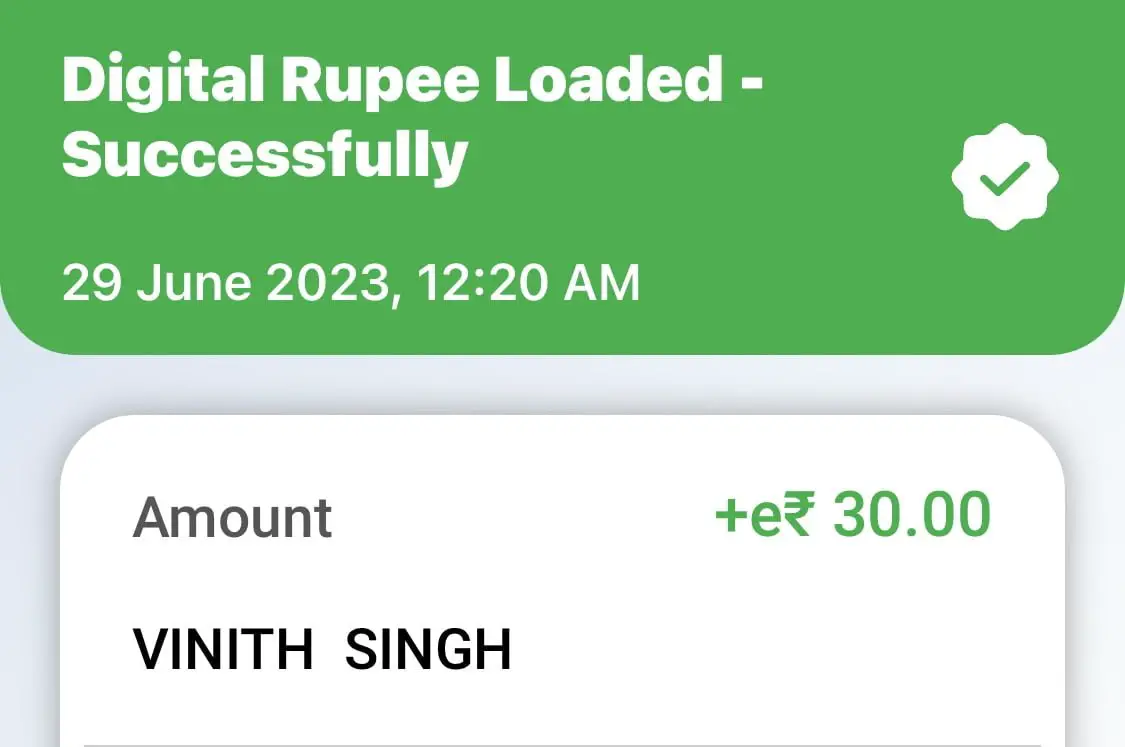

Step 12: As you can see, I have the summary of the coins and notes wanted to add in my wallet.

Step 13: As you can see Rs.30 has been debited from my account as you can see in the below image.

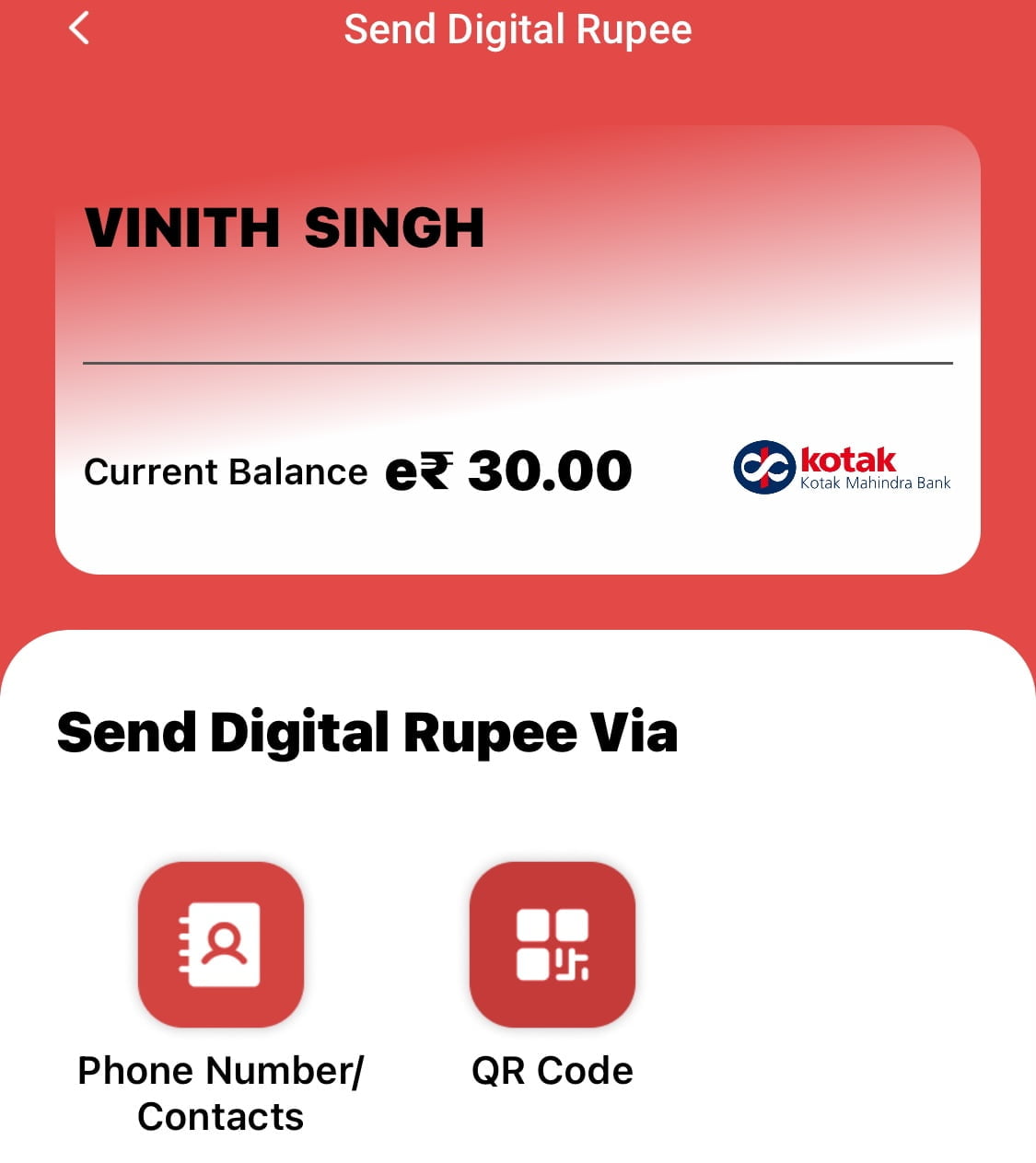

Step 14: Send Digital Rupee? If you select the send option then you can see that I can use either phone number or scan QR code to send a digital money to the person I want so currently there is only two options available in digital currency wallet .

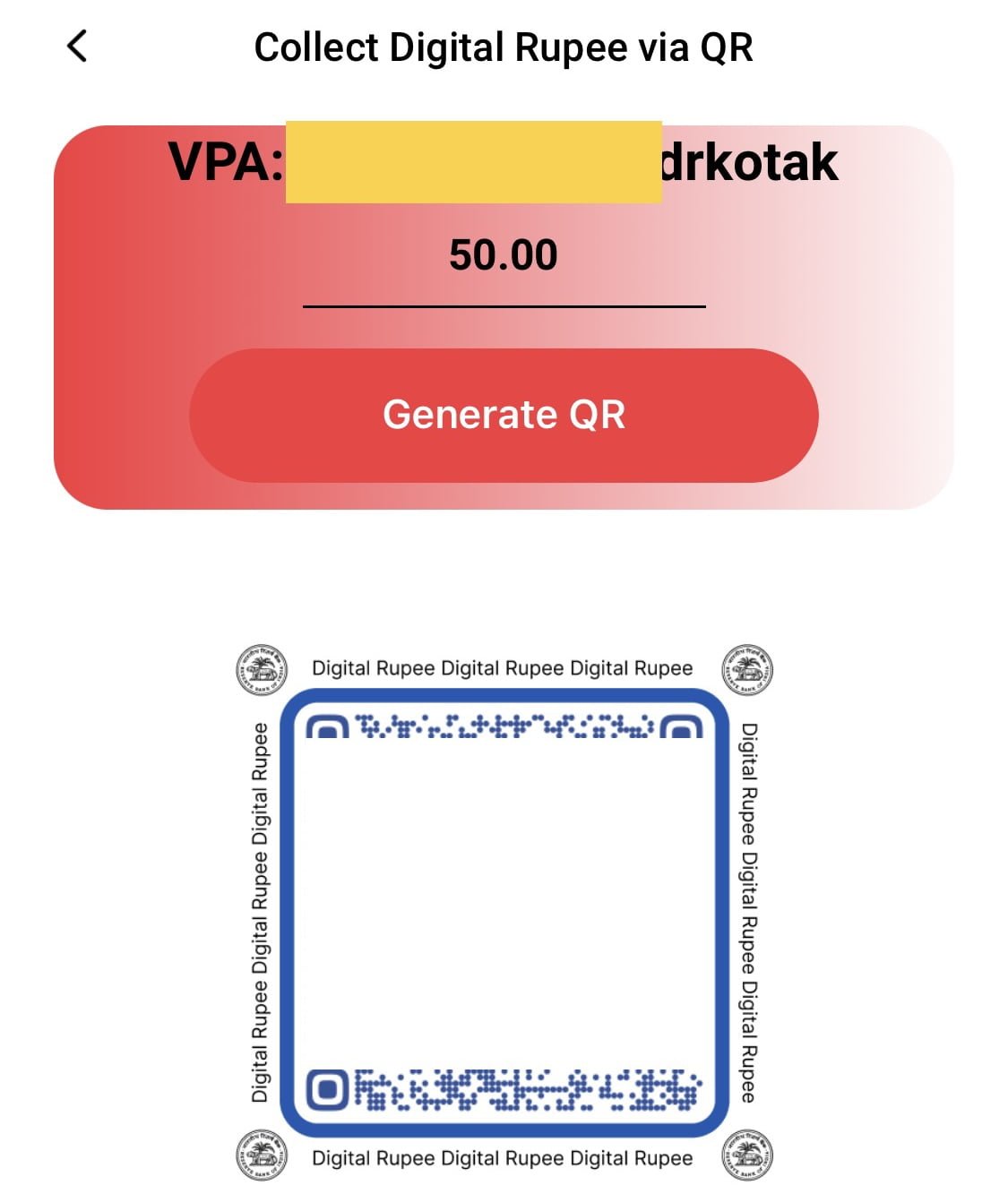

Step 15: Collect Digital Rupee? If you select the Collect digital rupee option, then you will be redirected to this page so here enter the amount you want to collect. In my case as you can see it is Rs.50 and once you click on generate QR, a QR code will be generated below. So anyone can scan this QR code and send you the digital money to your wallet. So this is very simple and quick to collect the physical money.

Watch more!

Conclusion:

Buying digital rupees from the list of five banks that the RBI has licensed yet?. They are the mainly State Bank of India(SBI), Yes Bank, Kotak Bank, ICICI Bank, and also IDFC First Bank. Meanwhile, RBI is also including more banks in this programme in the upcoming features.

For any doubt or concern please comment down below for any queries you can directly DM us on our social media handles. For more refer this document: CBDC Digital Rupee – Central Bank Digital Currency (kotak.com)